The second quarter ended at the top of a rollercoaster ride. The stock market had a decisive downturn for 6 weeks in June spooked by the latest round of European sovereign debt flare ups, but the market rebounded towards the last week of the month which more than made up for the losses sustained earlier. Some explained this spectacular reversal as a reaction to an oversold market position, short sellers covering their positions, and quarter end window dressing. Regardless of the causes, we all let out a collective sigh of relief.

The Age of Great Consequences

From the mid-1980s to the Great Recession, the U.S. business cycle experienced a period of low volatility and is now referred to as the period of Great Moderation. Since the Great Recession and the financial crisis of 2008-2009, the economic recovery is drawn out and full of unexpected risks and uncertainty. I consider this to be a period of “Great Consequences”. The Federal Reserve and the policymakers thought that they had discovered the perfect blend of monetary and fiscal policies and regulatory oversight that would eliminate the boom bust economic cycle. The Great Moderation delivered us a Goldilocks economy: “not too hot(inflation), not too cold(deflation), just right (GDP and employment).” We witnessed the unprecedented productivity and innovation gains brought on by the Internet and the computing age and appearance of China, India and other emerging economies with cheap labor and their desire to join the world trade. This is also the period that sets the stage for excess leverage and consumerism. In reality, we went from the Internet bubble to a real estate and debt bubble that ended badly. We have overspent, overbuilt, over-consumed, over-serviced, and over-employed while delaying sound and necessary fiscal and monetary policies to ensure long term safety and prosperity for our nation. The good times seem to go on forever until they disappear. The Great Consequences are being felt and injected upon all of us. We are and will be paying for the excesses of our economy over the past two decades for years to come. The consequences are anemic economic growth, lowering of our standard of living, weakening of our position in the world, and the continuing erosion of our reserve currency status. The rippling effects of these and many unknown consequences will have significant economic and financial impacts.

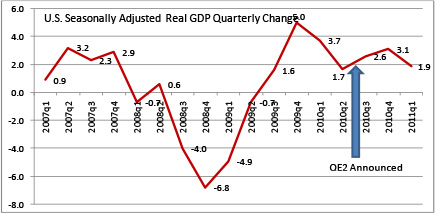

Gross Domestic Product Will Remain Weak

The supply chain disruption resulting from the Japanese earthquake/tsunami in March this year, the elevated oil and gasoline prices created by the Arab Spring, and the reoccurring default or restructuring risks from the European debt crisis are the often cited factors that contributed to the anemic economic activities we have been experiencing in the first half of this year.

After a 3.1% showing in the fourth quarter, GDP took a steep downturn to a revised 1.9% for the first quarter, and a similarly weak reading is expected for the second quarter. Many economists and market observers are convinced that what we are experiencing is a “soft patch” and the U.S. economy will be back on track to a more robust expansion. They cite the fact that the Japanese-led slowdown is behind us; oil and gas prices have retreated and are thus less burdensome on U.S. consumers; and the European debt crisis is contained and not likely to affect us in the near future. They believe that consumers with more money in their pockets will be spending again, and the overall sentiment is much more positive for the second half of this year. In fact, the majority view is a much improved stock market reflecting the real economy and the ever increasing profitability and earnings of corporate America. They see this current lull as transitory – thus the soft patch.

We take a different view and believe that the real economy is in a cyclical downturn or an extended “soft patch” – an oxymoron. Although a double dip recession (defined as a back to back quarter GDP contraction) remains a possible outcome 4 to 6 quarters from now, at this time the probability is low. There are of course lots of Black Swans (unintended high magnitude consequences to actions and inactions, extreme or high impact events that we have no knowledge of but are able to easily explain them after the fact) out there lurking to strike at any time, such as natural and man-made disasters. That can tilt us into a recession quickly. Since Black Swan events by definition are not predictable, there is not much one can do to prevent them. Then there are tail events. These are statistically remote, low probability events by definition, but they have been occurring far more frequently in the post Great Moderation world. The U.S. economy is healing but is not healed. There are plenty of signs that we have moved away from the bottom during 2008 and 2009 and landed on a higher baseline, but it is not entirely clear if the U.S. economy can be self-sustaining at a reasonable level now that the significant monetary and fiscal government support is ending. The second quarter GDP will be weak (1.5% to 2% range), and third and fourth quarter GDP is expected to be higher (2% to 2.5%). However, we do not believe this means the end of the soft patch. For the year, the real U.S. GDP will be less than 2.7%. In the Federal Reserve’s June 2011 economic projections, the economic growth was revised down to 2.7-2.9%.

