August this year will mark the 5th anniversary of the Lehman bankruptcy which ushered in the full force of the global financial crisis. Although the transmission mechanism was the sub-prime tainted, investment grade CMOs and much of the ills were manifested through moral hazard, poor regulatory oversight and enforcement and the incestuous relationship between sovereigns and banks, the real problem was, and continues to be, a lack of sustainable global economic growth without leverage. As the tide of easy credit rushed out, what became obvious was the “old” normal of high growth was an illusion. With cheap and abundant credit, consumers and corporations borrowed like drunken sailors to spend and “invest”. Without real and sustainable economic growth, this was siphoning future economic activities to the present – sort of borrowing forward. Collecting higher tax revenue from these excesses coupled with low borrowing costs, politicians fully participated to curry favors with all their stakeholders by dolling out more social and welfare benefits, employment, and guarantees. This was a worldwide phenomenon. Then came the financial crisis where the punchbowl was abruptly removed and the world began a long and painful hangover. After the initial massive fiscal response to prevent a total financial collapse coupled with a shrinking tax base, we witnessed the rise in budget deficits that quickly put a stop to more fiscal stimulus globally. The only tool left to restore confidence and buy time for recovery (i.e. economic growth back to “normal”) is through unprecedented monetary policies: near zero interest rates and massive quantitative easing. At the end, in order to restore confidence in the market and the economy, these central bank actions help to reassure the financial markets that they are there to prop up the banking system and to promote spending, borrowing and investing by flattening the yield curve. The premise or hope is that, by keeping interest rate low, savers and investors would be so uncomfortable that they will take on additional risks in order to earn a respectable return which would reignite capital markets and the economy and deliver the wealth effect over time. Further, by keeping longer term yields low through actively targeting the intermediate term portion (i.e. the belly) of the yield curve through quantitative easing, the borrowing cost would be lowered for mortgages and corporate investments. In short, the dual central bank actions are to buy time to stimulate economic recovery and to reach “escape velocity” and achieve self-sustainable growth.

Monetary Policy – The beginning of the beginning of the end

Since the first quantitative easing, economists and central bankers have been debating the efficacy and the unintended consequences of these unconventional policies. Some economists strongly suggest that quantitative easing and the extraordinary low interest rate are in fact dampening the economic recovery by preventing normal market functions while other believe that the policy should be extended and expanded in order for the US economy to fully recover from the Great Recession. Regardless of one’s view, the price of risk assets has continued its upward trajectory and the need for yield and return has extended beyond our borders and fueled asset price appreciation in emerging markets. It is every investor’s hope that either 1) the US economy or, for that matter, the world economy will grow fast enough to meet the elevated asset prices or 2) the accommodative central bank policies should perpetuate for a very long time. This reminds me of a very long tree branch that extends outward. Because we are uncomfortable with the rising water (low interest rate environment), we climb up the tree and walk out on the branch (take on risk) in hopes of reaching dry land on the other side (where we return to old normal). As more and more people climb up the tree and proceed to move outward on the branch, danger increases. If water does not recede (extraordinary monetary policy persists) so that we can climb back down safely, it gets exponentially more risky as more people pile onto the branch and begin their journey outward in hopes of reaching the other side (i.e. the economy recovers with sustainable healthy growth rates). The risk asset market is increasingly supported by the certainty of quantitative easing and the near 0% policy. Investors want to enjoy the enormous support by the central bank while waiting for the “old normal” to return. Yes, like it or not, the market is an addict.

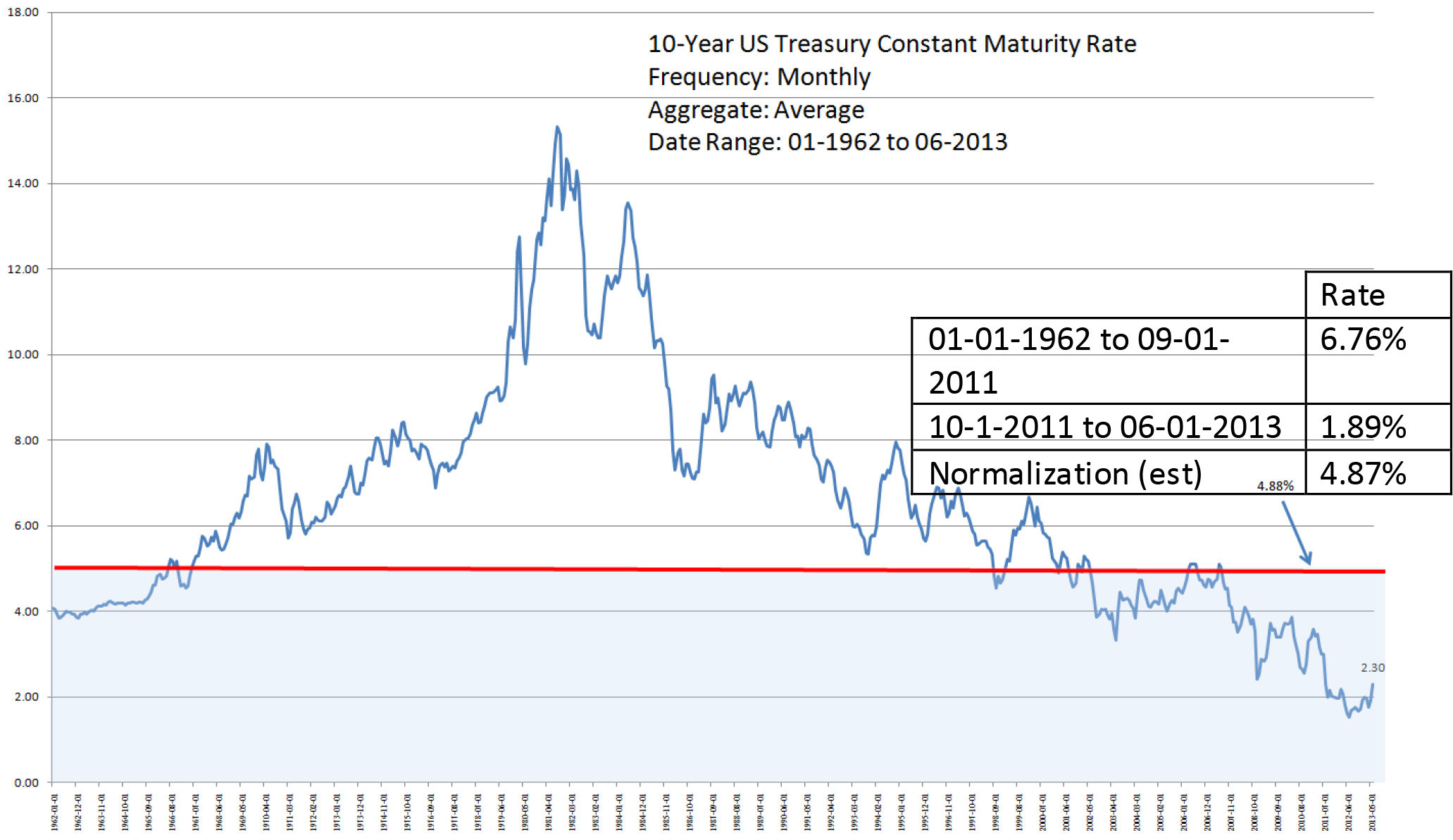

The $85 billion monthly purchase by the central bank has lowered interest rates through market action. The following graph shows the monthly 10-year US Treasury rate since January 1962 through last month.

