Executive Summary

- Brexit– A self-inflicted injury that has created political and economic damage to the U.K. with continuing fallout that will likely cause a recession in the UK with rolling uncertainty over the next few years. The expected drawn out negotiation with the European Union over trade, immigration, securities and other integrated agreements will dampen any animal spirit regarding investment in the U.K. Thus far, Brexit related risks seem to be contained. However, Brexit is signaling to other members that exiting the EU is no longer a thought process. This challenges the “ever closer union” desired by the EU elites. On a minimum, Brexit has and will put downward pressure on regional growth due to the uncertainty created regarding the scale and scope of its long term impact.

- Lower for Much Longer– According to the Federal Reserve’s June 2016 Economic Projections, the Committee members have continued to revise down their interest rate targets for the next few years along with lower projections for the real GDP. The Federal Reserve has highlighted Brexit as a real and serious economic threat and was a consideration for not raising rates in June. Now that Brexit is a reality, the Federal Reserve will likely place interest rates on hold in its July meeting. As the U.S. election draws close, the Federal Reserve is not likely to increase rates in September and October to prevent being perceived as a factor in the election outcome. Although we believe that two rate hikes remain the base case, the probability of a single 25bp increase has substantially increased.

- A Slowing World Continues– More sand has been poured into the global growth gear box, and headwinds are growing with more geopolitical and institutional events. The June semi-annual World Bank report – Global Economic Prospect, suggests that downside risks to the global growth outlook have become more pronounced. “Rising policy related and political uncertainties, geopolitical risks and eroding confidence in policy effectiveness could set back global growth and trigger financial market turbulence. A synchronous slowdown in major advanced or key emerging market economies could have large negative spillover effects across EMDEs (emerging markets and developing economies), while the impact of financial market stress could be acute among EMDEs with elevated private sector debt. Prolonged stagnation in advanced economies and weaker growth potential in EMDEs could exacerbate protectionist sentiments.” Global economies will stay at low or very low growth for a while.

- U.S. is the Growth Engine– Compared to other developed economies, the U.S. is doing fine. Employment continues to edge up; inflation is in check; growth is moderate; interest rate is low and steady; consumer is spending; and household wealth and the financial markets are all at all-time highs. There is no recession on the horizon, but the financial markets have high expectations with little room for errors. Although the equity market seems to have brushed off the uncertainties around the U.S. election in November, terrorism, random shootings and killings, increased geopolitical and institutional risks, and a slowing global economy, at any time the market can turn sore due to any number of factors.

Mohamed El-Erian, then CEO and co-chief investment officer at Pimco, used the analogy of a traveler to help frame investors’ post global financial crisis challenges. He postulated that the investor is a passenger in a car travelling on a bumpy journey to an uncertain destination without guard rails and a spare tire. This was a pretty dire picture in post-Lehman 2010. Fast forward 6-years, the conditions of the journey remain the same, and perhaps the journey is riddled with more potholes. The New Normal, as so coined by Pimco, is characterized by deleveraging, reregulation and de-globalizationwhich together contribute to a sustained low economic growth environment. This has not changed! After years of global zero interest rate policy (ZIRP), quantitative easing (QE), and now negative interest rate policy (NIRP) in many developed markets, the efficacy of these unconventional monetary policies are being called into question. The idea is to reduce systemic risks to spur economic activities and risk taking at the same time redistributing wealth from savers to borrowers (a condition known as financial repression). However, the transmission mechanisms have not produced the intended consequences. Even at low rates, banks have not been lendingeffectively. This may be a consequence of Basel III and Dodd-Frank regulations imposed on financial institutions, or there is simply a lack of demand for loans due to an overall lack of growth in the economy coupled with elevated uncertainty. Also, in the case of spiking corporate borrowing, much of it is corporations taking advantage of “cheap money” for stock buyback to push up their share price. In the areas where there is pent up consumer demand with relaxed lending standards, such as auto and higher educationfinancing, the transmission mechanism is working (and now maybe too well). Another transmission mechanism is currency exchange rates. When a central bank lowers interest rates, the action makes its currency less attractive on the global stage. In the past, these one-off events have been supportive to exporters as their goods and services became more attractive. However, the effectiveness of a currency devaluation driven export boost is not uniform as manufacturing is now global. For example, the Japanese auto industry sources parts and components globally and in many cases assemble vehicles in local markets. A lowering of the Japanese yen would have little effect on the Japanese auto industry price competitiveness. Further, in today’s low growth environment, trading partners and competitor nations’ likely responses are to devalue their own currencies to maintain competitiveness. Thus beggar-thy-neighbor policies ultimately become a zero sum game. Finally, in times of heightened uncertainty, capital tends to flow to “safe haven” countries regardless of monetary policies and defeats any temporary advantages of an engineered currency devaluation by a central bank. For example, when Bank of Japan instituted NIRP, the yen spiked up. Although central bank policies remain relevant and impactful, we witness the limits of their reach and the ability to calibrate outcomes. Perhaps most importantly, too much is expected of central bankers while the fiscal hand is tied.

Brexit – Took the World by Surprise

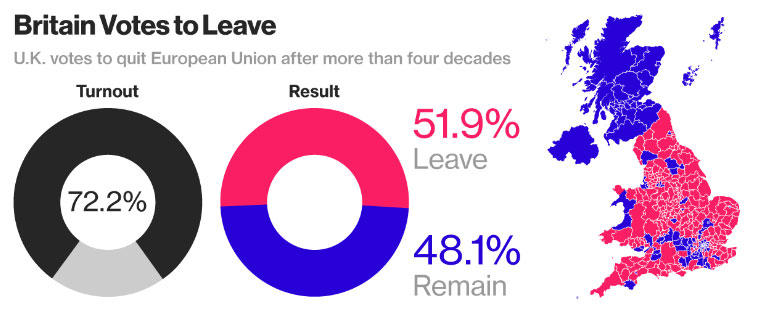

Citizens of the United Kingdom voted in a special referendum on June 24th to exit the European Union (EU). This significant decision sets up a wave of uncertainties around UK, other EU member countries, and ultimately the world economy. Observers are speculating and debating about the path forward and are unsure about the complete fallout, ramifications and timing. For now, the initial reaction seems to be contained, but the post Brexit data is not yet available for scrutiny.

Source: Bloomberg, http://www.bloomberg.com/news/articles/2016-06-24/what-now-brexit-win-sets-stage-for-two-years-of-bitter-talks

Prime Minister David Cameron immediately announced his resignation and will step down in October. The British Sterling crashed to a level not seen since 1985 against the U.S. Dollar as other safe haven currencies of Japan Yen and Swiss Franc and gold soared. Investor flight to safety has also pushed government bond yields significantly lower. Global stock markets lost more than $2tn in equity value in a single day. These reaction functions are expected as the world immediately adjusted to the new reality. Unfortunately, this is not just about Brexit but an acceptance of more institutional and EU risk to come. Brexit is only the tip of the iceberg of dis-unification. The short-term threat is the possible breakup of the United Kingdom. Scottish First Minister Nicola Sturgeon announced that her government is working on legislation for a new independence referendum and other alternatives as Scotland has always wanted to operate as a member of the EU. Still more to come are the April 2017 French election, August 2017 German election, and Feb 2018 Italian election. These are all opportunities for fringe and anti-establishment parties to gain control for the dis-unification of the EU. Typically, the ruling parties are made up of fragile coalitions and often with narrow margin. Under these circumstances, fringe or extreme groups could become the deciding factor and sway the election outcomes.

