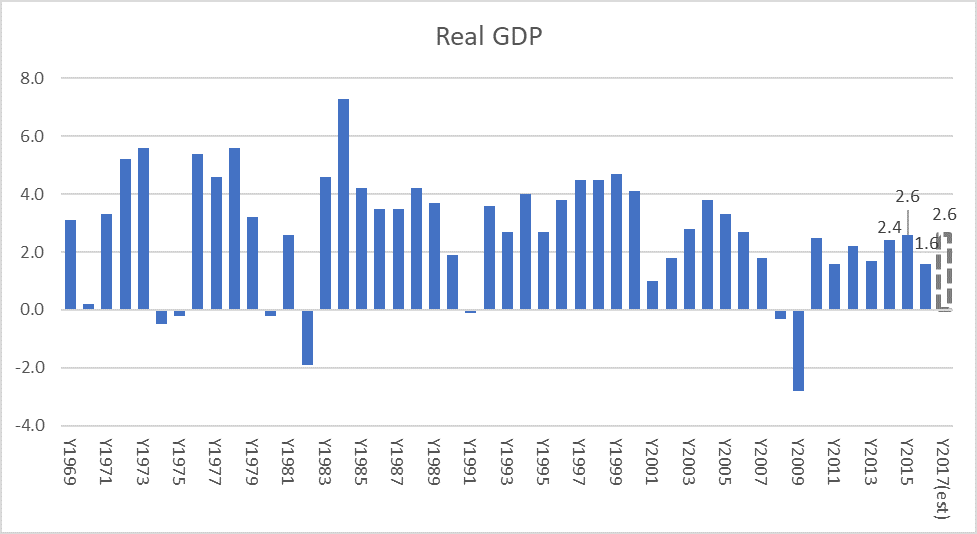

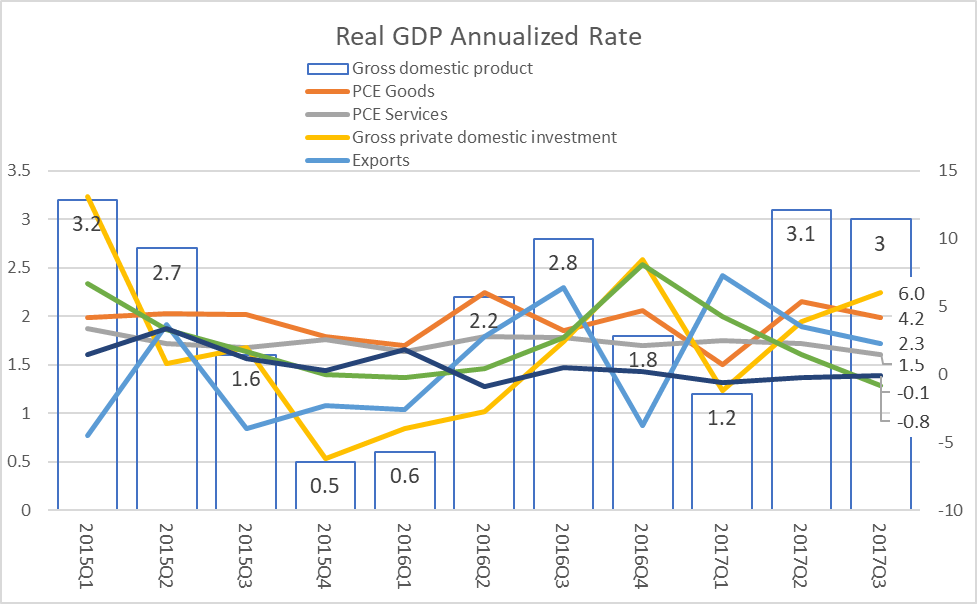

On October 27th, the Bureau of Economic Analysis (BEA) released its advance estimate for the 2017 Q3 real GDP[1] and it came in at 3.0% following a revised 3.1% for the second quarter. If the 4th quarter remains at the 3% real annualized growth rate, the projected real GDP for 2017 would be at the 2015 level of 2.6%.