The average nominal yield since 1962 through September 2011 (i.e. the month before the announcement of QE3) is 6.76%, compared to 1.89% since October 2011. The difference is 4.87%. As the Federal Reserve slows down or ceases QE3 to subsequently contract its balance sheet, the foreseeable future does not bode well for fixed income investors even though there are many strategies that can be deployed to mitigate some of the multi-year negative effects from rising interest rates.

The FOMC is aware that the long period of low interest rates has costs and risks. For example, savers who rely on interest income from savings accounts or government bonds are receiving very low returns, and there is a possibility that very low interest rates, if maintained too long, could undermine financial stability. The dual mandates of full employment and maintaining price stability (i.e. inflation) allow the Federal Reserve broad interpretation and policy actions. By anchoring a near zero Fed Fund rate and through aggressive bond purchases, the Federal Reserve justifies these actions by pointing at a systematically shrinking unemployment, increasing overall US wealth, improving housing market and an expanding US economy at the same time taking credit for price control since there is almost no inflation of which to speak. This gives FOMC more room to remain dovish. Although it is difficult, if not impossible, to draw a direct connection of a healing economy with low interest rate and quantitative easing policies, it is clear that the Federal Reserve’s actions have made risk-taking a necessity in order to earn an income or a return.

Since December, the FOMC has indicated that its current target range for the federal funds rate, 0 to 1/4%, is appropriate based on the two following conditions:

- the unemployment rate remains above 6.5%, and

- the inflation rate between one and two years ahead is projected to be no more than a 1/2% above the FOMC’s 2% longer-run goal, and longer-term inflation expectations continue to be well anchored.

On May 22, 2013, Federal Reserve Chairman Ben Bernanke appeared before the U.S. Congress Joint Economic Committee1 to express his economic outlook (the “May 22 Speech”). Bernanke stated that the FOMC has maintained low federal funds rate and other short-term money market rates at or close to zero since late 2008 and looked to alternative policy tools for help. The first of these alternative tools is “forward guidance” about the FOMC’s likely future target for the federal funds rate. This guidance underscores the FMOC’s intention to maintain highly accommodative monetary policy as long as needed to support continued progress toward maximum employment and price stability.

The second policy tool now in use is large-scale purchases of longer-term Treasury securities and agency mortgage-backed securities (MBS). These purchases put downward pressure on longer-term interest rates, including mortgage rates. Under quantitative easing (QEIII), the FOMC has been buying longer-term Treasury securities at a pace of $45 billion per month and agency Mortgage Backed Securities (MBS) at a pace of $40 billion per month. FOMC has said that it will continue its securities purchases until the outlook for the labor market has improved substantially in a context of price stability. The FOMC also has stated that, in determining the size, pace, and composition of its asset purchases, it will take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

“At its most recent meeting, FOMC made clear that it is prepared to increase or reduce the pace of its asset purchases to ensure that the stance of monetary policy remains appropriate as the outlook for the labor market or inflation changes. Accordingly, in considering whether a recalibration of the pace of its purchases is warranted, the Committee will continue to assess the degree of progress made toward its objectives in light of incoming information. The FOMC affirmed that it expects a highly accommodative stance of monetary policy to remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens.”

Recognizing the drawbacks of persistently low rates, the FOMC actively seeks economic conditions consistent with sustainably higher interest rates. Unfortunately, withdrawing policy accommodation at this juncture would be highly unlikely to produce such conditions. A premature tightening of monetary policy could lead interest rates to rise temporarily but would also carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further. Such outcomes tend to be associated with extended periods of lower, not higher, interest rates, as well as poor returns on other assets. Moreover, renewed economic weakness would pose its own risks to financial stability.

Investors actively interpreted the formal statement, and the market began to react to the May 22 Speech believing that Bernanke and the FOMC would begin curtailing QEIII. According to CNNMoney, investors began to pull money out of bond funds2 .

Investors waited for the June 19th conclusion of the two-day FOMC meeting held in Washington to obtain more definitive guidance regarding its monetary policies. In Bernanke’s press conference, he stated the following (with emphasis added):

- Overall, the Committee believes the downside risks to the outlook for the economy and the labor market have diminished since the fall, but we will continue to evaluate economic conditions and risks as they evolve.

- The current exceptionally low range for the funds rate will be appropriate at least as long as the unemployment rate remains above 6½ percent so long as inflation and inflation expectations remain well behaved.

- The economic conditions we have set out as preceding any future rate increase are thresholds, not triggers. In the projections submitted for this meeting, 14 of 19 FOMC participants indicated that they expect the first increase in the target for the federal funds rate to occur in 2015.

- The Committee expects a considerable interval of time to pass between when the Committee will cease adding accommodation through asset purchases and the time when the Committee will begin to reduce accommodation by moving the federal funds rate target toward more normal levels.

- The Committee left the pace of purchases ($40 billion per month in agency mortgage-backed securities and $45 billion per month in Treasury securities) unchanged at today’s meeting. It has stated that it may vary the pace of purchases as economic conditions evolve.

- Any such change would reflect the incoming data and their implications for the outlook, as well as the cumulative progress made toward the Committee’s objectives since the program began in September.

- Going forward, the economic outcomes that the Committee sees as most likely involve continuing gains in labor markets, supported by moderate growth that picks up over the next several quarters as the near-term restraint from fiscal policy and other headwinds diminishes. If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year, and if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.

- If conditions improve faster than expected, the pace of asset purchases could be reduced somewhat more quickly. If the outlook becomes less favorable, on the other hand or if financial conditions are judged to be inconsistent with further progress in the labor markets, reductions in the pace of purchases could be delayed. Indeed, should it be needed, the Committee would be prepared to employ all of its tools, including an increase in the pace of purchases for a time, to promote a return to maximum employment in a context of price stability.

- The very sharp rise in real interest rates seems larger than can be explained by a changing view of monetary policy. I think it was bigger than can be explained by changes in the ultimate stock of asset purchases within reasonable ranges, so I believe we have to conclude that there are other factors at work as well, including again, some optimism about the economy, maybe some uncertainty arising.