Brexit is a vote about the uneven participation in economic recovery and prosperity since the Financial Crisis; the seemingly unstoppable waves of immigrants competing for dwindling resources, benefits and jobs; and the push back against the status quo, the establishment and the elites who are deemed to be disconnected from the electorate. The vote is a pronouncement of discontentment and frustration with the status quo and the downside effects of globalization and free trade. At the end, this is about collective fear viewed from the lens of scarcity after years of anemic economic growth, disinflation and policies. In a world where a country-state’s boarder cannot be limited by physical boundaries and labor, industry, productivity and finance are fluid and cross-national, citizens and politicians feel vulnerable. This is exacerbated by the run up to the financial crisis where financial leverage and engineering made average citizens feel more financially comfortable and economically empowered. In reality, we brought forward the growth and returns of the future. Then came the Financial Crisis which exposed the weaknesses of our global financial system and the house of cards by which many have laid their foundations and expectations about the future.

Nationalism is one of modern Europe’s strongest traditions, but it fell into disrepute after the Second World War. Amid the avalanche of crises that have struck the EU over the past decade, of which Britain’s vote to leave the bloc is the latest example, nationalism is making a reappearance. Brexit is simply the latest manifestation of discontentment with the status quo and finger pointing. Populism is a powerful political force when segments of the electorate believe that they have been wronged and their interests disregarded. High tide has not lifted all boats and the push back and reversal of trade and free market capitalism is an understandable albeit a wrong path forward. This is a case of poor economics driving poor politics. Unfortunately, economic growth is the elixir that is nowhere to be found.

Brexit – Footprints in the Sand

The decisions and negotiations and the events such actions will shape have no blueprint to follow. No country has ever left the EU trading bloc. Although Article 50 of the Lisbon Treaty1 lays out the very general terms for a member country to legally exit, the details are extremely unclear and require significant negotiations. The Joint Statement made by Martin Schulz, President of the European Parliament, Donald Tusk, President of the European Council, Mark Rutte, Holder of the rotating Presidency of the Council of the EU, and Jean-Claude Juncker, President of the European Commission on June 27th offered their EU response2 :

We now expect the United Kingdom government to give effect to this decision of the British people as soon as possible, however painful that process may be. Any delay would unnecessarily prolong uncertainty. We have rules to deal with this in an orderly way. Article 50 of the Treaty on European Union sets out the procedure to be followed if a Member State decides to leave the European Union. We stand ready to launch negotiations swiftly with the United Kingdom regarding the terms and conditions of its withdrawal from the European Union. Until this process of negotiations is over, the United Kingdom remains a member of the European Union, with all the rights and obligations that derive from this. According to the Treaties which the United Kingdom has ratified, EU law continues to apply to the full to and in the United Kingdom until it is no longer a Member.

The Leave vote brought in a period of significant political uncertainty and disarray in the U.K.With the resignation of Cameron, a leader for the Conservative party has to be selected. Cameron has made it clear that he would not begin to negotiate with the EU for Brexit terms which includes the invocation of Article 50. Article 50 would set out the arrangements for the UK withdrawal and taking account of the framework for its future relationship with the EU. The poster boy for Brexit was the former London mayor, Boris Johnson, who withdrew from the bid to be the next prime minister just one week after the referendum. His party supporters had declared no confidence in him for the race. Less than a week later, the other vocal supporter of Brexit, Nigel Farage, leader of the Independent Party, resigned. At the same time, Jeremy Corbyn, leader of the Labor Party,received a vote of no confidence by his party.After four of the five candidates removed themselves from the race, Theresa May (a Remainder, Home Secretary under Cameron) became the new prime minister just one month after the Brexit referendum. She has maintained her posture: Brexit is Brexit; there is no going back but there is no rush to evoke Article 50. However the longer the wait, the higher the cost to the U.K. and the EU, but to act sooner, the U.K. perceives giving up negotiation leverage.

The EU understands that the Brexit vote has thrown the future of the EU bloc into question with unknown economic and political consequences. These questions are posed during a time of slowing global growth and increasing doubts regarding the effectiveness of central bank policies, not to mention the unresolved banking and debt challenges that have been part of the constant “can-kicking” process in hopes of some future resolution. Brexit is another bag of sand being dumped into the gear box driving the global economy. The degree and magnitude of the fallout will be predicated on how the exit is negotiated and handled and the actions the EU will take to bind the remaining 27 countries together. The only silver lining to the exit is that the U.K. is not part of the monetary union using the euro as the common currency (as in the case of Greece). Brexit by itself is no more than an uncomfortable disruption or a self-inflicted injury and not a calamitous act to the EU per se. As such, this event should not be considered a systemic risk driver oft-compared to Lehman event. However, if the divorce process turns ugly, a series of negative chain reactions could result in long-term financial, trade and political consequences. One end game (although not the base case), which is most feared, is the unraveling of the EU itself. It is generally agreed that the negative short term impact is squarely on the U.K. economy and people and Brexit could turn out to be a containable and localized event with no long term impact to the EU or the global economy. But now is simply too soon to telland thus it is understandable that this event adds to uncertainty.

U.S. Interest Rates – Lower for Much Longer

The Federal Open Market Committee (FOMC) June 15th press release stated that the labor market has slowed even though the unemployment rate declined further. Also, economic growth has picked up along with the housing sector and consumer spending while business fixed investment is soft and inflation remains muted. Since the FOMC does not operate in a vacuum, the Committee continues to closely monitor global economic and financial developments. The bottom line is to take no rate increase action this meeting. More importantly, the press release stated that “[t]he Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.”

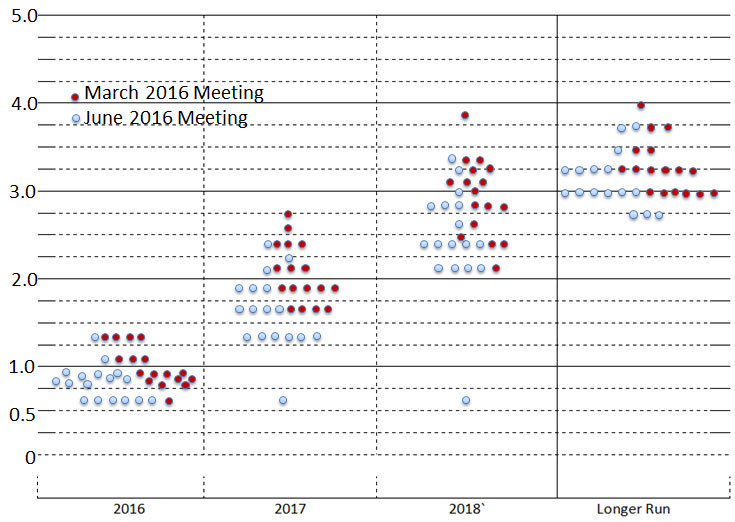

On the surface, the FOMC’s position has not deviated too much from recent meetings. The FOMC’s path for the federal funds rate will continue to depend on the economic outlook as informed by incoming data and that each meeting is a “live” meeting for rate increase. However, the economic projections that accompanied the press release tell a different story. These projections represent each FOMC member’s individual assessments regarding real GDP, U3 unemployment rate, core PCE inflation and the expected interest rate policy path (i.e. the dot plot) from 2016 forward. The following dot chart plots the value of each individual FOMC participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specified calendar year or over the longer run. The red dots represent member projections during the March 16, 2016, meeting, and the blue dots represent their projections during the June 15, 2016, meeting.

This clearly shows that the participants have lowered their sights for 2016, and the path to 2018 and beyond has also been lowered (blue dots are generally lower and concentrated in the lower ranges.) Attention should not only be paid to the median projected rate but also the range of the projections. This helps to inform us of the breadth of the projections. In the transcript to Chair Yellen’s June 15th press conference, she stated that “the economic outlook is inherently uncertain, so each participant’s assessment of appropriate policy, is also necessarily uncertain, especially at longer time horizons, and will change ibn response to changes to the economic outlook and associated risks.” The members are involved in a process of constantly reevaluating where is the neutral rate going and what is evident is a downward shift in that assessment overtime. Further, the FOMC is quite uncertain about where rates are heading in the longer term. She also cited that “vulnerabilities in the global economy remain and in the current sluggish global growth, low inflation and very accommodative monetary policy environment, investor perceptions of, and appetite for, risk can change abruptly.” In her response to reporters’ questions, she stated that the outcome of Brexit is one of the factors that was factored into the FOMC’s rate decision. At the end, FOMC’s decision is data dependent. Every meeting is a live meeting, so rates are not set on a pre-specified course.