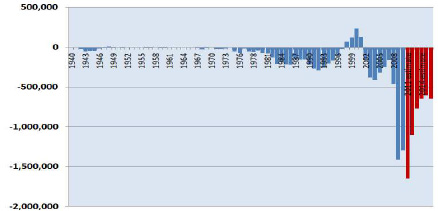

Unemployment Remains High

The latest unemployment report is abysmal. According to the Bureau of Labor Statistics, after a 25,000 person gain in May, June payroll only rose by 18,000. On average, our economy needs to create 125,000 jobs a month jus to keep up with new entries into the job market, and we need 250,000 new jobs a month to begin making meaningful reductions to our unemployment statistics. The national unemployment (as measured by U3 or the blue line) has ticked up to 9.2% in June while the labor force participation rate has shrunk to 64.1%, the lowest since 1984. The broader measure of the labor market is U6 (red line) which includes marginally attached job seekers and workers who are discouraged or are part-timers due to economic reasons. This broader measure of unemployment and underemployment has jumped by 0.4% to 16.2% in June.

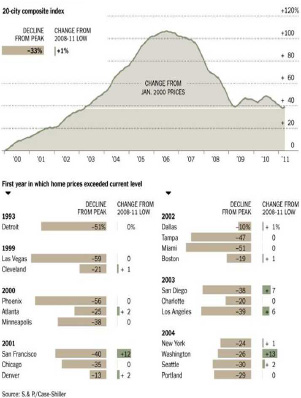

More Downside for Housing

Housing remains a major trouble spot for the economy. The home prices continue their downward trend (even though the index managed a small rise in April). In many of the 20 cities that make up the composite index, home prices remain at a level first reached in May 2003.

This chart represents the most current data from Case-Shiller (a quarterly index released with a three-month lag) and published in the New York Times Business section on July 1, 2011 .

The Housing and Economic Recovery Act of 2008 changed Fannie Mae’s charter to expand the definition of a “conforming” loan. Two sets of limits are provided for first mortgages — general conforming loan limits, and high-cost area conforming loan limits . The 2010 high-cost area loan limits remain applicable to all loans originated on or before September 30, 2011. Loans originated on or after October 1, 2011, will use the “permanent” high-cost area loan limits established by FHFA under a formula of 115% of the 2010 median home price, up to a maximum of $625,500 for a 1-unit property in the continental U.S. This simply means that the ability for individuals to buy (thus for sale) in high-cost areas (i.e. major metropolitan areas) will be curtailed which will put further downward pressure on overall housing prices next year.

After reaching a historical high, sub-prime loans outstanding have significantly shrunk to the 2003 level. Due to challenges faced by homeowners, an estimated 30% have mortgages that exceed their home value. This fact combined with the questionable legal rights of lenders causes foreclosure inventory to remain high. This excess inventory of houses and the yet to foreclose inventory will continue to add downward pressure on real estate prices.

Deleveraging

The financial crisis and the bursting of the real estate bubble can both be traced to the abundance of credit. The post Internet bubble world of easy money and a low return environment set up the perfect storm of “risk on” with steroids through the use of leverage. Bankers, hedge funds, consumers, corporations and just about anyone who can hold a pen to sign a loan document can borrow. As a result, this country, not unlike many other developed economies, went on a building and spending spree. After the Great Recession and many bankruptcies and foreclosures later, consumer debts as a percentage of personal income have significantly improved on a historical basis, while the personal savings rate has rebounded from its all time low levels. However the total debt per household remains high. It peaked at 127% of income in 2007 and is now down to 112%. Not all the debt reduction has been due to aggressive repayment for the consumers. Banks and financial institutions have been aggressively writing off or writing down consumer debts, and this is likely to continue.

