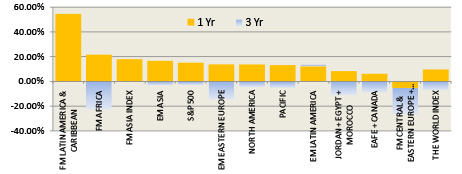

2010 turned out to be a decent year for the capital markets. The world stock markets have significantly recovered since the low was reached in March 2009. The following chart shows the performance of various MSCI regional index returns for developed markets, emerging markets and frontier markets. With the exception of frontier markets of Central and Eastern Europe and the Commonwealth of Independent States, the rest of the world markets all delivered a positive return for 2010, but this masks the underlying market volatility, especially during the first 3 quarters.

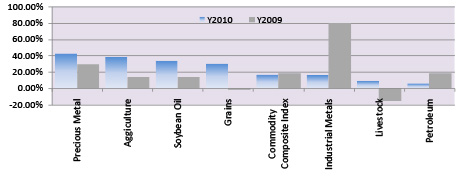

The story for commodities is also positive and summarized below using the Dow Jones Commodity index return data for 2010 vs. 2009 with signs of inflation:

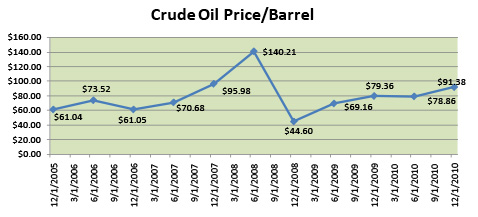

After a spectacular rise in prices, oil dropped over $100 per barrel by the end of 2008 during the depth of the Great Recession. Since then, it has doubled and is heading back towards $100 per barrel. The following charts show the Crude Oil Prices at The New York Mercantile Exchange at mid-year and year-end since 2005.

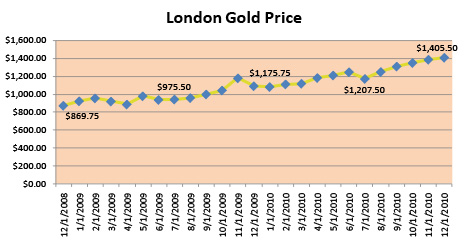

Gold prices have also escalated. The London Gold price per ounce has been steadily rising from $869.75 at the end of 2009 to over $1,400 at the end of 2010. The drive behind this unprecedented price move is partially due to increasing global sovereign risks and the mounting public debts.

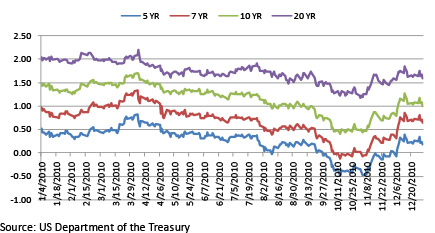

In the meantime, intermediate term interest rates have shot back up in the final two months of the year. The following chart shows the real interest Treasury yield curve for 2010.

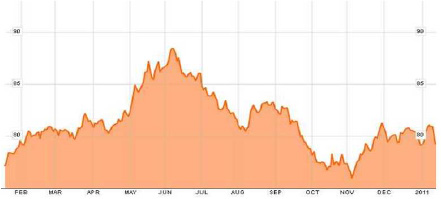

While the world developed a love-hate relationship with the reserve currency, the US dollar continued its inverse relationship with financial risk. The following Bloomberg graph shows the US dollar increased in value when the Europe sovereign debt crisis risk intensified in early May and decreased in value through early November when the risk diminished. The US dollar moved higher again towards the end of the year when the European debt fear began to resurface. We expect the US dollar to continue this oscillating relationship with financial and geopolitical risks in the coming year when compared with other developed economy currencies but mainly in a downward trend against developing economy currencies.

United States

The US economic recovery remained uneven in 2010, and the annual performance in the stock markets does not tell the story of the lingering risks from the Great Recession as well as the benefits from continuing support by super accommodative monetary and fiscal policies. The persistent high unemployment, consumer deleveraging, lack of credit, regulatory uncertainty, and the weak residential real estate market all contributed to a protracted economic recovery. For much of the year the fear was a double dip recession and deflation. The Federal Reserve initiated quantitative easing for a second time (QEII) to give the economy another shot in the arm in the fourth quarter. This QEII has again delayed the handoff of sustainable economic revival from the government to the private sector.