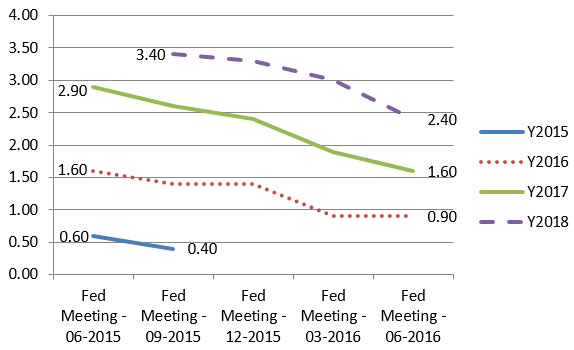

The FOMC has consistently been revising their expected neutral rate and annual rate lower. The following diagram plots the projected year end interest rates during the past 6 FOMC meetings where projections are published. For example, in the September 2015 meeting, the FOMC projected the rate would be 3.4% at the end of 2018, and this projection is now lowered to 2.4% during the June 2016 meeting.

For a long time now, the market has been projecting a lower-to-a-much-lower interest rate environment as compared to FOMC projections for interest rates. This gap has been viewed as a constant risk. However, so far the market has been right about rates and FOMC has continued to adjust downwards its interest rate projections. FOMC’s dual mission is “to foster maximum employment and price stability.” This means that the FOMC makes interest rate decisions that would strike a balance between full employment (however that is defined and measured) and a stable level of inflation. In a simple binary world when employment reaches and passes the full employment point, wages would rise and spur spending that would lead to increased inflation or potential price instability. The opposite is also true that increasing interest rates to slow down inflation could slow down the economy and ultimately bring an end to the economic cycle. It is understandable that the FOMC is interested in measuring the temperature of the domestic economy.

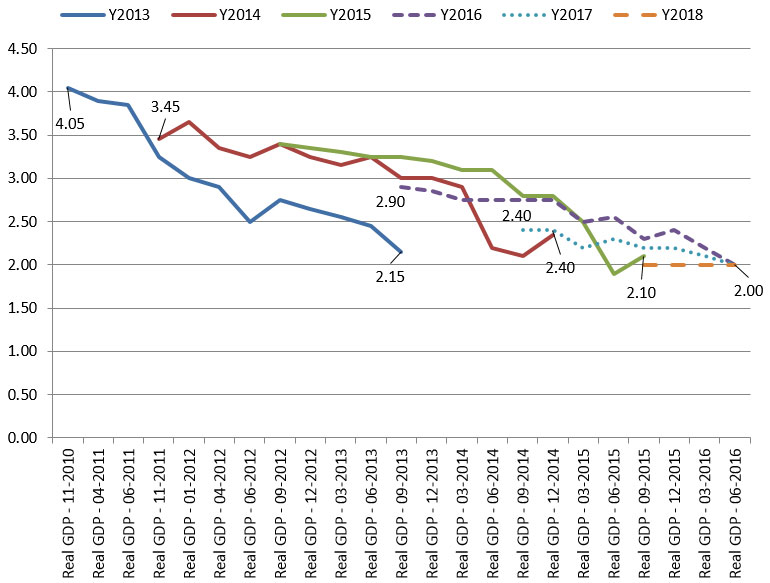

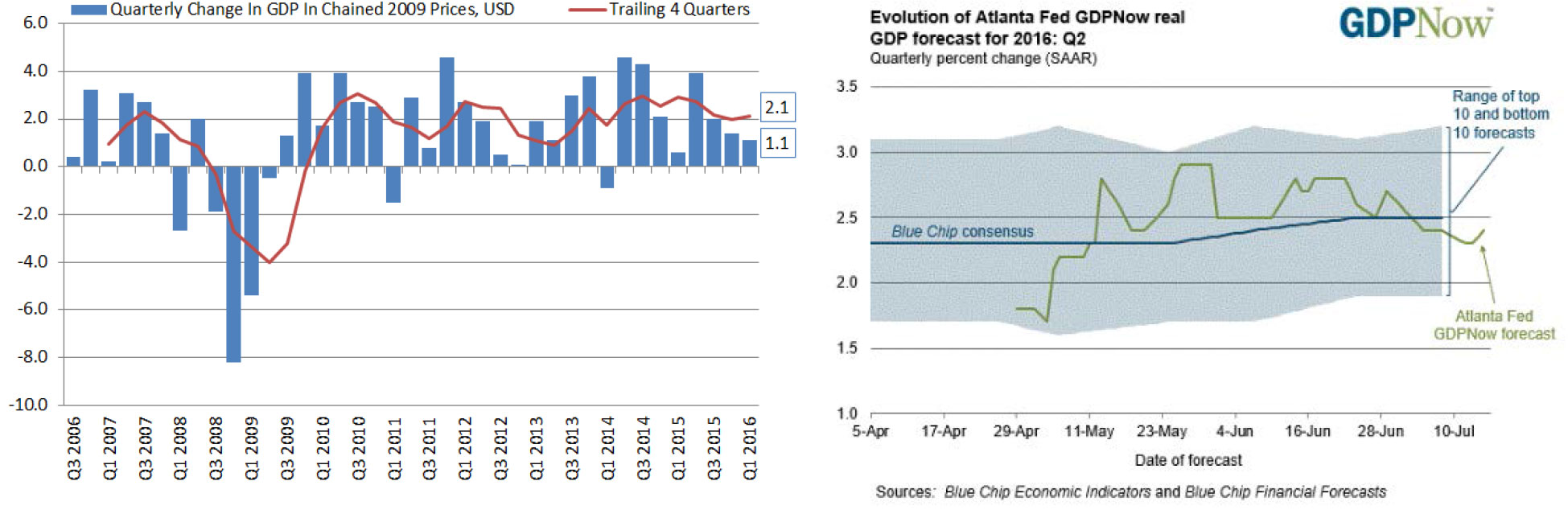

This left graph plots the FOMC meeting projections since November 2010 through June 2016. It is clear that during the past 6-years the FOMC has been overestimating the strength of the U.S. economy and expecting a “normal” real GDP. Over time, the projections have to be revised downward. The projections for 2016 through 2018 now have been revised to 2.00% for real GDP in the U.S. This downward projection is one of the basis for FOMC’s inaction. In the real world, the U.S. GDP for the first quarter – increased at an annual rate of 1.1% in the first quarter of 2016, according to the “third” estimate released by the Bureau of Economic Analysis. This was an upward revision from 0.8% in the second estimate and the advance estimate of 0.5%. However, 1.1% remains weak. The GDPNow3 model from the Atlanta Federal Reserve Bank forecasts for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2016 is 2.4% on July 6. If this holds true, the U.S. economy would be growing at an annual real rate of 1.75% during the first half. In order for the U.S. economy to grow above 2% for the year, the second half must have an average annualized real growth rate of over 2.25%.