Not Feeling Too Good

According to the Conference Board, the Consumer Confidence Index “had declined in May, decreased again in June. The Index now stands at 58.5 (1985=100), down from 61.7 in May. The Present Situation Index decreased to 37.6 from 39.3. The Expectations Index declined to 72.4 from 76.7 last month”. People surveyed indicated that the current business and labor market conditions are less favorable than in May, with less consumers seeing improving conditions in the next six months.

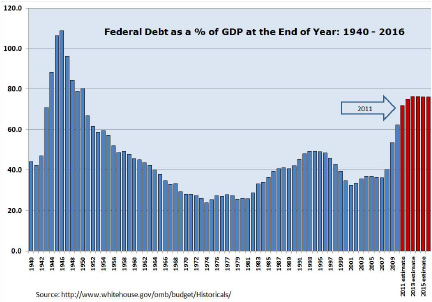

U.S. Debt Limit and Voluntary Default

The world has been responding to the European sovereign debt crisis in a much more reactionary manner than to what is going on in the U.S. Credit spreads, bond yields and credit default swap premiums have been moving higher each time the market senses that there may be a peripheral European default resulting in a pan-European contagion. In the U.S., as we march closer to the August 2 deadline to raise the $14.29 trillion borrowing limit or face a possible default on U.S. sovereign debt, there is little to no market movement, thus far. Perhaps investors believe that, one way or another, U.S. politicians will come to their senses and take pragmatic steps to avoid a default. After all, a U.S. default would be voluntary and by every measure is an unnecessary self sustaining injury that will have massive short and long term unintended consequences to the U.S. Nonetheless, one week is a lifetime in markets. Things could change exponentially or explosively.

As a summary, the following highlights the debt ceiling categories that are being discussed:

- Raising the ceiling by $4 trillion or more. This is known as the “grand bargain” timeframe allowing both sides of the debate to come up with a plan by 2014. This is the best option among the 4 assuming the politicians are able to constructively negotiate with an open mind, but it is also the least likely option. There is no political will, and time is running out.

- Raising the ceiling by $2 to $2.5 trillion. This is the “grand bargain light” and pushes the timeframe to 2013. This allows a new Congress and possibly new administration to address the problem. This is a probable option and fits the universal political mantra: why take political risk during my watch, and why not just kick the can down the road and the conditions may change.

- Raising the ceiling by $1 to $1.5 trillion. This one year timeframe pushes the decision to a year from now likely making the debate even more political since 2012 is an election year. This cynical option encourages both parties to make the debt ceiling an election issue. This is a misguided and terrible option. The debt ceiling is not the issue. It is simply an arbitrary event, and our creditors, civil servants, government contractors, and citizens will be held hostage for political gains. Magnifying this event during an election year adds emotionalfuel to the self-created fire. The credit agencies will likely go beyond a “credit watch” status to downgrade the U.S. sovereign debt rating. This is a significant event, and the complete ramifications are not known.

- Band Aid Fix. This option simply extends the default date a few months at a time. This is not a real solution, and the credit agencies will likely downgrade the U.Ssovereign debt rating if this occurs. Mr. Obama has consistently rejected this option publically.

We believe option 2 and option 3 are the most likely outcomes before August 2. Not unlike the European sovereign debt crisis painfully unfolding in front of us, our process of addressing economic and fiscal structural issues will also be drawn out and extended far longer than is in the best interest of this country. Setting shorter term deadlines guarantees that our budget and debt ceiling issues will be front page news over and over again. This adds uncertainty to the markets and will weigh on our anemic economic recovery. By not decisively and comprehensively mapping out a long term plan, the collective pain will be unnecessarily exaggerated with possible and viable alternatives eliminated one by one like the falling wheels towards a train wreck.