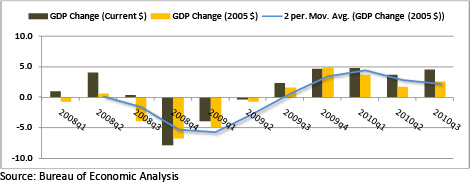

The quarterly US GDP tells the story of strong growth in the first quarter when the benefits of government support and inventory cycle were in full force. Then the economy weakened in the second quarter and began to show signs of weakness in the third quarter. The fourth quarter real GDP has been reported at 2.3% a bit weaker than the widely expected 3.5% and is much improved from the 2.6% for the third quarter.

At the end of the year, the Obama Administration extended the entire Bush-tax-cuts package for two more years, introduced a one-year 2% payroll tax cut and prolonged the 99-week extended unemployment benefits for another year. These provisions are expected to buy time for the economy to gain more strength. As such, we expect the first half of 2011 to be stronger than the second half with the economy growing at an annual rate of 3.75% during the first two quarters. As the QEII comes to an end in the second quarter along with the expirations of much of the government stimulus programs, the economic recovery will again be expected to be self-sustaining without the significant support of the public sector. With the anticipation of continuing high unemployment, a double dip in the housing sector of the economy, and the slowing of the developing economies, the second half of 2011 is likely to be slow. The annual economic forecast compiled by the Federal Reserve Bank of Chicago expects the U.S. economy to grow at a real rate of 3% for the year 2011.

By keeping the short-end interest rates low and the two rounds of quantitative easing, the Federal Reserve has been sending a very loud message: embrace risk. A zero interest rate environment is pushing savers and investors to abandon “safe” fixed income and time deposit investments for alternatives that could deliver a better and higher yield and return. Quantitative easing is accomplished by the Federal Reserve purchasing bonds at different portions of the yield curve to stimulate the economy to drive market rates lower and the sellers, who are flushed with newly printed cash, invest in riskier assets for higher yield and return. This approach certainly has produced short term benefits for investors thus far as we witness the compression of yield spreads between corporate bonds and US Treasuries as well as the steady climb in world stock markets, but, if not carefully managed, this could contribute to significant downside risks. At this time, the Federal Reserve is not expected to initiate QEIII this summer, nor is it expected to raise interest rates until the middle of 2012. Historically, the bond market begins to anticipate and react to rising rates 9 to 12 months before the actual event. The sudden rise in market interest rates at the end of last year may be a sign of more market adjustments to come in 2011. There is certainly no pressure for the Federal Reserve to raise rates. Excess capacity, unemployment, high debt levels, growing budget deficits in the state and local level and consumer deleveraging are all helping to keep a lid on consumer spending and serious economic expansion in the US. However the Federal Reserve may wish to normalize the short term rates in 2012. The much bigger risk to investors is the reversal of quantitative easing. Although it is not in the cards now, the Federal Reserve may elect to soak up the excess liquidity first as the US economy shows more signs of recovery and stability before raising rates. We believe raising interest rates would be the final act and not the first act of the Federal Reserve

China and Other Developing Economies

According to The World Bank, after the sharp growth deceleration of 2008 and the contraction in 2009, global GDP is estimated to have increased 3.9% in 2010. The 7% growth in developing countries was more than twice as strong as in high-income countries. As a result, low and middle-income countries contributed almost half of global growth (4%) in 2010. Moreover, all of the developing country growth was due to increased domestic demand. Growth in both high-income and developing countries is expected to slow somewhat in 2011, mainly reflecting the easing already observed in the second half of 2010, before picking up again toward mid 2011 and settling at rates close to their longer-run potential. Global GDP is projected to increase by 3.3% and 3.6% during 2011 and 2012, with developing economies expanding by 6%+ each year, more than twice the 2.4% and 2.7% growth expected for high-income countries. Unfortunately these growth rates are unlikely to be fast enough to eliminate unemployment and slack in the hardest hit economies and economic sectors.