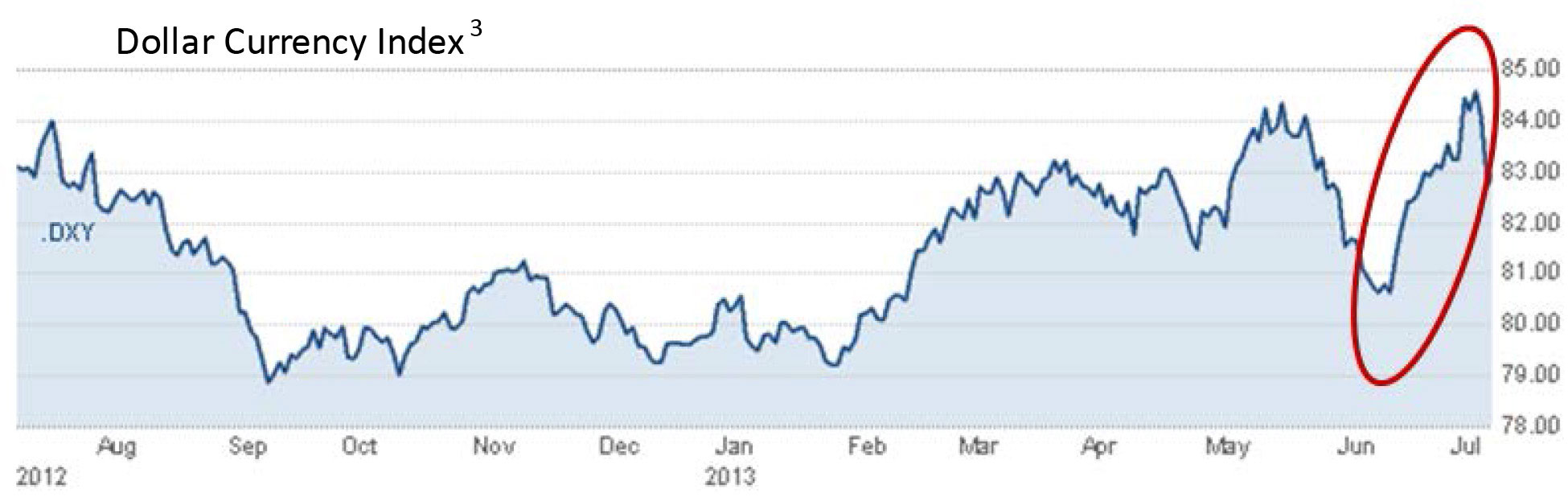

Investors took the comment to suggest that the Federal Reserve is increasingly more confident with the US economy and it is likely to tapper its quantitative easing efforts. After the comment, the yield on 10-year Treasuries hit its highest since March 2012 at 2.3%, up sharply from 1.60% at the beginning of May, while equities stumbled with the S&P 500 closing 1.4% lower. This is just the beginning of a two week period of market reaction and volatility. The US dollar strengthened based on the expectation of Fed tapering which would reduce the monetary expansion process (money printing). This further contributed to the losses for US investors with foreign exposures. Sensing the possibility of Fed tapering, investors began selling their investments in emerging markets in anticipation of lowering liquidity globally which contributed to a serious sell-off in such markets.