In the meantime, we are in the majority camp that believes the U.S. will not default on its obligations on August 2. Everyone knows that there will be significant and severe reactions and consequences to our reserve currency status, interest rates, and investments both short and long term. However, no one knows the course, scope and speed of the destruction. In the event that an agreement is not reached on August 2 but reached sometime in the future, the amount of time that elapses before a decision (e.g. 1 days vs. 1 week, vs. 1 month) will significantly impact the magnitude of the repercussions. Bear in mind that the unwillingness by our lawmakers to up the debt limit cap does not automatically mean that the U.S. will default on its sovereign obligations. Depending on the time elapsed between August 1 and the final debt limit increase, the U.S. Treasury has the capacity to continue to meet our debt obligations by temporarily defaulting on our social contracts (payments under Social Security, Medicare, etc.) If the U.S. does not default on its debts, the market would price in that possibility as we get closer to August 2 without a resolution or at least the likelihood of one. Under this scenario, it is conceivable that the credit markets would react.

The bottom line is that a spectrum of outcomes from a “grand bargain” to an extended sovereign default generates a myriad of possible financial and market outcomes. If an investor believes that a deal cannot be struck by August 2, it is safe to suggest that getting out of all (short and long) U.S. Treasury securities and many money market funds now would make sense. If the investor has an extreme degree of conviction that a U.S. sovereign default will be extended for a longer period of time, the investor should take further action. Under this scenario, the U.S. dollar would be under pressure and lose value and, if sustained, would be a significant contributor to inflation. Stock markets could react globally with the biggest impact on the U.S. market. Interest rates would increase progressively as the default continues. Commodities contracts and especially oil contracts are typically negotiated in U.S. dollars; therefore, they could fail to be honored causing significant worldwide dislocations. Many financial instruments and especially derivatives and future contracts use the U.S. “risk-free” treasuries and rates as cash equivalents or benchmark. Re-pricing of countless transactions and future transactions would have to take place and bring the world financial markets to a stop. Under this Armageddon scenario, no paper currencies would be safe. In an attempt to protect financial assets against this type of scenario, the investor should consider selling all financial instruments in the investor’s portfolio now and buy physical gold and gold coins (not ETFS or mutual funds) and stock up on all living essentials for 6 months. Please note that this is not our base case scenario and should not be considered our recommendation for action.

The irresponsibility of our politicians and so called leaders, couched as taking their respective positions for the betterment or long term prosperity of Americans, is an act of Russian roulette. Each side is daring the other to back down, and at the end, the U.S. financial system becomes the victim. Regardless if this voluntary default becomes reality, the fact that the U.S. can default is the new reality which should not be taken lightly. Our country has moved the default dial from possibility to probability. The very leaders who are professing that they are protecting our economic system are demonstrating to all stakeholders that the U.S. can be voluntarily irresponsible and not worthy of serving as the world leader, reserve currency and maintain a AAA credit rating. Our leaders are willing to risk our financial standing in the world, which took generations to achieve, for self gain. If the U.S. looses the AAA credit rating, the known consequence is the repricing of all U.S. debt which leads to higher interest rates. This will negatively impact our economy further at the time of an anemic recovery. The duel strategy of raising revenue (Democrats’ favorite) or cutting government programs and spending (Republicans’ favorite) produces a net result of austerity for America. The local governments have been on the austerity path and the federal government must also take similar actions or else changes will be forced upon us.

In his June 14, 2011, speech at the Annual Conference of the Committee for a Responsible Federal Budget, Ben Bernanke said that:

“Perhaps the most important thing for people to understand about the federal budget is that maintaining the status quo is not an option. Creditors will not lend to a government whose debt, relative to national income, is rising without limit; so, one way or the other, fiscal adjustments sufficient to stabilize the federal budget must occur at some point. These adjustments could take place through a careful and deliberative process that weighs priorities and gives individuals and firms adequate time to adjust to changes in government programs and tax policies. Or the needed fiscal adjustments could come as a rapid and much more painful response to a looming or actual fiscal crisis in an environment of rising interest rates, collapsing confidence and asset values, and a slowing economy. The choice is ours to make.”