The Great Recession is a consequence of the overleveraged economies of the developed world where much of the spending and prosperity was based on debt and asset appreciation. The developed economies have been the driving force for the world economy based on easy monetary policies and unchecked fiscal spending. The uni-polar world is now a fading concept as America, Europe and Japan face significant deleveraging challenges, both private and public sectors of the developing economies are in a much better fiscal position. We have witnessed the V shaped recovery in the emerging markets as compared to the slow and painful climb out of the economic dislocation of the G3 nations. For the first time, developing nations are not lenders to the developed world. Over the last several years the economic growth gap between the two worlds has progressively widened. This disparity will continue for some time as Western Europe travels down the path of austerity, unemployment, breaking social contracts and sovereign debt crisis while the US and Japan are weighted down by ever growing budget deficits, and, not to mention, poor demographic trends are working against the G3 nations. For advanced economies, public debt has replaced private debt, and in the case of the Euro Zone, it went one step further where super-sovereign debts are replacing sovereign debts of its member countries. In the long term, every piece of evidence points to economic growth in the developing economies, and it seems too obvious not to simply close our eyes and dive head first into these vibrant markets. However, in the short and intermediate term, the answer may not be so obvious. We will focus our discussion using China as the illustrative example.

For 2010, China’s National Bureau of Statistics reported that their economy grew 10.3%, the fastest pace in three years and up from 9.2% in 2009. China’s GDP topped US$6 trillion last year. China has been trying to engineer an economic soft landing to cool down their red hot economy. There is little denial that China has kept its currency low for a number of internal and external reasons. This has helped China’s policy of full employment and in keeping its citizens peaceful, but it has also become a contributing factor to a systematic rise in domestic inflation and inflation overall among satellite emerging markets that supply to China. These countries are subject to the same inflation forces as they try to also keep their currency down to remain competitive. The influx of foreign and flight capital has also been a double-edged sword as we witness the unsustainable rise in real estate prices in China.

According to the February 2010 IMF Staff Position Note – Capital Inflows: The Role of Controls, the global economy is beginning to emerge from the financial crisis and capital is flowing back to emerging market economies (EMEs). These flows, and capital mobility more generally, allow countries with limited savings to attract financing for productive investment projects, foster the diversification of investment risk, promote intertemporal trade, and contribute to the development of financial markets. Many EMEs are concerned that the recent surge in capital inflows could cause problems for their economies. Many of the flows are perceived to be temporary, reflecting interest rate differentials, which may be at least partially reversed when policy interest rates in advanced economies return to more normal levels. Against this backdrop, capital controls are again in the news. A concern has been that massive inflows can lead to exchange rate overshooting (or merely strong appreciations that significantly complicate economic management) or inflate asset price bubbles, which can amplify financial fragility and crisis risk. Concerns that foreign investors may be subject to herd behavior and suffer from excessive optimism have grown stronger, and even when flows are fundamentally sound, it is recognized that they may contribute to collateral damage, including bubbles and asset booms and busts. Although capital flows to developing and emerging market countries are generally welcome— providing lower-cost financing and indicating market confidence in the fundamentals of the economy—sudden surges can complicate macroeconomic management and create further financial risks. On the macroeconomic front, the concern is that the surge will lead to an appreciation of the exchange rate and undermine competitiveness of the tradable sector—possibly causing lasting damage even when inflows abate or reverse. The main worry from the financial fragility perspective is that large capital inflows may lead to excessive foreign borrowing and foreign currency exposure, possibly fueling domestic credit booms (especially foreign-exchange denominated lending) and asset bubbles (with significant adverse effects in the case of a sudden reversal). These are all happening in varying degrees across developing economies, and the probability of countries not responding with the right policies is rising.

China’s inflation rate was at 4.6% in December, down from a 28-month high of 5.1% the month before but well above the government’s target of 3%. Annual inflation in 2010 was 3.3%. China has been a net importer of every commodity and is now the dominant player as commodity prices rise and fall based on the speculation of China’s economy. Along with escalating demands from other emerging and developing economies, commodity prices are on the rise again. To combat inflation, especially in the property market, China has increased interest rates and hiked minimum down payment requirements as well as instituted new property taxes. So far these tactics have proven to be ineffective in dampening consumer inflation. Beijing has announced its minimum wage will rise by 20.8% this year as its citizens continue to demand higher wages to stay ahead of inflation. This is the beginning of the classic wage-price spiral where price increases lead to wage hikes which lead to more price increases. This scenario is likely to continue for some time if China does not initiate necessary structural reform. One of the consequences is that China will no longer be the low labor cost producers and the label of “factory to the world” will no longer apply as lower labor cost countries take over as manufacturers of choice for low value products. China will move upstream to higher value goods and innovate as we have witnessed the same progression decades ago in Japan and South Korea.