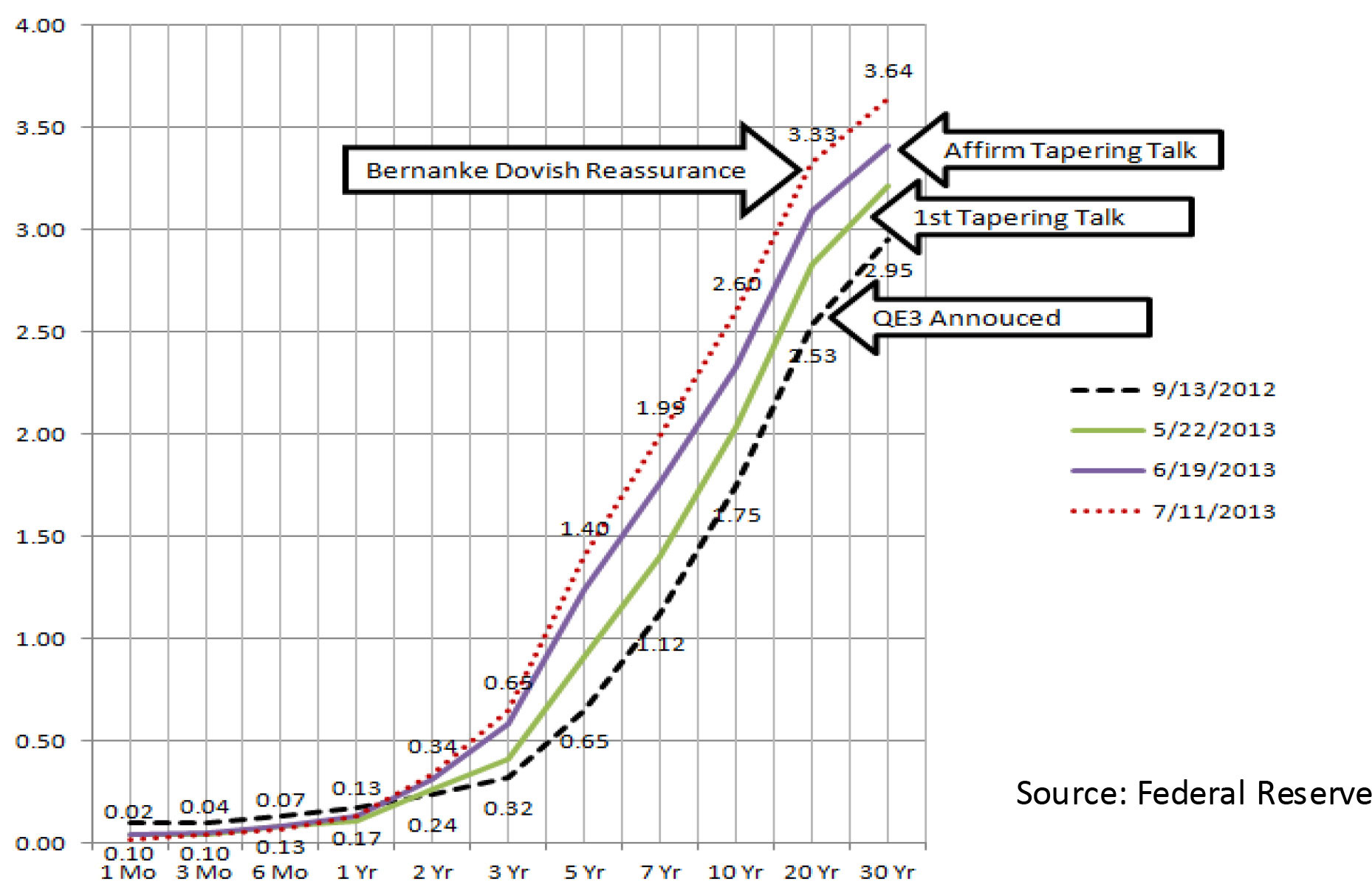

If the Federal Reserve was surprised or taken aback by the market reactions since May 22nd, the reaction was even more severe since the June 19th statement. Virtually every section of the fixed income market was negatively and significantly impacted. Credit spread increased (i.e. investors expect more yield for taking on more credit risk when compared to the US treasuries) and market liquidity tightened (i.e. less money available for transactions). Trying to control the market overreaction, Bernanke told the audience during the National Bureau of Economic Research conference on July 10 that, because unemployment remains high and inflation is below the Fed’s target, the policies are still necessary. The Federal Reserve is deliberately trying to calm market fears by signaling that even tapering is not certain at this time and higher interest rates would be a drag on the economy and the housing market.

The following table shows the change in interest rate from before the May 18th statement and the post July 10 statement. The 3- to 10-year Treasury securities were the most affected while the short-end witnessed a drop in rates.

| Date | 1 Yr | 2 Yr | 3 Yr | 5 Yr | 7 Yr | 10 Yr | 20 Yr | 30 Yr |

|---|---|---|---|---|---|---|---|---|

| 5/17/2013 | 0.12 | 0.26 | 0.40 | 0.84 | 1.32 | 1.95 | 2.77 | 3.17 |

| 7/19/2013 | 0.11 | 0.32 | 0.59 | 1.31 | 1.90 | 2.50 | 3.25 | 3.56 |

| Change | -8.33% | 23.08% | 47.50% | 55.95% | 43.94% | 28.21% | 17.33% | 12.30% |

| Source: Federal Reserve | ||||||||

This interest rate movement clearly shows the most vulnerable portion of the yield curve which is the most sensitive to Fed tapering or rate normalization. Although the speed of this correction was greater than anyone anticipated, the direction and the eventuality are clear. The latest FOMC minutes show the following threshold (not trigger) for possible Fed action:

| 2013 Range | 2015 Range | |

|---|---|---|

| GDP | 2.3% – 2.6% | 2.9% – 3.6% |

| Unemployment | 7.2% – 7.3% | 5.8% – 6.2% |

| Inflation | 0.8% – 1.2% | 1.6% – 2.0% |

Market is by definition forward looking. As such, investors will continue to anticipate Fed actions. This will contribute to and maintain a higher level of market volatility in the next few years as the Fed attempts to begin weaning the world off from its quantitative easing and to allow interest rate normalization. It is reasonable to assume that markets will react negatively towards encouraging economic data suggesting quicker tapering action by the Fed.

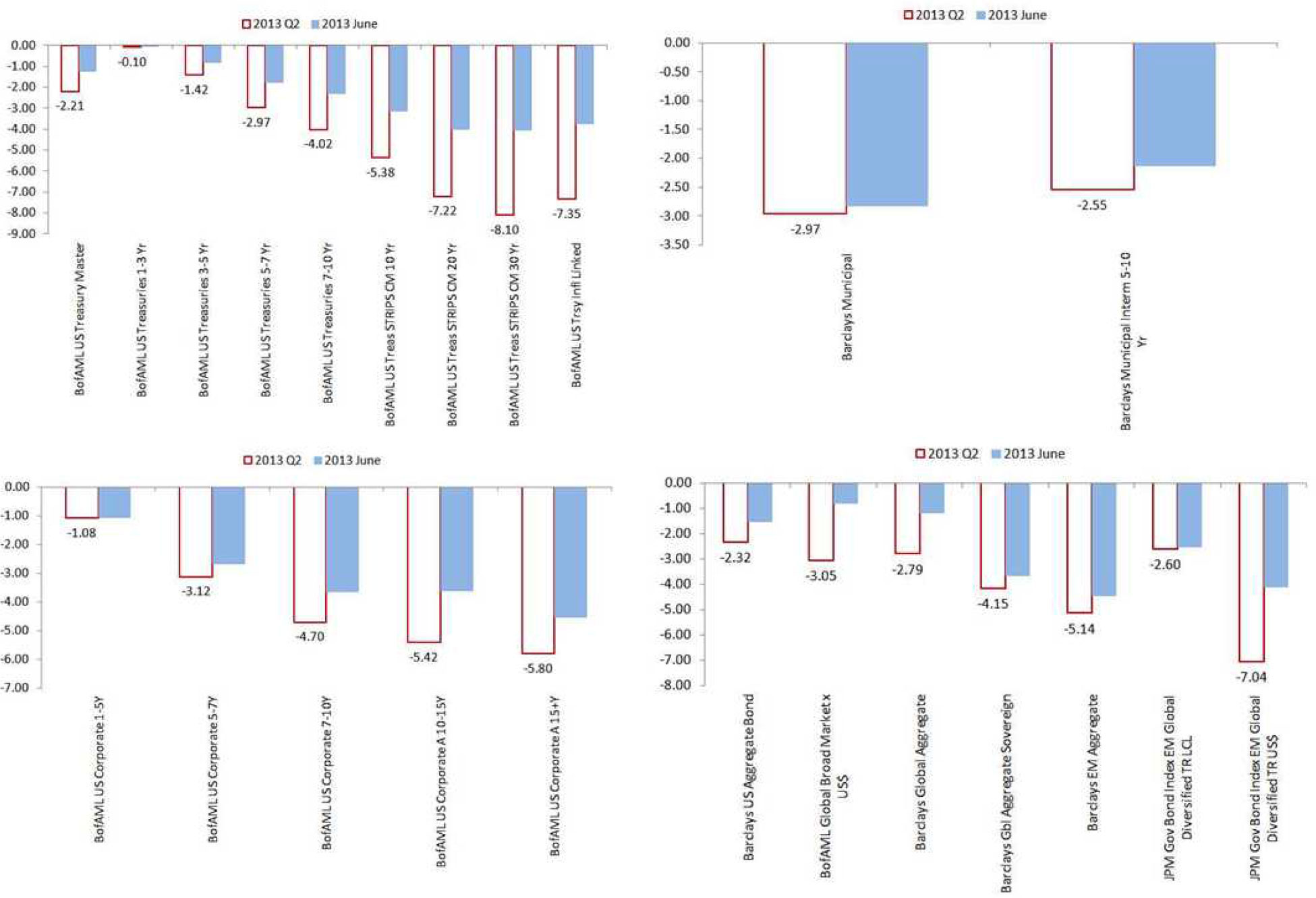

The following graphs summarize the second quarter and specifically June performance of a number of fixed income asset and sub-asset classes as expressed in their respective benchmark indexes. This shows the nondiscriminatory reaction towards all bonds as the market anticipates the Fed to taper its asset purchase program towards the end of this year and the beginning of a long road back to normalizing rates along the yield curve.