It is a positive surprise that the U.S. economy grew at 3% even with the devastating twin hurricanes of Harvey and Irma on the mainland. The Conference Board estimated the third quarter at 2.6% while the Atlanta Federal Reserve Bank’s GDPNow projected the third quarter rate at 2.5%[2]

Beware that the first estimate tends to be revised. According to BEA, this estimate is “based on source data that are incomplete or subject to further revision by the source agency.”

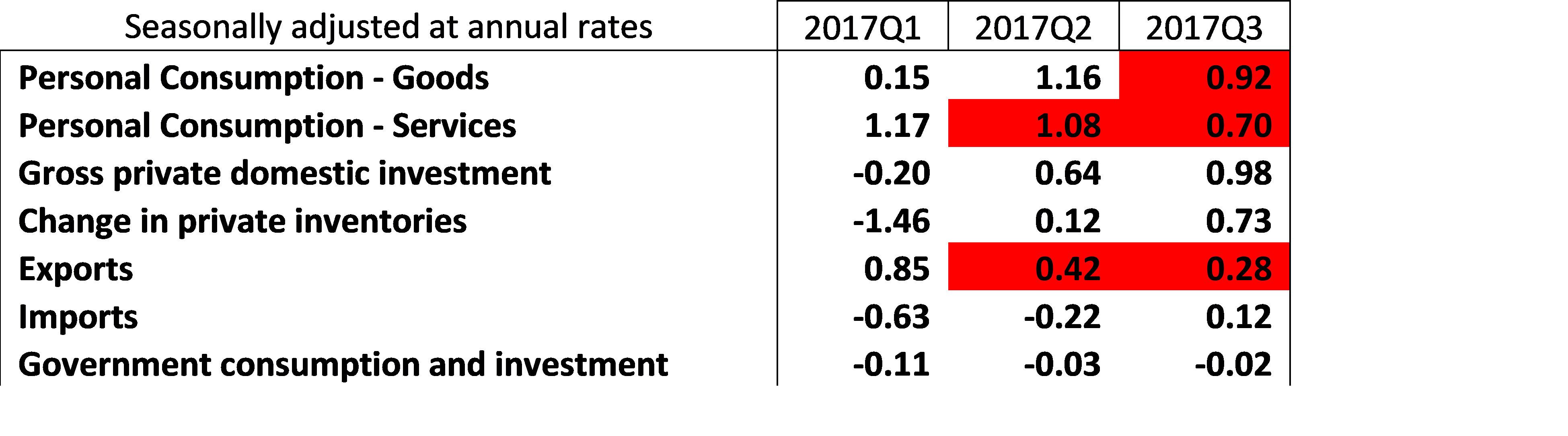

Change in private inventories contributed 0.73 to the GDP. This likely reflects businesses increasing inventory in anticipation for better demand. The following table shows the percentage contribution to the Q3 GDP for most major categories. The numbers in red highlights the slowing trend from the prior quarter. For example, although consumers continue to be a positive factor, the contribution is reducing.