Excluding Japan, which remains in a state of chronic deflation, Asian inflation rose to 5.3% in the 12 months ending in November 2010, up markedly from the 3.5% rate a year earlier. India is running in excess of 8% and price growth in Indonesia is at 7%, Singapore at3.8%, Korea at 3.5%, and Thailand at 3%. In low income countries such as China, food is a large component of its CPI. In fact, the share of foodstuffs in household budgets – 46% in India and 33% in China – is 2-3 times the ratio in developed countries, and agricultural commodity prices cannot simply be contained by government monetary policies.

To maintain its grip on power, the Chinese government must carefully navigate the processes of urbanization and modernization while not marginalizing segments of the population. China must strike a balance between promoting capitalistic animal spirit with centralized planning and industrial policies so that a full and fair economic spectrum is developed and not viewed as favoring the elite or the few. At the end, if the people of China feel that they are falling backwards economically since they cannot keep up with spiraling inflation and that the opportunities and gains are not shared, civil and political instability will result.

Nonetheless, investor enthusiasm for emerging markets has been nothing less than bullish. That has driven equity valuations higher. The broad risks for emerging market equities currently are inflation and the blowback from negative surprises from China. If China experiences multiple hiccups and is unable to contain inflation and engineer a soft landing, the outcome will cause a rippling effect beyond just the Asian and emerging markets. China accounts for approximately 40% of the world’s consumption of industrial metals, and many emerging market economies rely on commodity production for their growth. Other commodity producing countries such as Canada, Russia, Brazil, Australia, and New Zealand, to name a few, will all be impacted as an unintended consequence of a mismanaged slowdown in China.

Europe

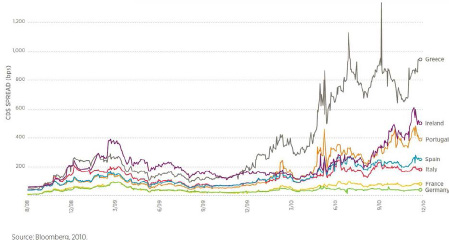

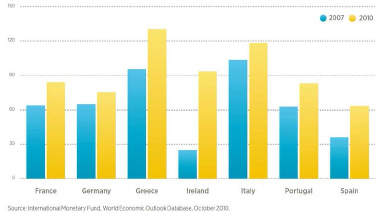

The challenges faced by Europe have been decades in the making and cannot be solved quickly. The European Union, successor to the European Common Market, is made up of 27 countries. A subset of which is a group of 14 countries that use the Euro as a result of the “Monetary Union” with the European Central Bank controlling the single money market and currency. However, fiscal policy remains in the hands of each sovereign state with the independence to make local tax and spending decisions. This imperfect union was formed with full knowledge of its frailties by all parties. Politicians of the member states wanted the benefits of a common market while giving up the least amount of sovereign rights. When inflation was low with high employment and money was plentiful through debt, asset price appreciation and capital flows, member states implemented different fiscal policies. When the Great Recession came and liquidity dried up, consequences of years of irresponsible spending and borrowing became evident. Countries with lax regulation and enforcement, excess borrowing, over promised social benefits and financial bubbles are now left with few options. Typically, there are a few actions that are available when a country faces a fiscal crisis. It can: 1) make fiscal adjustment by cutting spending and raising taxes; 2) engage in structural reform that promotes long term economic growth; 3) adjust monetary policy by allowing its currency to devalue; and 4) look to world organizations such as the IMF as alternative sources of funding away from the markets. However, for member countries in the Monetary Union, not all these choices are available. The current crisis is testing the relationship with the stronger members of the group. The peripheral counties of Europe, such as Portugal, Ireland, Italy, Greece and Spain, are having a tough time managing their debt load, both real and perceived. In order to overcome the current crisis, spending cuts and raising taxes are essential and must be coupled with long term structural changes in individual countries as well as the Monetary Union level, but this is not simply a sovereign crisis (and not a liquidity crisis as some would like us to believe) but also a banking crisis. During the go-go days of the Monetary Union, commercial banks heavily purchased higher yielding sovereign debts from the peripheral countries with the assumption that the risk is the same as those of the stronger and fiscally responsible economies, such as Germany. Today the wide spread in yields and the ever increasing credit default swap premiums demonstrates that not all sovereign debts have been created equal.