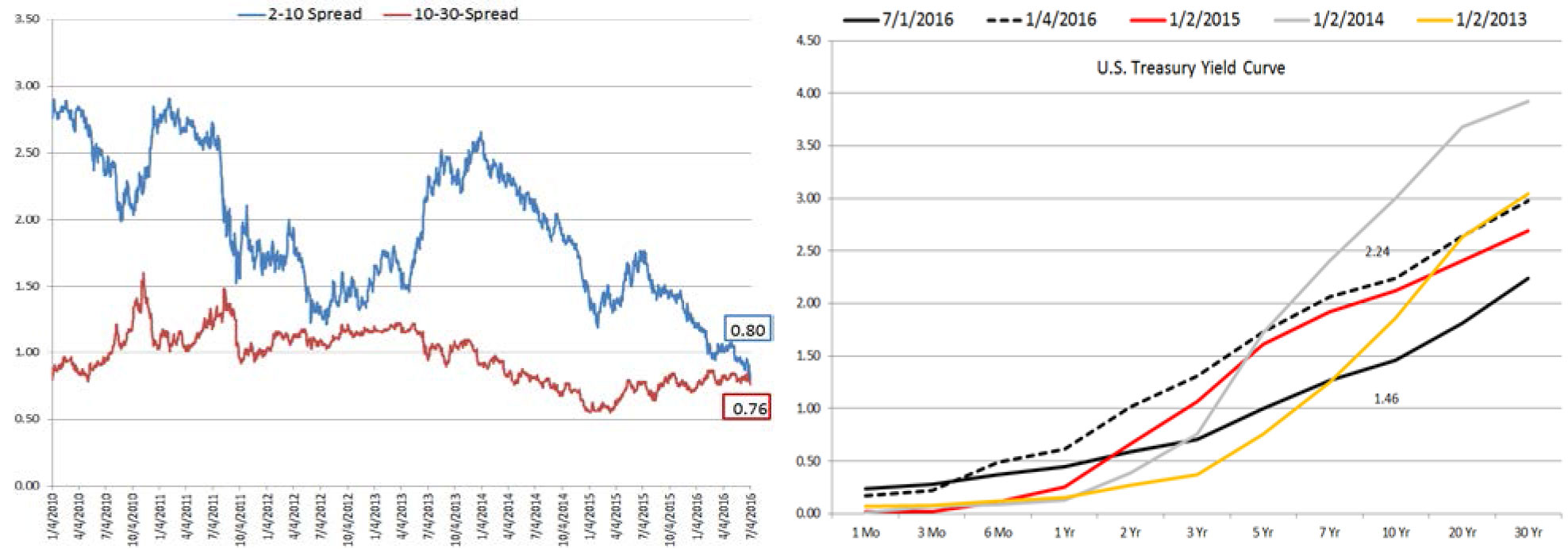

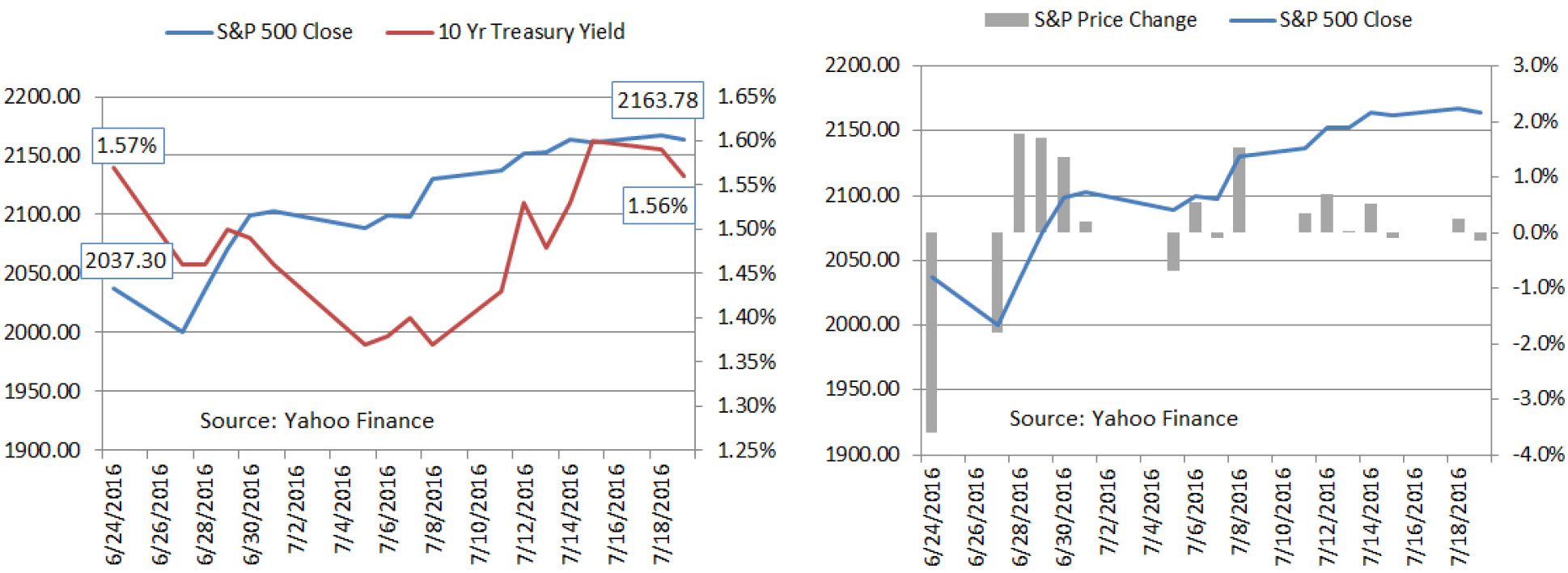

Now that Brexit is a reality, a rate hike in the upcoming FOMC meeting on July 26-27 is unlikely. Market volatility typically tightens financial conditions and contributes to market uncertainty. This is not the time to raise interest rates. In the meantime, the 10-year U.S. Treasury note is yielding at 1.38% on July 6th. The spread between the U.S. 2- and 10-year (at 0.80%) and the 10- and 30-year (at 0.76%) treasuries continues to compress and further flatten the Treasury yield curve. Since the beginning of this year, the 10-year note yield has dropped from 2.24% to 1.46%.

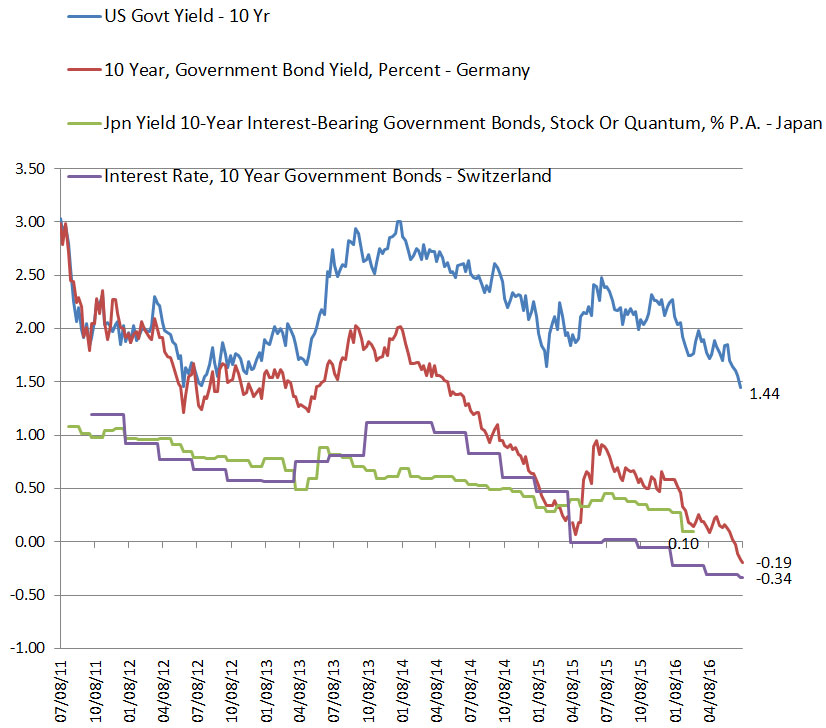

Of course the low yield on developed sovereign bonds is not confined to the U.S. In fact, the U.S. 10-year yield is head and shoulders above other developed economies. This relative attractiveness in yield is also helping to drive the U.S. interest yield curve flatter as more foreign investors find the U.S. yields more attractive. The global flight to safe haven currencies is placing significant downward pressure on the reserve currencies (US, Japan, Switzerland and Europe) and their sovereign bonds. This places a strain on the Federal Reserve’s ability to have influence over the yield curve as well as its ability to raise short-term interest rates. The Federal Reserve’s interest rate decisions have global implications, and at the same time, events globally limit the Federal Reserve’s degree of freedom to act in its country’s best interest. This globally linked monetary-financial system is making a diverging policy action that much more challenging. The movement of the 10-year government bond yields of the US, Germany, Japan and Switzerland continue to trend lower. If the current trajectory continues, the U.S. is more likely to push towards 1% rather than 2%.