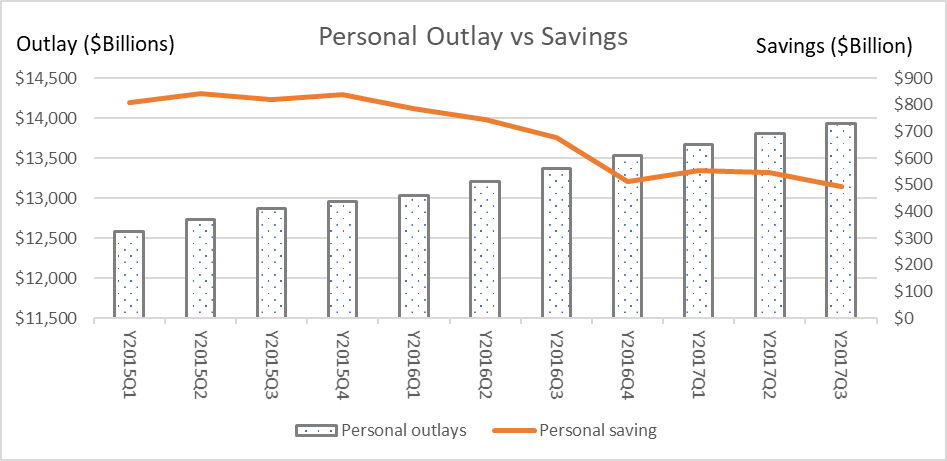

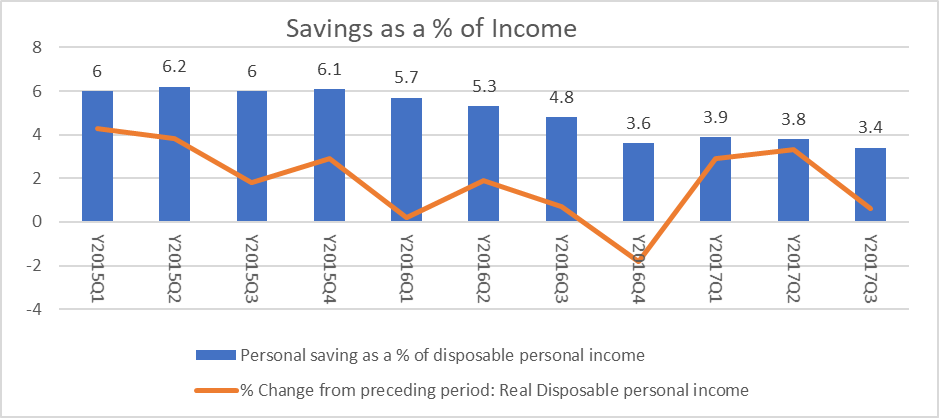

Other looks at the consumer from the data are as follows. The first graph shows the increasing consumer spending/outlay and decreasing savings. This suggests that the current increase in consumption came from consumers digging into their savings.

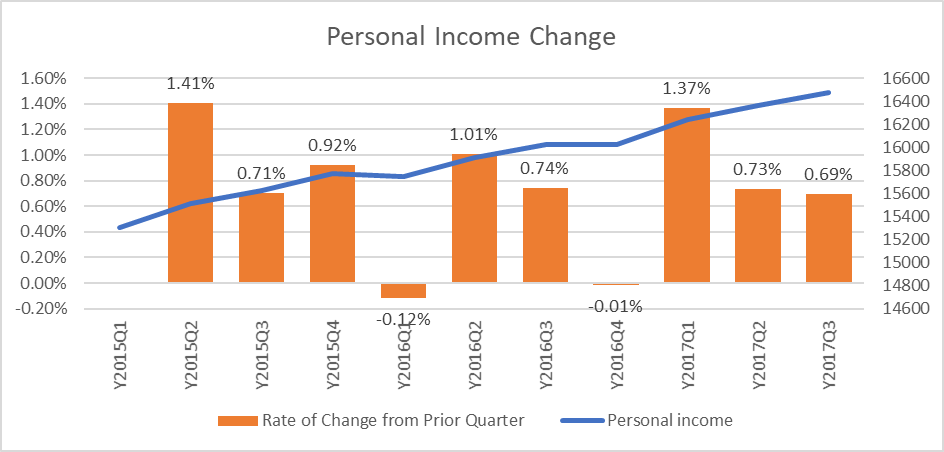

The challenge remains a lack of meaningful wage growth. The third graph shows that although personal income continues to escalate, the rate of growth from quarter to quarter on an annualized basis remains stagnant and low.

[1] https://www.bea.gov/newsreleases/national/gdp/2017/pdf/gdp3q17_adv.pdf

[2] https://www.frbatlanta.org/-/media/Documents/cqer/researchcq/gdpnow/RealGDPTrackingSlides.pdf