Large Scale Asset Purchase – a.k.a. Quantitative Easing

The Federal Reserve instituted the first round of quantitative easing during the height of the Great Recession and in response to the financial crisis. Starting in November 2008, the Federal Reserve purchased more than $1 trillion of both mortgage-backed securities and Treasuries. This made liquidity plentiful for banks and credit available to corporations and households. QE1 is generally thought to be a success. After a 5% and a 3.7% GDP growth in the last quarter of 2009 and first quarter 2010, markets were anticipating the Federal Reserve hiking interest rates to soak up excess liquidity from QE1. The second quarter GDP came in at a disappointing 1.7% and the economy was showing signs of deterioration, and the talk of a double dip recession began to surface. On August 27, 2010, Chairman Bernanke announced the second round of quantitative easing during his annual speech delivered in Jackson Hole, Wyoming. The $600 billion asset purchase program was just completed at the end of June, and the economy is beginning to feel a lot like a year ago.

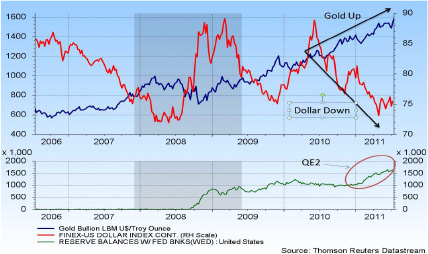

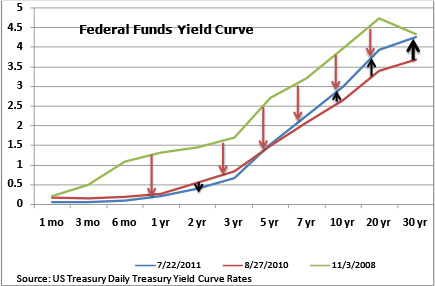

It is clear that during the period of QE2, the U.S. dollar has lost value while the price of gold has increased. The idea of QE2 is to continue to lower the borrowing cost along the intermediate term rates by purchasing U.S. securities of the targeted maturities from banks. This would lower corporate and household borrowing costs and stimulate the animal spirit. From the August announcement to the end of May, the stock market appreciated over 20% along with Gold and most commodities. Although there are many other factors that may have contributed to the rise in commodities prices globally, it is clear that such general price increases coincided with QE2.

Unlike QE1, QE2 did not have the significant impact of reducing interest rates since the rates are at historical lows. QE2 did have the effect of maintaining low yields in the intermediate range of the yield curve. However, the longer end of the yield curve witnessed an increase in yields which may be attributable to market reactions to dollar depreciation and the increasing risks resulting from loose monetary policies.

The economy is potentially at a crossroad again. Depending on the economic performance over the next two to three months, Federal Reserve may initiate QE3 later this year. This is an indicator that the Federal Reserve is running out of options to stimulate this economy or to bring full employment. The combination of a QE3 and the expected recurring debt limit debate will place long term pressure on the U.S. dollar pushing long term yield higher. Either action, if prolonged, is not positive for our economy.

Europe

Europe’s answer to the U.S. Goldilocks economy is an economic and monetary union composed of a common market and a common currency where 17 countries agreed to use the euro as the single currency. What is absent is fiscal union among all countries, and this was purposely left out since it was construed as seceding sovereign powers and control by each country. There are 4 conditions that must be met in order to join the EMU:

- Inflation rate cannot be more than 1.5% higher than the average of the three best performing member states.

- The ratio of the annual government deficit to GDP must not exceed 3% at the end of the preceding fiscal year. Only exceptional and temporary excesses would be granted for exceptional cases. The ratio of gross government debt to GDP must not exceed 60% at the end of the preceding fiscal year.

- Countries should have joined the exchange-rate mechanism under the European Monetary System (EMS) for 2 years and should not have devalued its currency during the period.

- The nominal long-term interest rate must be 2% or less than in the 3 lowest inflation member states.

