Summary The financial, emotional, geopolitical, demographics, financial and economic impact and effects (especially exposing the system vulnerability and behavioral finance) from the Pandemic have a very long tail. Changes in some areas are more structural and...

Quarterly Commentary

Quarterly Market Commentary – 2024 Q1

What's Morphed in 2024Q1? It’s all about inflation and the Fed’s interest rate reaction function. From the absence of forward guidance to the incessant data dependency – understandably in a time of uncertainty – the Fed is feeling its way to a landing. In the prepared...

Quarterly Market Commentary – 2023 Q4

2023 reminds me of the “Everything Everywhere All at Once” movie. The most anticipated hard landing or recession did not happen even after a rapid 525bp increase in interest rates since 2022. Chair Powell said that the FOMC is “navigating by the stars under cloudy...

Quarterly Market Commentary – 2023 Q3

Executive Summary The first half of the year was full of hope that inflation will continue to decelerate and thus the Fed will take its foot off the rate hiking gas. The scenario of a soft landing fast became the (desired) base case. This is the immaculate...

Quarterly Market Commentary – 2023 Q2

2023 Q2 Commentary: Clear as Mud The second quarter data continue to support every market narrative – more noise and few clear signals. The stock market extended its first quarter advance, and the S&P 500 Index in June entered a new bull market (20% above the 2022...

In-Depth Analysis of the 2023 Bank Failures

Philip Chao sheds light on the recent tremors in the banking world, marked by significant bank failures. Explore the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank, surpassing the size of the 2008 crisis. Understand the reasons behind these failures, including mismanagement of investments and interest rate risks. Discover the impact on depositors and strategies to protect your assets, such as staying within FDIC insurance limits and exploring safe investment options like U.S. Treasuries and money market funds. Gain insights into the banking landscape and learn how to navigate this turbulent period with prudence.

Decoding the Federal Reserve: Implications of Recent Interest Rate Hikes on Economic Stability

Join Philip Chao as he discusses recent movements in the Federal Reserve’s monetary policy and their implications for the US economy. Explore the significant FOMC meetings in March and May, which hinted at an end to the Fed’s hiking cycle. Gain insights into the Fed’s dual mandate of maintaining price stability and ensuring full employment, and how they are navigating the current economic paradox. Discover the influence of the labor market on monetary policy and the potential risks of inflation and a recession. Stay informed for potential economic shifts with Philip Chao’s expert analysis.

Deciphering Economic Landings: A Forecast on the 2023 Economy and Beyond

Join Philip Chao as he delves into the economic landscape at the beginning of 2023. In this video, Philip explores three possible scenarios: No Landing, Soft Landing, and Hard Landing. Discover what each scenario means, how they could impact our economy, and how recent interest rate hikes may influence future outcomes. Stay informed and prepared for potential shifts in the economic climate.

Quarterly Market Commentary – 2023 Q1

2023 Q1 Commentary: Walk and Chew The excitement and relief of “no landing” and “soft landing” in the U.S. during the past 6-months have given way to a hard landing scenario on March 10th when Silicon Valley Bank was shut down by federal regulators. An investigation...

The COVID Effect on Supply and Demand

An overview of how COVID negatively impacted both supply and demand worldwide.

Investing in Current and New Energy

A lot of money is being spent on transitioning to “new energy,” but we are not ready to abandon our current energy infrastructure completely. There are investment opportunities in both old and new energy.

Quarterly Market Commentary – 2022 Q4

2022 Q4 Commentary: The Future is Always Uncertain 2022 was a year of non-linear recovery which incorporated significant political, financial, investment and human turmoil. Many of us are glad that 2022 is behind us, but time is a human construct. There is nothing...

Overview of Q3 2022 – Is The US Economy Bending or Breaking?

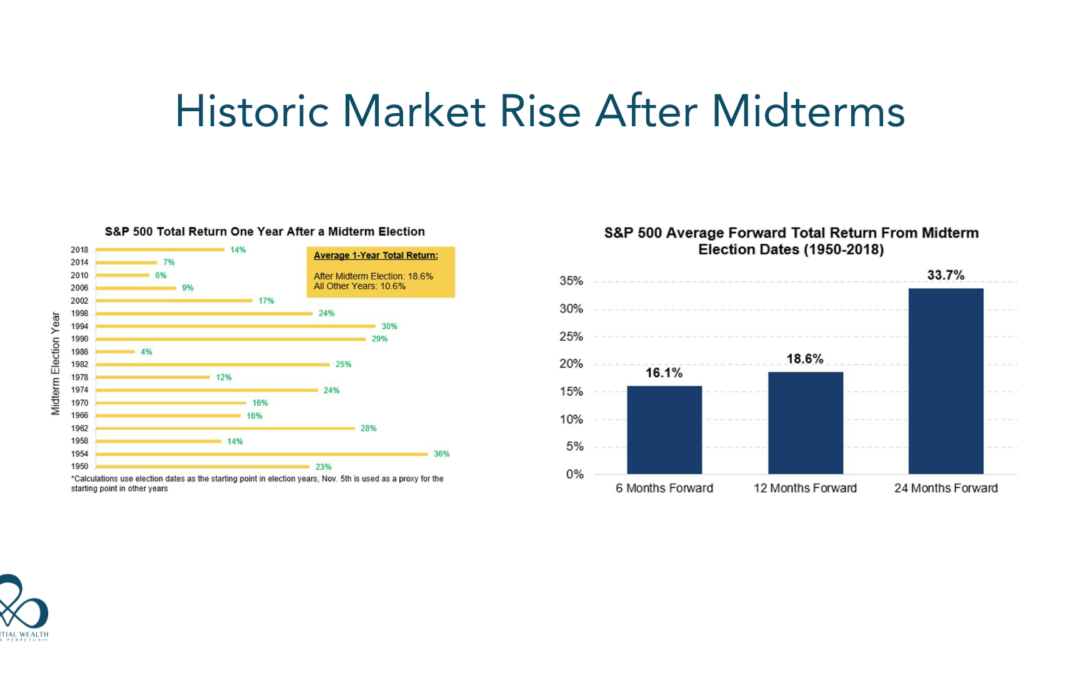

Though historically the market rises after the midterms, you must consider the other economic factors currently in play.

How Will The Market React To The Midterms?

Though historically the market rises after the midterms, you must consider the other economic factors currently in play.

Quarterly Market Commentary – 2022 Q3

This is the 3rd quarter of 2022 market commentary which represents the current views of Experiential Wealth, Inc.

What Is The Current Ailment For The US Economy And What Is The Cure?

The economy is facing several issues including inflation, supply chain disruption and labor shortages. How can we move forward to stabilizing the economy?

Quarterly Market Commentary – 2022 Q2

This is the 2nd quarter of 2022 market commentary which represents the current views of Experiential Wealth, Inc.

Quarterly Market Commentary – 2022 Q1

This is the 1st quarter of 2022 market commentary which represents the current views of Experiential Wealth, Inc.

Quarterly Market Commentary – 2021 Q4

This is the 4th quarter of 2021 market commentary which represents the current views of Experiential Wealth, Inc.

Quarterly Market Commentary – 2021 Q3

This is the 3rd quarter of 2021 market commentary which represents the current views of Experiential Wealth, Inc.