The World Economy – Where Are We?

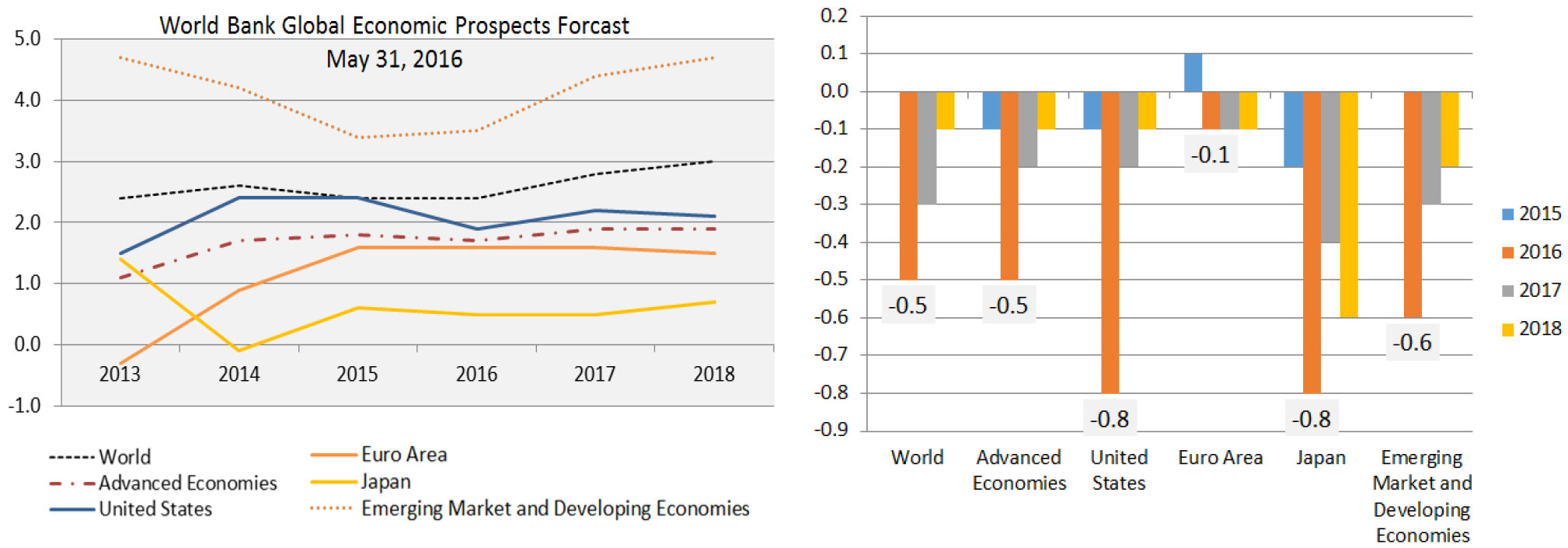

According to the World Bank Global Economic Prospects Report4 released in June for data through the end of May, the world economy is facing weak growth, pronounced risks, and limited policy space. This report revised down 2015 (estmate) through 2018 annual growth rates for all global regions. The Report points out that global growth continues to be muted and below potential in next few years. Although global growth is projected to accelerate gradually, a wide range of risks threaten to derail the recovery:

- a sharper-than-expected slowdown in major emerging markets,

- sudden escalation of financial market volatility,

- heightened geopolitical tensions,

- slowing activity in advanced economies, and

- diminished confidence in the effectiveness of policies to spur growth.

Furthermore, policy buffers have eroded substantially, particularly in commodity exporting emerging and developing countries. Slow growth is further diminishing policy buffers to counteract shocks, leaving the global economy less prepared to confront these downside risks.

World growth for 2016 at 2.4% is revised down by 0.5% from January projections (which was itself revised down from 3.3% in June 2015 to 2.9%.). Since this revision happened before Brexit, terrorism attacks5 and the unsuccessful coup in Turkey on July 15, it is highly likely that the world growth will continue to be adjusted lower going forward. The failed coup event on Friday night against the Turkey president Erdogan has been contained with massive number of perpetrators rounded up. This event is likely to be a localized isolated even shock with little rippling effect around the region. However, it is a confidence shock with economic ramifications. This event, regardless of more crack down and purging to come, would further discourage tourism in Turkey and raise more concern about investment and trade due to increase political risks in the near term. This will likely raise risk premia for Turkish denominated investments.

The divergence between commodity exporting countries and importing countries continues even though commodity prices have somewhat stabilized and recovered. For exporting countries, the rapid diminishing foreign reserves and fiscal buffers have forced these countries to tighten policy which contribute to slowing growth. For importing countries, the sustained low commodity prices have helped to lower fiscal and external vulnerabilities and inflation, but the capacity to expand fiscal policy remains limited. In the case of developed economies, inflation continues to be below policy target. However, with the ineffectiveness displaced by NIRP, there is little to no room for further rate reduction. The only scalable central bank policy tool remaining is quantitative easing (to include monetary financial or helicopter money). However the effectiveness or potency of such additional efforts had diminished while raising financial asset and stability risks.

G-20 finance minister just completed its meeting held at Chengdu, China6 . Much of the discussion revolved around Brexit and its fallout, and the ministers understood the need to proactively address the potential economic and financial consequences stemming from the Brexit vote to leave EU. G-20 encourages the UK to remain a close partner of the EU. G-20 affirmed that the weak global economic recovery remains challenging with persistent downside risks highlighted by fluctuating commodity prices, and low inflation in many economies. Financial market volatility remains high, and geopolitical conflicts, terrorism, and refugee flows continue to complicate the global economic environment. One theme that threads through the meeting is the recognition of the need to deploy all policy tools to include monetary, fiscal and structural to bring about a strong, sustainable, balanced and inclusive growth globally. Moreover, the rise of protectionism and nationalism has not gone unnoticed. The recognition for open trade policies and a strong and secure global trading system in promoting inclusive global economic growth is emphasized.

The U.S. Economy – Where Are We?

Real Gross Domestic Product

The third revision to the Q1 U.S. real GDP was 1.1%. The trailing 4 quarter average GDP is now at 2.1%. According to the Atlanta Federal Reserve’s computerized model, GDPNow, the second quarter real GDP is projected, as of 07-15-2016, to be 2.4%. This means, during the first half of 2016, the real GDP was growing at an annual rate of 1.6%. For the U.S. 2016 real GDP to be 2% or more, the last two quarters must be growing at a rate of no less than 2.5%. We project the real GDP will be below 2% for the year. The good news is that we remain the “best house in a bad neighborhood”, but the bad news is that unless we can generate growth organically and bring back the animal spirit and some fiscal policy support to prime the pump, we may still end up with Lawrence Summers’ Secular Stagnation. The Mid-Session Review published by the White House’s Office of Management and Budget for Fiscal Year 20177 (page 6), projected that real GDP growth in 2016 is expected to be 2.2% from Q4 2015 to Q4 2016 which is a downward revision from 2.7% and 2.4% per year in 2017 and 2018 from 2.5% previously.Separately, the IMF now has also revised its estimate for the U.S. from 2.4% in April estimate to 2.2% this year citing a strong U.S. dollar, a weak energy sector and the risk of Brexit.