The strict requirements to be a member of the EMU are limiting the flexibility of each member state to react and respond to their own economic cycle. The structural problems and challenges of EMU and the euro go beyond the scope of this quarterly analysis, but it is important to understand that each member statehas agreed to link and thus given up their independent ability to make, monetary decisions. Each member state has relinquished its ability to adjust its own currency to respond to an economic crisis. One such consequence is the sovereign debt crisis being played out in the European peripheral countries of Portugal, Ireland, Italy, Greece and Spain (PIIGS). As a reminder, Greece announced one year after becoming a member state that it misrepresented its debt and GDP numbers in order to join the EMU (i.e. lied or cooked its books). Its financial position worsened further after the massive spending for hosting the Olympic Games.

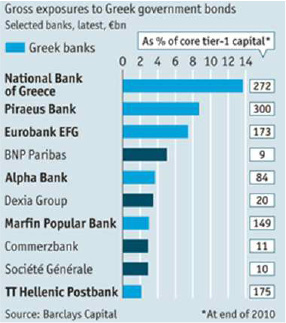

The last round of €110 billion bailout package from its European partners and the International Monetary Fund was not enough to calm the markets. In the meantime, the Greek economy is expected to shrink by 3.8-4% this year after contracting by 4.5% last year. The Greek government owes more than €300 billion with two-thirds of its debt held by about 30 institutions, and most of them are Greek banks.Some banks have purchased credit-default swaps (CDSs), which pay the full principal if Greece defaults, from insurers and financial institutions. This has shifted some of the liabilities on to others.

Analysis suggests that a Greek default will have little long lasting impact to others and the losses should be fairly well contained. However, it is the contagion mentality about what a developed economy default would do to the rest of the financial system and peripheral European countries.

Thus, after a series of failed short term measures to stabilize the Greek sovereign debt crisis, the European leaders met again in Brussels and approved another round of debt relief. The total financing this time is €109 billion. The agreement involves a voluntary restructuring by official lenders (not private) to include maturity extension, coupon adjustment and principal reduction. Supposedly, this latest action pushes the crisis to 2014. There is no certainty that this latest round of injections will be sufficient to solve the Greek debt crisis.Much of it depends on implementation and timeliness. It is good to see that European leaders are finally willing to restructure the terms of Greek debt (i.e. soft default) which has been off the table.

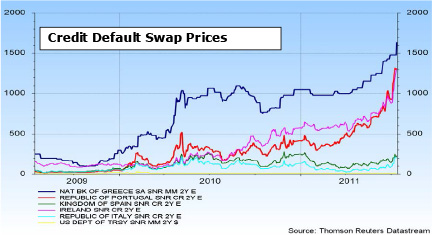

Although the immediate or short term crisis may be over for Greece, the market remains nervous about the other European countries. One good indicator is the prices for CDS.

Although Greece has dominated the headline, pressure has been mounting on Portugal, Spain and Italy. Credit default swap (CDS) premiums for Greece, Portugal and Ireland remain head and shoulder above the rest, but the CDS rates for Spain and Italy are rising.

The Rest of the World

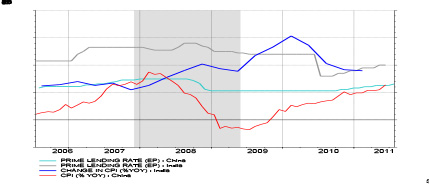

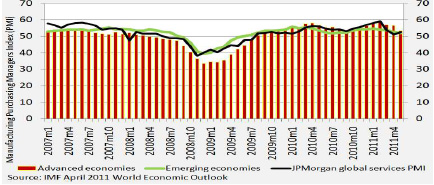

The IMF’s April 2011 World Economic Outlook confirmed that the emerging markets (“EM”) are in far better economic shape than the developed markets of the United States, Europe and Japan (“DM”). EM has come out of the Great Recession faster and has a much better balance sheet for the public and the private sector. Global growth going forward will be disproportionately driven by EM as the DM continues to be weighted down by debt onevery level and the austerity programs that are needed to

restore their balance sheets. However, the growth in EM remains export-dependent as each country attempts to fuel domestic demand. A consequence to the rapid growth is inflation. In the case of China the challenges are further compounded by currency manipulation. Many of the EM countries have raised rates repeatedly to cool their economy and to minimize the possibility of a hard landing.