Economic Growth

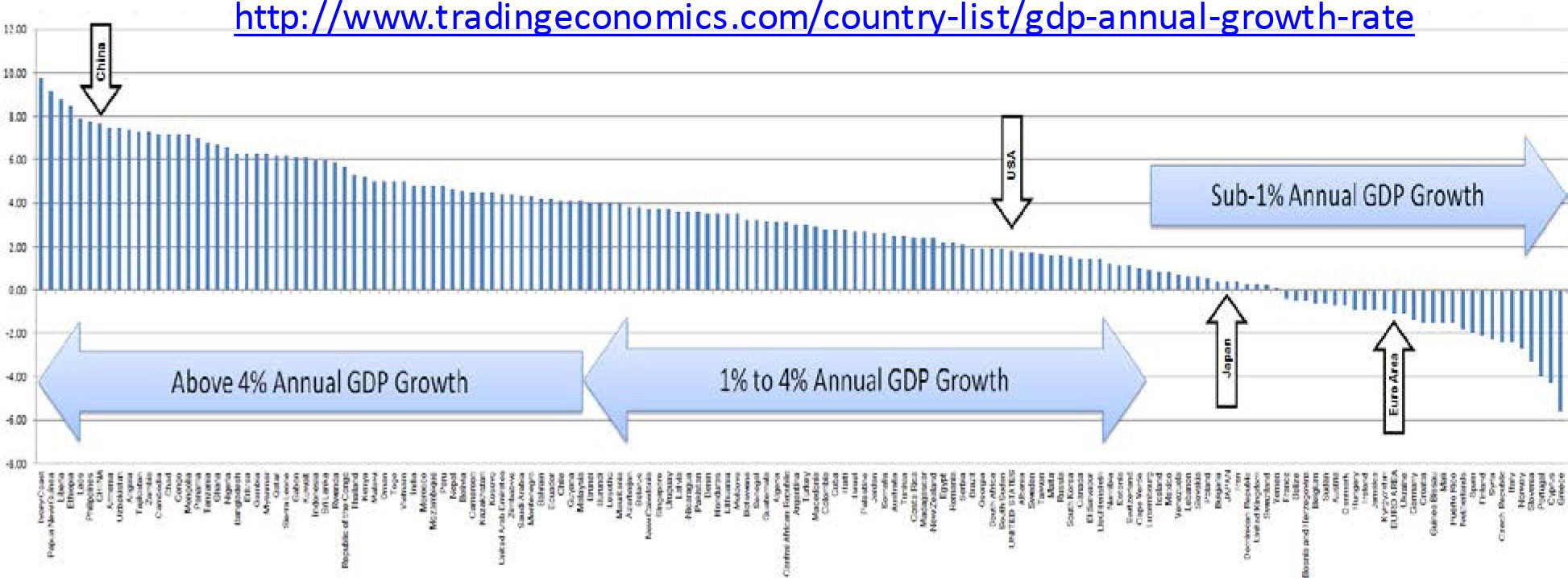

The New Normal world continues to evolve. As the global economy stabilizes from the financial socks, countries with the healthiest balance sheets recovered first. According to the IMF, the multi-speed world is separated into 3 groups: developed or advanced economies ex US that are mired in recession or economic contraction, US and other slow growth economies that are growing at sub-normal annual rate of 1-4%, and the China-led developing or emerging economies that are the world growth engines.