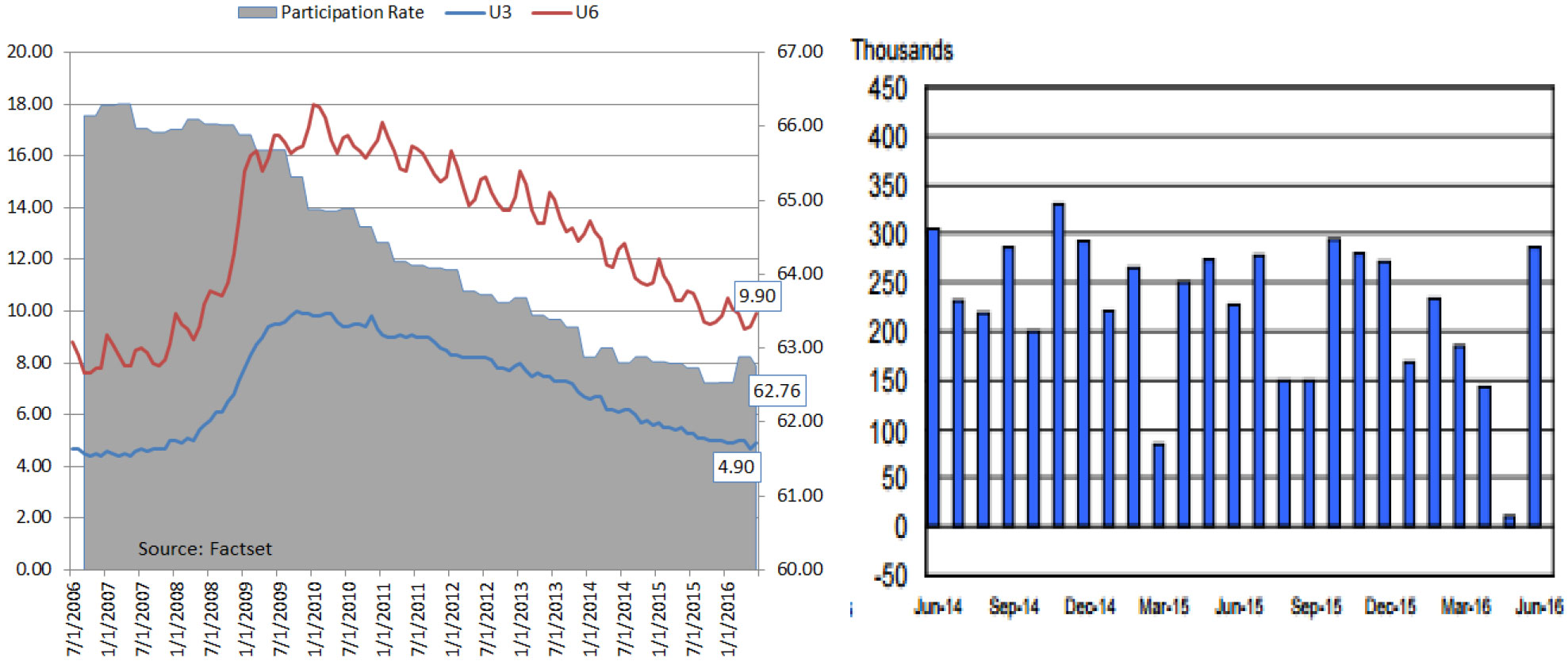

The U.S. employment picture continues to improve (although it is still not a perfect picture) and the rate of improvement will likely slow as we reach or get close to the full employment rate or NAIRU – the non-accelerating inflation rate of unemployment. The participation rate has been a bit volatile and now back down to 62.76%. In May, we were surprised by the low job creation number of 38,000 and then shocked again to find the June number to be over 287,000. When the monthly numbers are smoothed out over 3 months, the job creation rate is at an average of 147,000, which is respectable.

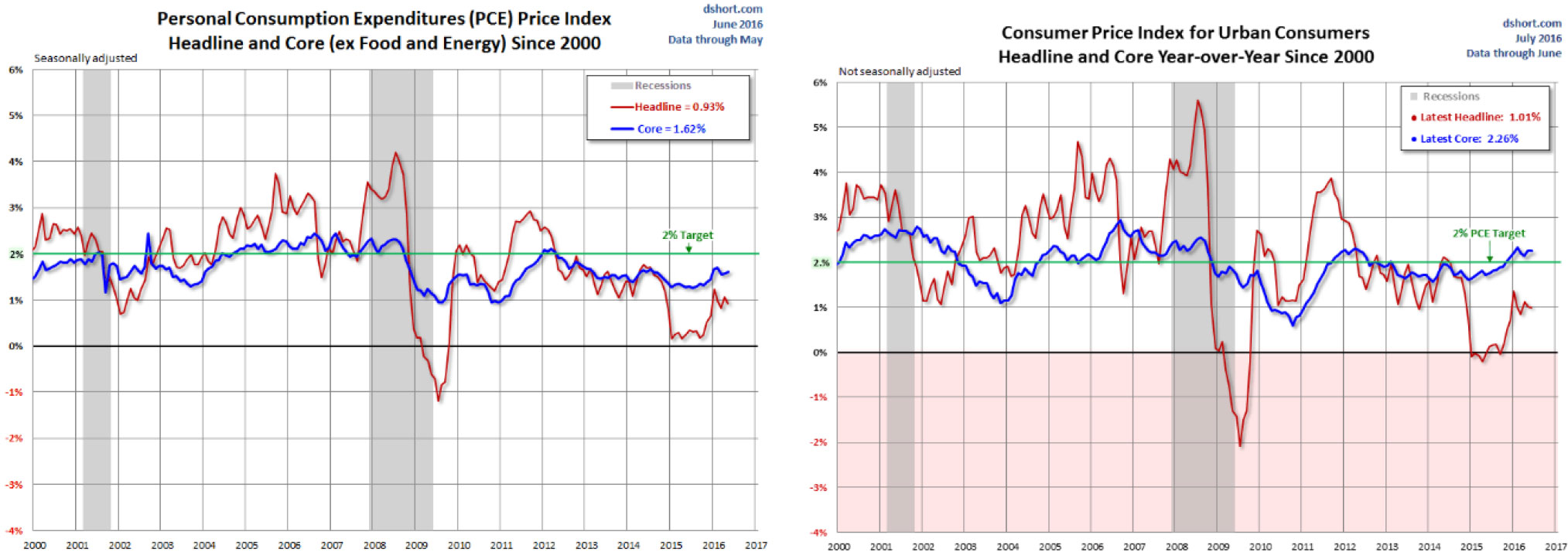

Inflation

The latest headline CPI is 1.01% and core is 2.26% (removing the volatile food and energy components). The latest headline Personal Consumption Expenditure (PCE) is 0.93%, and core is 1.62%. The favored core PCF reading for the FOMC remains well below the target. The FOMC also looks at inflation expectations since long-term inflation is anchored on consumer expectation.

