ERISA Investment Consulting

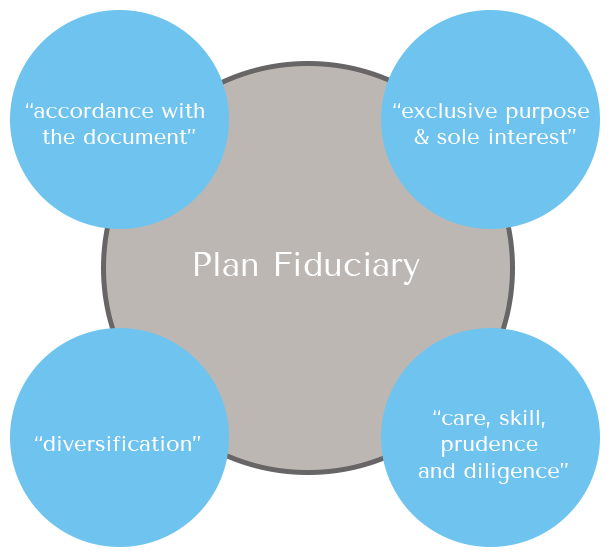

Experiential Wealth’s Investment Consulting provides investment fiduciary advice with the goal of reducing fiduciary responsibilities and liabilities for Plan Sponsors.

Through the development of a reasoned and practical Investment Policy Statement, we aim to guide the process in a way that will deliver cost effective solutions, identify and select investment vehicles that align with the stated goals, and prudently monitor investments.

A detailed and deliberative process helps to prepare an Investment Policy Statement. Some of the factors being considered are:

- Organization and participant background and demographics

- The Plan’s goals and objectives

- Identify all fiduciaries including functions

- Identify asset and sub asset classes or strategies to be included in the core menu

- Investment philosophy – the role of passive vs active investment options

- Investment selection criteria and benchmarks

- QDIA (multi-asset portfolio) selection and monitoring criteria

- Review historical returns, risk and correlation

- Investment monitoring criteria

- Watch list criteria

- Participant level advice selection and monitoring

- Miscellaneous issues such as company stock, 404(c) and brokerage accounts

Sign Up to Receive Our Commentaries