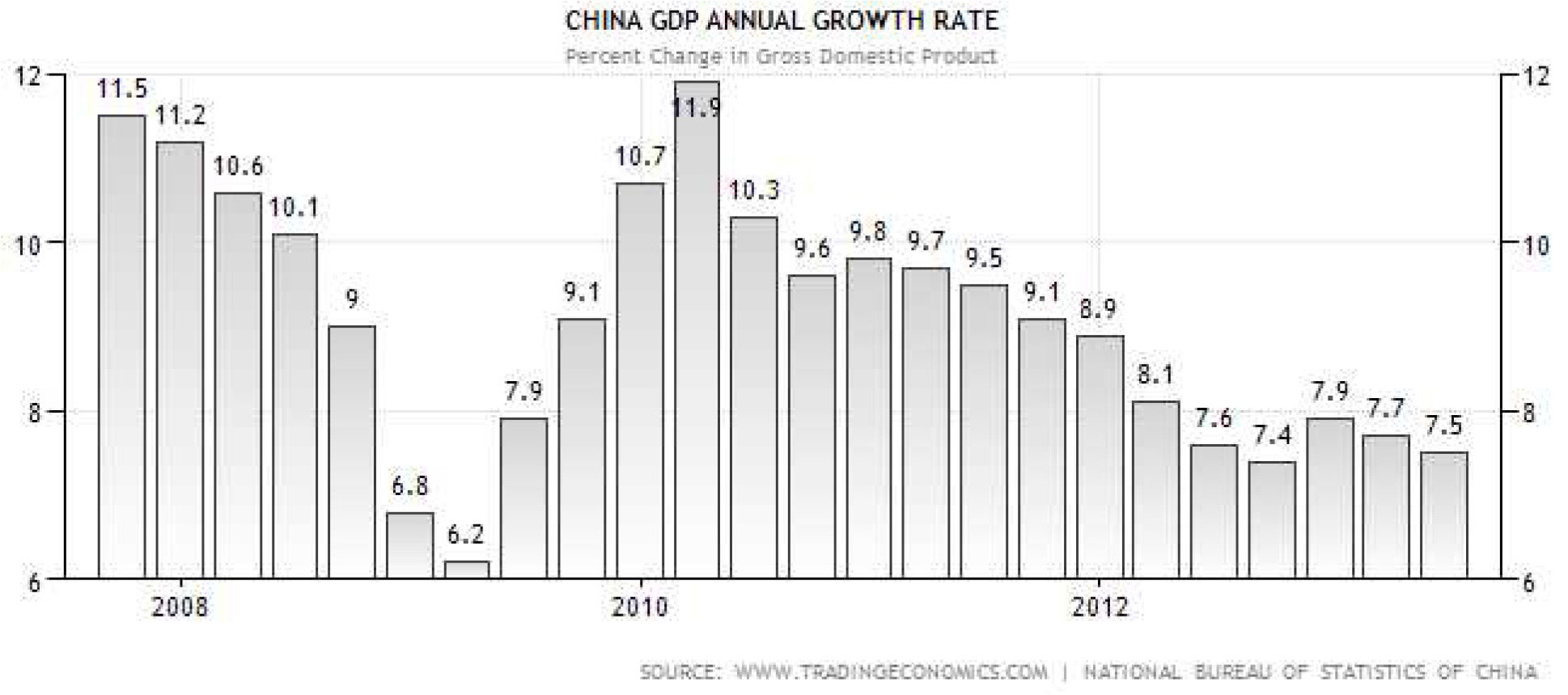

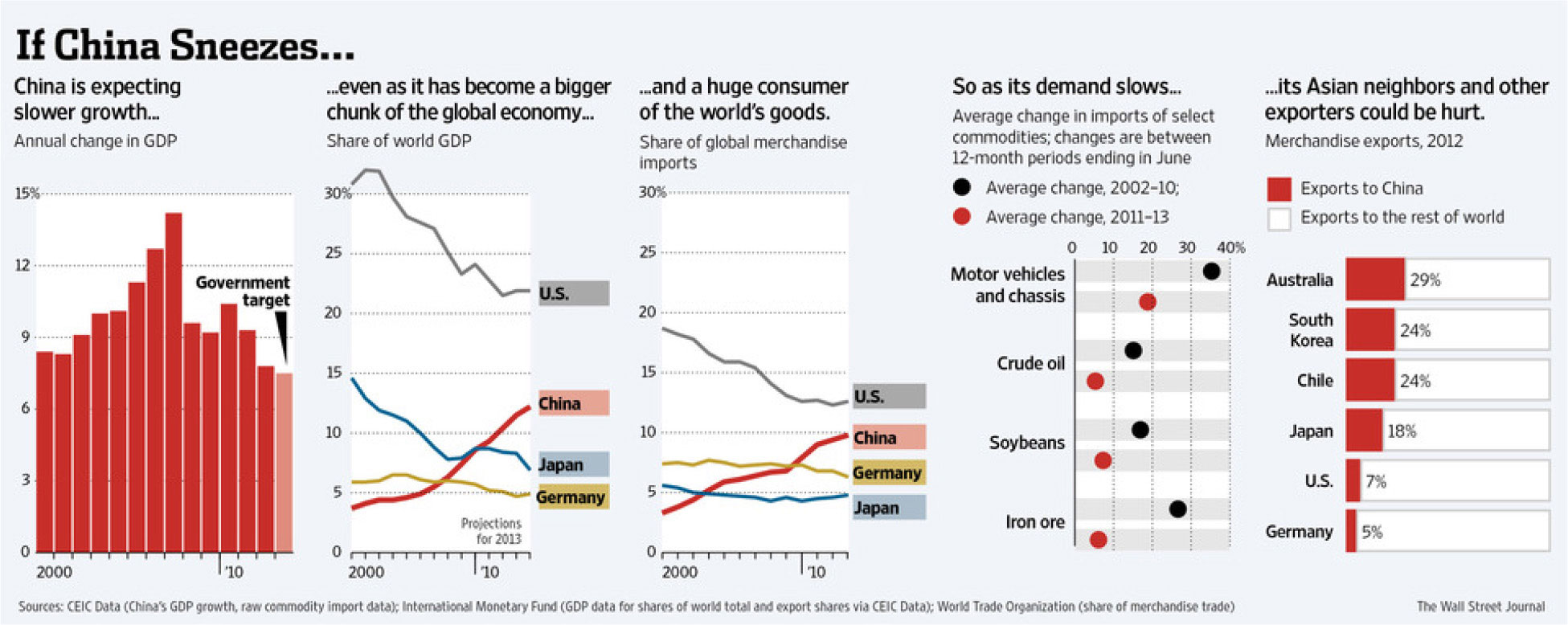

This multi-speed world will likely persist for some time as the eurozone (EZ) economies continue to struggle under crushing national debt, unwinding of decades of government largess, a monetary union without a banking and fiscal union, confronting the need for economic structural reform, and a demographics challenge of a growing aging population. Japan has similar issues of an overwhelming national debt, multi-decades of failed monetary and fiscal policies, a shrinking surplus, and an aging population. In the case of China, after decades of double digit export and investment driven growth, it is slowing. This is significant. The second largest global economy has many trading partners and is an important economic player on the world stage. Its ability to engineer a smooth transition from a government investment and “factory to the world” based economy to a more domestic/consumer centric model is critical. Along the way, China has to deal with its bank debt, the shadow banking system, its red hot housing market and the tension between the provincial/local and the central government. China’s economy has been slowing and continues to slow. In official statements, China is acknowledging this trend and believes that it can manage an annual growth rate of 7.5%. Since China’s economic statistics are not often reliable, the actual annual growth rate may be 7% or less in reality.

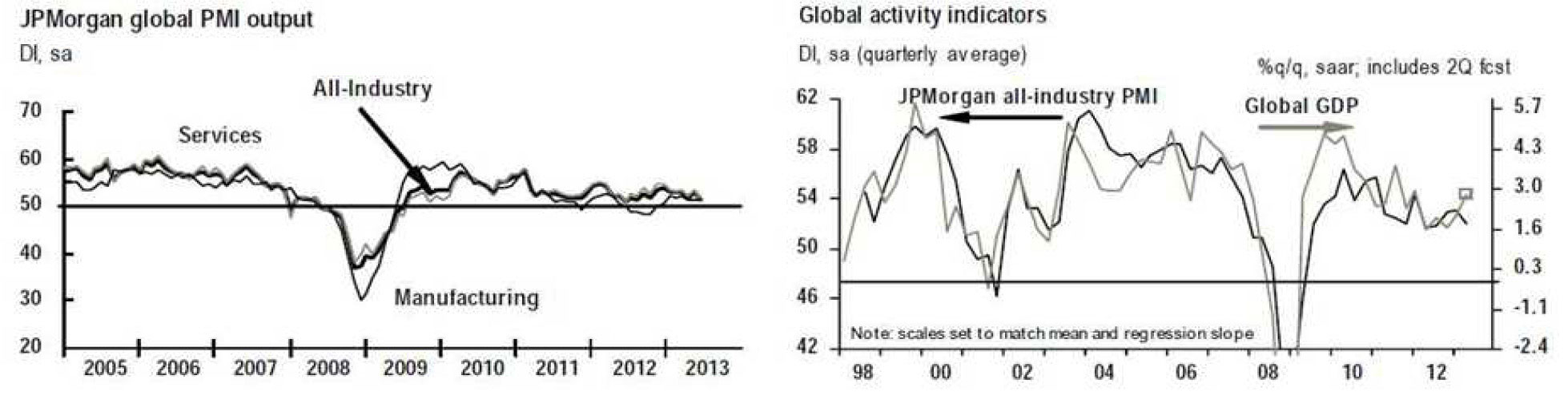

At 51.4 in June down from 52.9 in May, the Global All-Industry Output Index4 – produced by JPMorgan and Markit in association with ISM and IFPSM – posted its lowest reading in a year. The index has nonetheless remained in expansion territory throughout the past 47 months.