A consequence to raising interest rates to get ahead of inflation is an overall economic slowdown in EM. Since EM is the driver for world growth, this can become problematic for the rest of the world as the DM are looking to EM as customers for their goods and services to sustain their anemic economies. Can we all export our way out of our own economic malaise?

Conclusion

On December 5, 1996, at the annual dinner and Francis Boyer Lecture of The American Enterprise Institute for Public Policy Research, then Federal Reserve Chairman Alan Greenspan asked “how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?” On July 21, 2010, Federal Reserve Chairman Ben Bernanke warned Congress that the economic outlook remains “unusually uncertain” and was ready to take additional actions to keep the recovery alive if the economy worsens. Over these 14 years, the road from “irrational exuberance” to “unusually uncertain” is an old story of boom and bust. The Great Moderation was setting up for the Great Recession exaggerated by the financial and housing bubble. It sure was quiet before the storm. During this period of Great Consequences, the developed economies of the United States, Europe and Japan will continue to experience the Pimco coined phase of “the journey to the New Normal”. The road is bumpy and full of unexpected headwinds. It is human nature to defer the pain or the tough love that is needed in order to recuperate from the irrational and excess years. Politicians are not willing to take the kind of selfless leadership actions. There is no pain-free reset button or time travel to get things right without any consequences. Even though they are fiduciaries to our money and our country, they are conflicted with their self interests and the interests of our nation. During the time of excesses, we believed that the good times would be here forever. We rationalized that “this time is different” and somehow we could cheat death. When the music stopped, the process of correction and reversion to the mean is typically far longer and more severe. I hope that we will not experience a multi-decade recovery process with anemic growth and watch our country’s debt burden eat away our alternatives, opportunities and prosperity. Although our demographics are better than Europe and Japan, this is the time to address the huge burden of supporting and caring for our elderly and the financial strain we will be encountering.The combination of high debt service with austerity programs is lethal for economic growth. Citizens of developed countries will have to endure more pain before there is a light at the end of the tunnel. The longer our politicians delay the necessary actions and policies to get through this process, the longer and worse the journey will be.

The U.S. has been in a secular bear market since the beginning of this century. Historically, based on the Dow Index, the duration is between 16 to 21 years.

| Secular Bear Markets | Duration (Years) |

Avg Yly Ret | Secular Bull Markets | Duration (Years) |

Avg Yly Ret |

|---|---|---|---|---|---|

| 1906-1921 | 16 | 1.58% | 1922-1928 | 7 | 17.20% |

| 1929-1949 | 21 | 1.69% | 1950-1965 | 16 | 10.60% |

| 1966-1982 | 17 | 1.59% | 1983-1999 | 17 | 15.30% |

With 10 years behind us, we are about halfway through. However, don’t forget, there are many bull cycles within every secular bear market for stocks. This means that we need to be nimble when managing investment portfolios and be mindful of downside risks. This period is particularly challenging due to: 1) globalization and interdependency of markets, 2) end of a leverage bubble, 3) end of a 30 year bull market for U.S. bonds, and 4) the escalating U.S. sovereign debt problem.

Proper portfolio diversification and rebalancing and managing real return expectations remain important and true as we experience this period of Great Consequences on our bumpy road to the New Normal.

- http://www.nytimes.com/2011/07/02/business/02charts.html?ref=standardpoorscaseshillerhomepriceindex

-

Maximum Original Principal Balance for

Loans Closed in 2011*Units Contiguous States, District of Columbia, and Puerto Rico General High-Cost* 1 $417,000 $729,750 2 $533,850 $934,200 3 $645,300 $1,129,250 4 $801,950 $1,403,400