Based on the increase in the Consumer Price Index (CPI-W) from the third quarter of 2018 through the third quarter of 2019, Social Security and Supplemental Security Income (SSI) beneficiaries will receive a 1.6 percent COLA for 2020. Please retrieve the Social...

Limits

2020 HSA Plan Limits

On May 22, 2019, the Internal Revenue Service issued Revenue Procedure 2019-25, announcing the 2020 inflation-adjusted amounts for Health Savings Accounts (HSAs), as determined under the Internal Revenue Code § 223. Here is a comparison of the HSA calendar year 2019 and 2020 annual limits.

2019 Annual Qualified Retirement Plan Contribution Limits

On November 1, 2018, the Internal Revenue Service announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2019.

2019 HSA Plan Limits

On May 14, 2018, the Internal Revenue Service issued Revenue Procedure 2018-30 , announcing the 2019 inflation-adjusted amounts for Health Savings Accounts (HSAs), as determined under the Internal Revenue Code § 223.

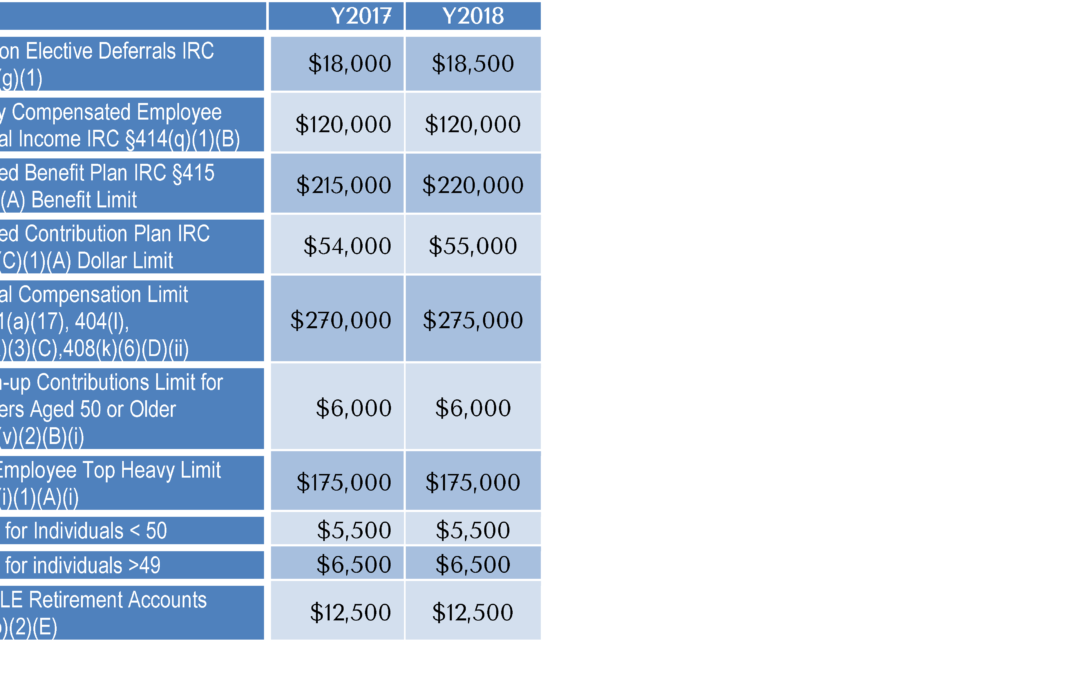

2018 Annual Qualified Retirement Plan Contribution Limits

On October 18, 2017, the Internal Revenue Service announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2017.

2018 HSA Plan Limits

On May 04, 2017, the IRS announced the 2018 inflation-adjusted amounts for Health Savings Accounts. The following is a comparison of the 2017 and 2018 limits.

2017 Annual Qualified Retirement Plan Contribution Limits

On October 27, 2016, the IRS announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2017. The following is a comparison of the 2016 and 2017 limitations.

2017 Health Savings Account Plan Limits

On April 29, 2016, the IRS announced the 2017 inflation-adjusted amounts for Health Savings Accounts. The following is a comparison of the 2016 and 2017 limits.

2016 Health Savings Account Plan Limits

On May 04, 2015, the IRS announced the 2016 inflation-adjusted amounts for Health Savings Accounts. The following is a comparison of the 2015 and 2016 limits.

2016 Annual Qualified Retirement Plan Limitations

On October 21, 2015, the IRS announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2016. Here is the comparison of 2015 and 2016 plan limits.

2015 Annual Qualified Retirement Plan Limitations

On October 23, 2014, the IRS announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2015. The following is a comparison of the 2014 and 2015 limitations.

2015 Health Savings Account Plan Limits

On April 23, 2014, the IRS issued Revenue Procedure 2014-301 announcing the 2015 inflation-adjusted amounts for Health Savings Accounts, as determined under the Internal Revenue Code § 223. Here is a comparison of the 2014 and 2015 limits.

2014 Annual Qualified Retirement Plan Limitations

On October 31, 2013, the Internal Revenue Service announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2014. Here is a summary of those limit increases.

2014 Health Savings Account Plan Limits

On May 3, 2013, the Internal Revenue Service issued Revenue Procedure 2013-251 announcing the 2014 inflation-adjusted amounts for Health Savings Accounts (HSAs), as determined under the Internal Revenue Code § 223. The following is a comparison of the 2013 and 2014...

2013 Annual Qualified Retirement Plan Limitations

2013 Annual Qualified Retirement Plan Limitations On October 18, 2012, the Internal Revenue Service published (IR-2012-77) cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2012. Generally...

2013 Health Savings Account Plan Limits

On April 27, 2012, the IRS announced the 2013 inflation-adjusted amounts for Health Savings Accounts (HSAs) as determined under the Internal Revenue Code § 223.

PPACA Sets First Time Health FSA Limit: $2,500 per year for Employee Contribution

Effective for plan year beginning on or after January 1, 2013, an employee must limit salary reduction to no more than $2,500 in contributions to medical care flexible spending arrangements.

2012 Annual Qualified Retirement Plan Limitations

On October 20, 2011, the Internal Revenue Service published (IR-2011-1031) cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2012.

2012 Health Savings Account Plan Limits

On October 20, 2011, the Internal Revenue Service announced the 2012 inflation-adjusted amounts for Health Savings Accounts (HSAs) as determined under the Internal Revenue Code § 223.