Service and manufacturing PMI reports provided by Markit Economics suggest that growth is slow but the overall trend continues the global recovery and healing theme. Although the EZ remains in economic contraction, it appears that the worst may be behind them.

| PMI | May | June | Change |

| Global Manufacturing | 50.60% | 50.60% | 0.00% |

| EZ Composite | 47.70% | 48.70% | 1.00% |

| EZ Manufacturing | 48.30% | 48.80% | 0.50% |

| EZ Services Business | 47.20% | 48.30% | 1.10% |

| Brazil manufacturing | 50.40% | 50.40% | 0.00% |

| Brazil Services | 51.20% | 51.10% | -0.10% |

| Canada Manufacturing | 53.20% | 52.40% | -0.80% |

| China Manufacturing | 49.20% | 48.20% | -1.00% |

| China Services | 51.20% | 51.30% | 0.10% |

| France Composite | 44.60% | 47.40% | 2.80% |

| France Manufacturing | 46.40% | 48.40% | 2.00% |

| France Services | 44.30% | 47.20% | 2.90% |

| PMI | May | June | Change |

| Germany Composite | 50.20% | 50.40% | 0.20% |

| Germany Manufacturing | 49.40% | 48.60% | -0.80% |

| Germany Services | 49.70% | 50.40% | 0.70% |

| Greece Manufacturing | 45.30% | 45.40% | 0.10% |

| India Services | 53.60% | 51.70% | -1.90% |

| Italy Services | 46.50% | 45.80% | -0.70% |

| Japan Manufacturing | 51.50% | 52.30% | 0.80% |

| Japan Services | 54.80% | 52.10% | -2.70% |

| Mexico Manufacturing | 51.70% | 51.30% | -0.40% |

| Russia Services | 51.40% | 48.80% | -2.60% |

| Spain Services | 47.30% | 47.80% | 0.50% |

| UK Services | 54.90% | 56.90% | 2.00% |

| US Manufacturing | 52.30% | 51.90% | -0.40% |

The Two-Handed US Economy

The Bureau of Economic Analysis revised down the 1st quarter US GDP from 2.4% to 1.8% annualized rate. The second quarter is expected to be even lower with some projecting a sub-1% level.

As evidence of a slowing economy begins to surface, economists are rushing to revise down their 2013 GDP estimate. Unless economic activities pick up in the third and fourth quarter, the 2013 GDP is likely to be at or around 2%, which is not enough growth for the Federal Reserve to consider tapering.

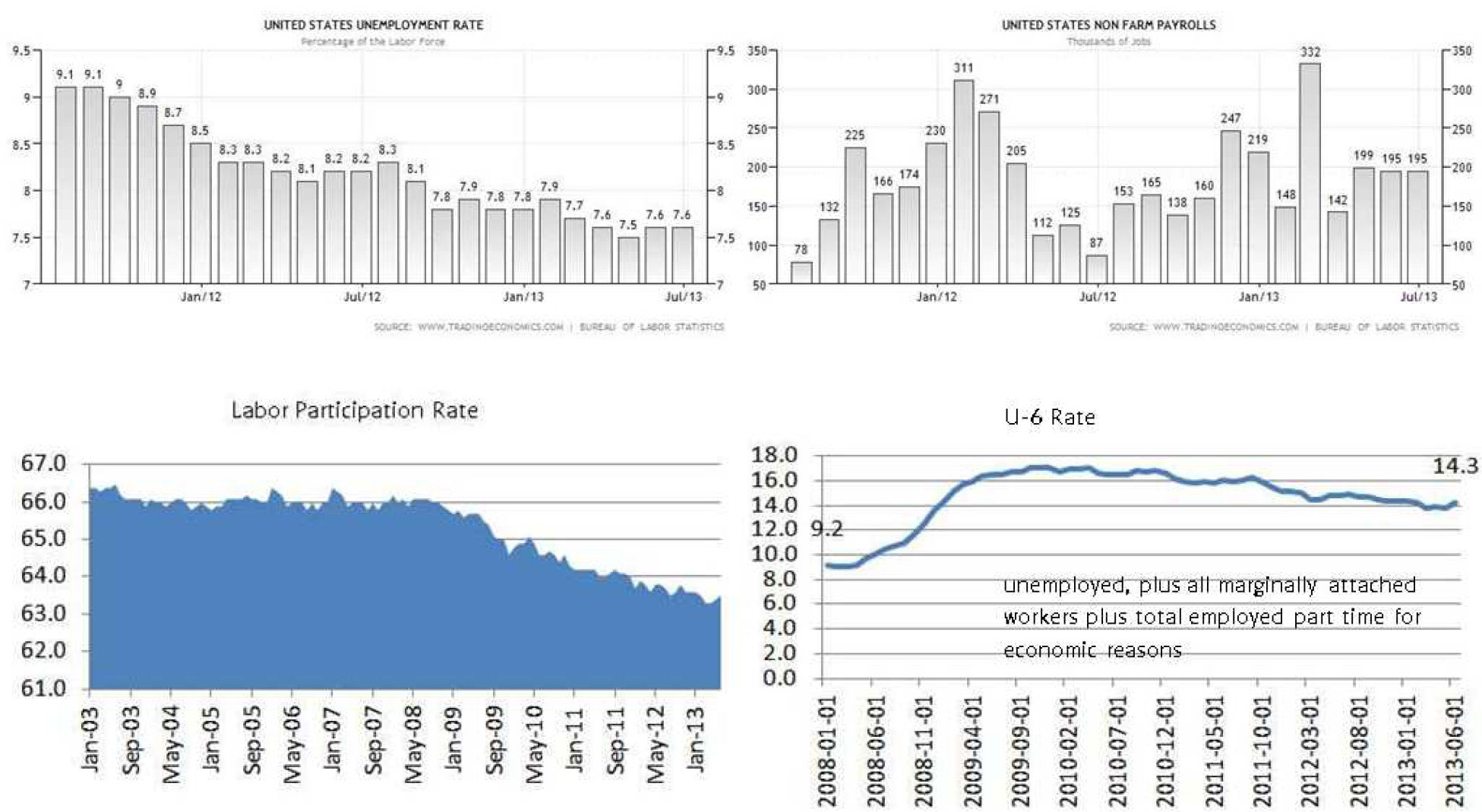

Although unemployment had come down 0.6% since July 2012 and over 90,000 jobs are being created each month over the past 3 months, the labor participation rate remains at historical lows. Further, the more representative U-6 rate continues to remain at an uncomfortably high level of 14.3%. This means that the new jobs created have been insufficient to reduce the stubborn unemployment rate. Rather, the decrease in U-3 unemployment rate is more of a function of a declining labor participation rate (age 16 and older).

