On October 18, 2017, the Internal Revenue Service announced cost of living adjustments affecting dollar limitations for pension plans and other retirement related items for Tax Year 2018. Generally speaking, many of the pension plan limitations do not change for 2018 because the rise in the cost-of-living index does not meet the statutory thresholds that trigger their adjustment.

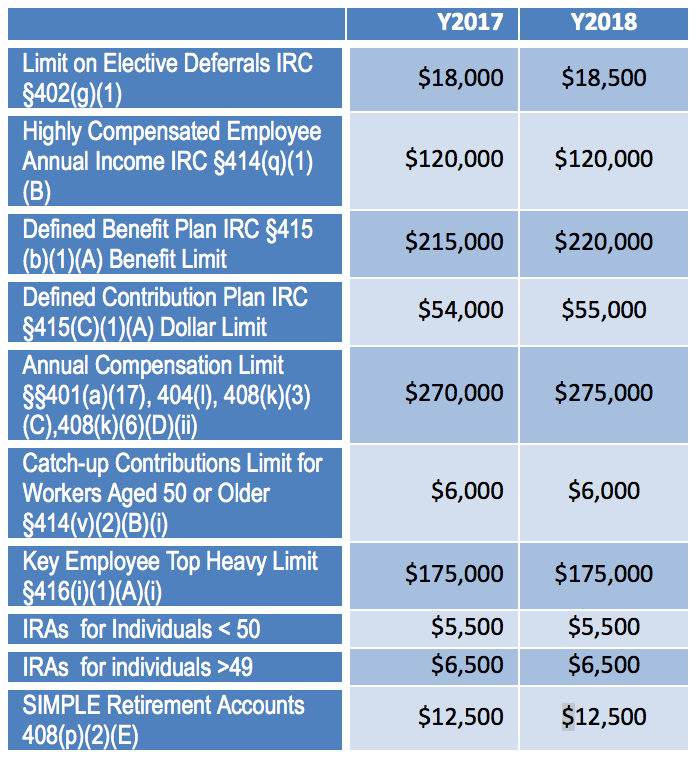

The following is a comparison of the 2017 and 2018 annual limits:

On October 19, 2016, the Social Security Administration announced that there is a 2% in the cost of living adjustment (“COLA”). The Social Security COLA is 0.3% for 2017 and 0% for 2016. For 2017:

• The Social Security Taxable wage base will be $128,700 from $127,200

• The FICA tax (OASDI and Medicare) payable by both employees and employers remains 7.65% up to the taxable wage base and 15.30% for self-employed.

• The 1.45% Medicare tax continues to apply to all earnings.

• Since January 2013, an additional 0.9% of Medicare Tax applies to individuals with earned income of more than $200,000 ($250,000 for married couples filing jointly).

• The Social Security (OASDI) tax, assessed up to the taxable wage base, remains 6.2% for employers and 6.2% for employees.