The simple truth is that countries are burdened with too much debt and there is no easy way to repay without drastic actions. Any default would shock the banking system worldwide, just as a starter. One solution would be to devalue its currency as a way out, but this is not available as long as the insolvent country remains a member of the Monetary Union. To accomplish this, the insolvent country must extricate itself from the common currency for monetary independence as an added tool for overcoming default. The second way is to grow the economy out of the mess. This assumes that an insolvent country can consume, manufacture and export its way to an economic renaissance and repay its debts. In this environment where citizens will have to work harder, receive less income and benefits while paying more in taxes, an economic expansion at a speed to grow its way out is wishful thinking. So what are the likely solutions? The first is to look to the ECB as the super-sovereign to shoulder a large portion of the refinancing and interest rate risks. This is a form of shared sacrifice by other members of the Monetary Union where the strong will bail out the weak with their discipline and good credit. ECB will be the purchaser and holder of risky sovereign debts for as long as necessary. Another solution would be to ask the note holders, i.e. the commercial banks, to accept new and easier terms (lower interest rates) with a haircut on the principal. The duration of the sovereign debt is likely to be much longer as well.

There are no easy solutions in solving the European sovereign debt crisis, and the citizens are only willing or able to share in the sacrifice for so long. If the escalation in food and commodity prices initiated by the developing markets eventually translates into an increasing cost of living for the Europeans, more civil unrest is expected. The ECB will likely raise rates to combat inflation, making the debt crisis even more difficult. In dismal economic times, low income and immigrant population are further marginalized. This could add more division along race and religion lines in Europe which further destabilizes the area. Politicians are overall a myopic bunch. The motto for them is what can be done for the least amount of pain so that they can remain in office for another day. As long as “it” does not happen on their watch, it is natural to kick this can down the road for a while longer.

2011 will continue the slow economic recovery to which we have become accustomed. There are far too many headwinds for developed economies to return to business as usual. The high income countries are also the high debt countries. Servicing the current level of debt (let alone more expected debt) will become increasingly burdensome and expensive. Couple this with consumers’ needs to deleverage personal debt accumulated during the fat and mindless years and there is a strong case for less fuel being available to grow the economy. The world relies on the developing economies to shoulder the lion’s share of the world economic growth going forward. Asia and South America must turn their economies from export driven to those that are balanced between domestic consumption and export s. Although the US is not likely to be experiencing a double-dip recession in 2011, the ability to realize a self sustaining recovery after the government support has waned is not certain. It is important that China succeeds in engineering an economic soft landing and gets their inflation in control without generating an unintended domino effect to the rest of the world. Investors are already spooked by Europe’s sovereign debt challenges, and investor sentiment will likely drive up the market volatility this coming year. This also means that the US dollar will be on an upswing along with the US treasury bonds – a classic flight to safety move.

We are living and investing in a global village. The Butterfly Effect germinated in far away regions will have an effect on how our portfolios will perform and how our lives may be affected. Our investments are all inter-connected, and being domestically centric with a home bias cannot shield us from exogenous events. Chao & Company continues to favor US large cap equities (especially dividend paying companies with an international business footprint); high yield, lower quality, fixed income securities; short term adjustable bank debts; emerging market local debts denominated in local currencies; and, to a lesser extent, commodities and industrial metals. There is no investment decision that is more important than asset allocation. Continuing to allocate to low or non-correlated asset classes and investment strategies will be key to shielding the portfolio from downside risks. We expect an increase in portfolio volatility as the high income world continues its journey to pay for its excesses of the past while the low income world learns to adjust to new realities. We are uncomfortable with enhanced geopolitical risks and civil unrests throughout the world and how such instability could negatively impact investments everywhere. Yes, the Great Recession is behind us and we now know what the contributing factors are, but the future is uncertain and random. The period of Great Moderation is also over. A simple buy and hold or buy-on-the-dip strategy no longer assures success.