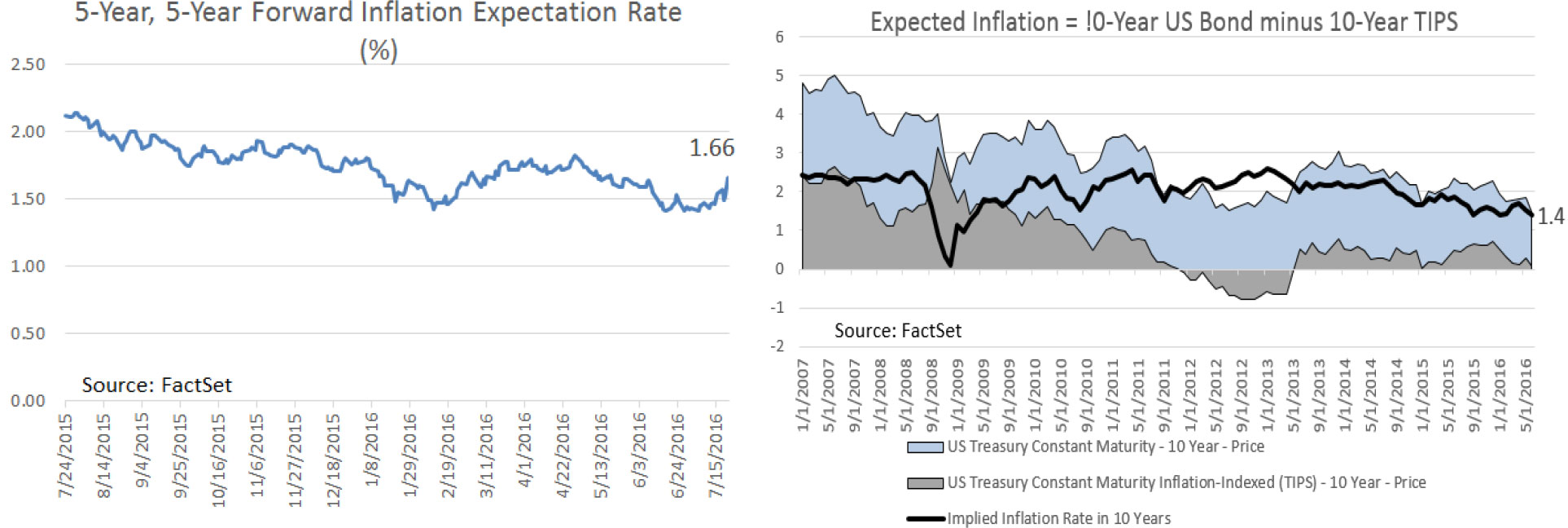

The 5 Year, 5 Year Forward is a measure of bond investor’s expected inflation (on average) over the 5-year period that begins 5 years from today. Currently, it is at 1.66% compared to current core PCE at headline CPI at 2.26%. When we take the difference between current 10-year US Treasury Bond (i.e. the yield investors need to be compensated for 10 years) and the 10-year US Treasury Inflation Protection Securities (TIPS), the net amount represents the investor’s expectation of inflation 10 years from now. This is at 1.4%.

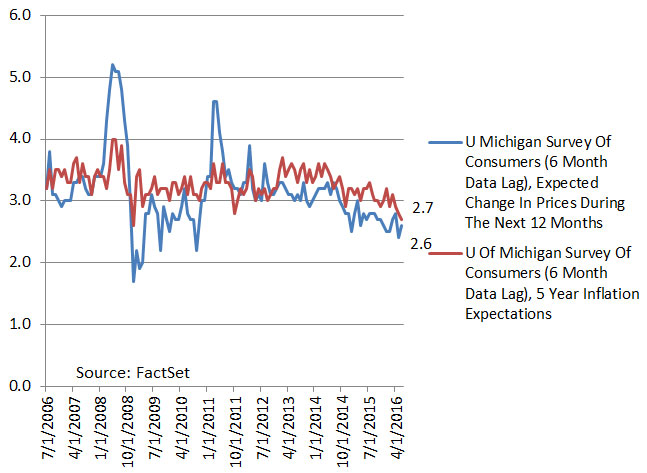

Separately, the June 30th University of Michigan consumer inflation expectation is 2.6% in a year and 2.7% in 5-years. This means the average consumer is expecting a higher inflation rate in 5 years than the bond investor’s expectation at 1.66%. Regardless which expectation more accurately reflects the future expectation, it is critical that the expectation remains stable.

Employment

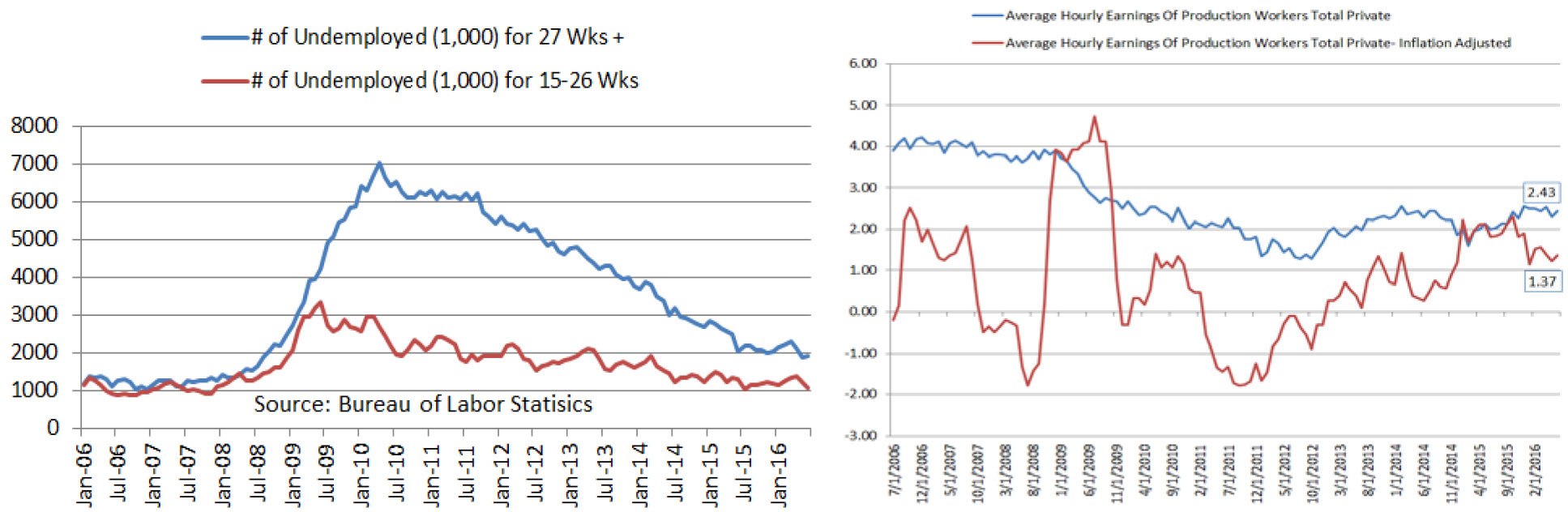

The U6 (broad measure) unemployment rate remaining close to the 10% mark is concerning, and even though the long–term unemployed (15 weeks or longer) has improved significantly over time, it remains elevated when compared to the pre-crisis levels for those unemployed for 27 weeks and longer.

As the U3 and U6 unemployment rates gradually decline, it is understandable that one of the top employer complaints is their inability to find qualified workers. As such, we are getting closer to witnessing a more meaningful rise in real wages although we have an above trend structural unemployed.

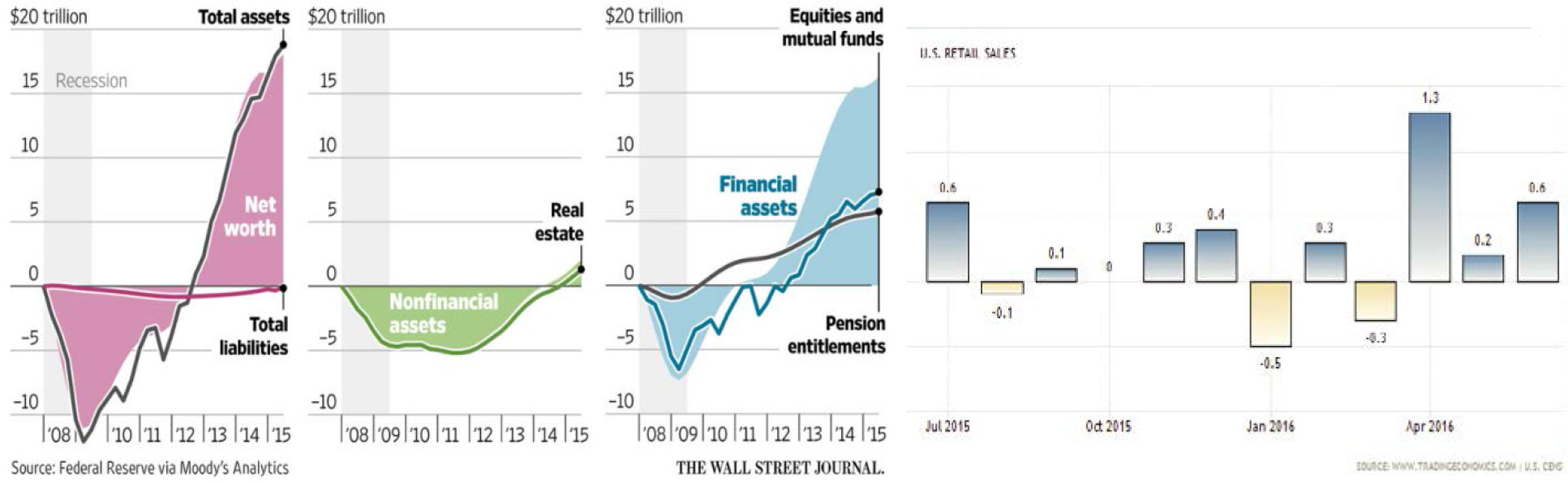

US Consumer

Household nominal net worth for U.S. is hitting an all-time high in the second quarter with rising real estate values and financial assets. This, coupled with strong employment numbers, is showing up in retail sales. Even though the aggregate U.S. household wealth does not account for the lumpy or uneven distribution, retail sales over the past three months have been strong.

The combination of higher employment, low interest rates and the prospect of higher wages helped the June 1.1% increase in existing home sales. This pushed the seasonally adjusted rate to 5.57 million which is the highest level since February 2007. With the current housing inventory, the supply of existing homes would be exhausted in 4.6 months. This trend suggests stable to increasing resale value and pressure on new construction.

It is reasonable to suggest that the U.S. economy continues to expand and grow with consumers leading the way. To grow faster from here requires evidence of stronger real wage growth, a dosage of government (fiscal) spending, structural reform (especially tax reform), normalizing interest rates on a measured pace, and a recovering or growing global economy. Otherwise, we will likely remain in this slow growth environment without a threat to recession in the foreseeable future.

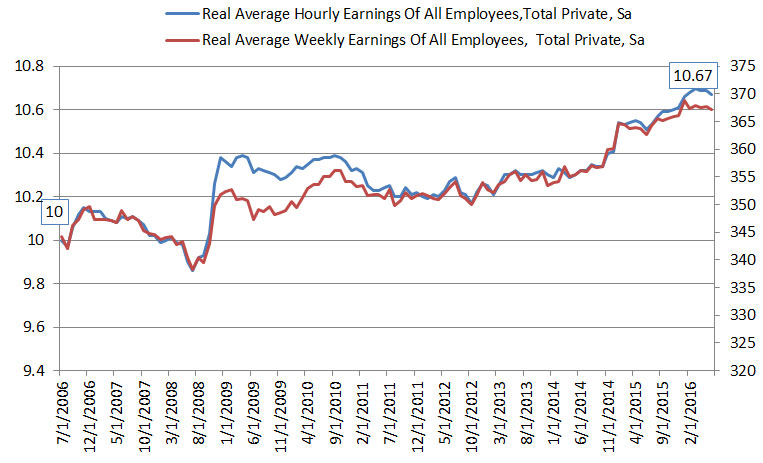

Wages

The Bureau of Labor Statistics8 chart to the left shows that the real average hourly earnings for all private employees went from $10.00 on July 1, 2006 to $10.67 on June 30, 2016. This is a 0.67 per hour increase, after adjusted for inflation, over 10-years. The inflation adjusted average weekly wage increased from $344.17 to $367.19, an improvement of $23.02. The average wage has gone nowhere during the decade. As stated earlier, the continuing drop in the unemployment rate and the lack of qualified labor should finally push for real wage growth.

Uncomfortably Comfortable

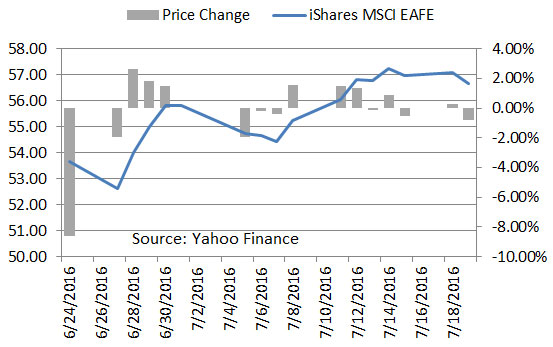

On June 24th, the financial market was taken by surprise when the UK referendum result was to leave the EU. As a reaction function, stock markets globally sold off quickly and deeply. Contemporaneously, there was a flight to safety, and we witnessed the drop in US treasury yields (high demand in bonds drive down yields). Furthermore, the market expected even more dovish monetary policies from the Bank of England, Bank of Japan, and the European Central bank. Further, the Federal Reserve is expected to delay any rate increases, perhaps until 2017.

Since the initial reaction, the global stock market has recovered quickly. The political risk subsided with the quick succession of May as the new prime minister and seemingly absence (or non-observable) of any rippling effects from the Brexit fallout helped the market to march forward. The speed of the market recovery and advancement to all-time highs cannot be explained by economic fundamentals. This is just more macro liquidity for longer periods, and with volatility in check, risk assets reaching new highs makes sense. The more worrisome longer term issue is bond yields. With Europe and Japan remaining in a stagnant economy and with no meaningful structural reform and relying heavily on monetary policies, the U.S. Treasury yields look great in comparison. If the Federal Reserve is able and willing to raise rates over the next couple of years to a new neutral rate of say 2%, the U.S. may end up with an even flatter yield curve or inverse yield curve without experiencing a recession simply due to foreign demand in our bonds. This of course assumes inflation remains in check. The ramifications to a prolonged low interest environment are multi-channeled with rippling consequences from breaking the social contracts with labor unions to state and local governments, massive underfunding of defined benefit plans, inability to generate sufficient return for endowments to sustain its mandated distributions, to the inability for insurance companies to match their assets with liabilities to meet future benefit promises; just to name a few.

Further, a prolonged disconnect between the economy and the financial markets will not likely end well. The rationale for chasing returns and income during a time of low interest rates and the assurance by central banks that they “got your back” reminds me of villagers running for safety from a tsunami to higher grounds just to end up sitting on top of a dormant volcano. One day the safety of higher ground could turn out to be the mirage. With the Federal Reserve likely to only raise rates once this year, we are years away from the new neural rate of 2% (i.e. the rate that equals the inflation rate). However, if inflation returns much quicker than anticipated while the Federal Reserve (in the name of prudence and caution) purposely waited, the rate and scale of increase may have to be adjusted in response. When the market loses faith in the Federal Reserve’s abilities and expects a faster and greater rate rise as a reaction function, all financial asset prices would be adjusted downward and quickly. This is especially true for long dated, safe assets. This would likely usher in the next U.S. recession and initiate a fast chain of events of which we should be fearful. But between now and then, we have a U.S. presidential race to suffer through to elect the candidate we dislike a bit less.

This quarterly commentary represents the current views of Chao & Company and they are subject to change. This Firm has no obligation or responsibility to update our views. The comments and views should not be deemed as Philip Chao, or any member of this Firm, offering personal or personalized investment advice. The quarterly commentary is informational only and is insufficient to be relied upon to make any financial or investment decisions or to make any changes to your financial condition.

- http://www.lisbon-treaty.org/wcm/the-lisbon-treaty/treaty-on-european-union-and-comments/title-6-final-provisions/137-article-50.html

- http://eeas.europa.eu/delegations/new_zealand/press_corner/all_news/news/2016/20160627_brexit_en.htm

- https://www.frbatlanta.org/cqer/research/gdpnow.aspx?panel=1

- http://pubdocs.worldbank.org/en/842861463605615468/Global-Economic-Prospects-June-2016-Divergences-and-risks.pdf

- June 7 & 8 bombing in Turkey, June 28th airport attack in Turkey, July 14 in Nice, France, among numerous other terror attacks in the Middle East and Africa.

- https://www.whitehouse.gov/sites/default/files/omb/budget/fy2017/assets/17msr.pdf

- http://www.bls.gov/news.release/pdf/realer.pdf