These statistics also should not offer sufficient confidence to the Federal Reserve about the US economy for tapering to begin soon.

This does not mean that there are no bright spots in the US economy. Housing, consumer borrowing and auto sales are three good indicators of a healing and expanding US economy. The US austerity program (sequestration) and general slowdown in Federal spending is expected to remain a headwind at a rate of 1% to 1.5% reduction this year. Although a US recession (which speaks well of the US consumer) is not expected, a higher GDP is also not likely. Of course, if the EZ banking-sovereign debt crisis resurfaces or a political crisis arises in the Middle East, North Korea or other hot spots, the US economy would likely be negatively impacted.

The Vacationing Europe Zone

As Europe witnessed the reactions to the possible slowdown in the Fed’s large scale asset purchase program on July 4th, the Bank of England and the European Central Bank independently announced that their extraordinary low rates will remain extraordinarily low for an extended period of time. They intend to separate themselves from any market blowback as a result of the Fed’s statements or possible policy shift. Going forward, it is all about “forward guidance” by the Central banks in an effort to better “control” the interpretation or reaction to their future actions.

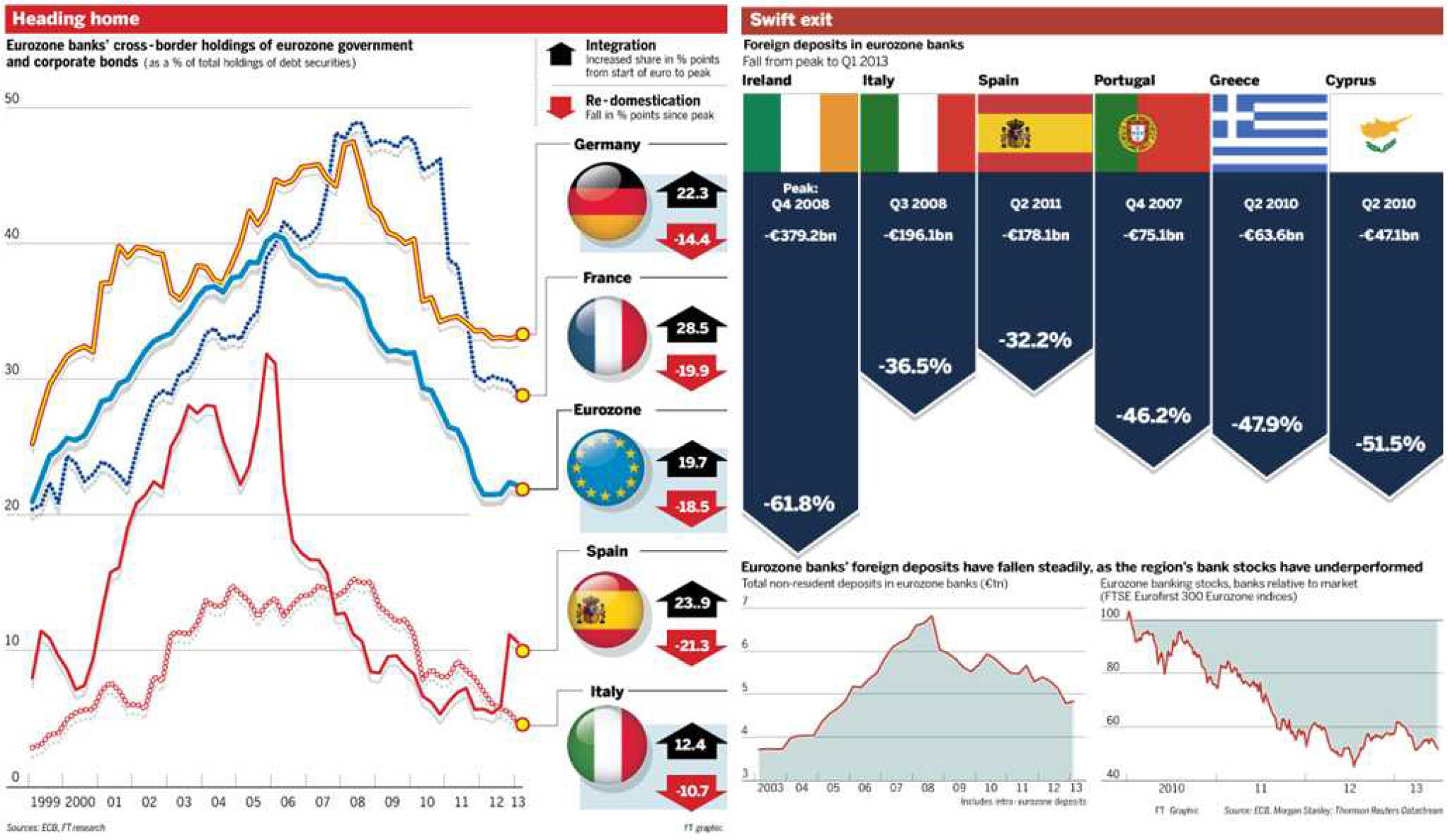

One of the benefits of a monetary union and the creation of the EZ is the cross-border holdings of government and corporate bonds. At its height in 2006, banks holding other EZ debt had 40% of their total holdings in debt, and today it is less than 22%5 . Although understandable, this re-domestication of the bond market is a result of the financial crisis and the continuing fear in the market place and the uncertainty to regulations. This would dampen liquidity and restrict capital availability in the EZ. A part of this reversal has been due to ECB’s promotion for domestic banks to buy home-country sovereign debt since last year and the fear of certain countries possibly breaking off from the EMU. In the longer term, the re-domestication of bond markets concentrate bank risks to their home country and that could become a challenge for the ECB.

One of the steps that is central to preventing the banking crisis is a “banking union” in the EZ. The need to sever the tie between banks and their sovereigns is obvious and necessary. The idea is to transfer bank oversight and bailout/rescue from states to the EU. The German government advocates that the cost for cleaning up any failed banks remains the responsibility of the home country while others suggest a single authority with a bailout fund.

The finance ministers attending the EU Summit in late June agreed to an operational framework for the European Stability Mechanism (ESM) to directly recapitalize trouble or failed banks. However, no agreement was reached regarding the flexibility national resolution authorities should have over “bailing in” bank shareholders, creditors and depositors (e.g. the Cypress experience). Further, there is no agreement for a single resolution authority with Germany stating that EU treaties do not allow the transfer of power to the EU from states to shut down and restructure banks.

With the EZ crisis on hold and decision makers and citizens on summer break, the current calm may be short lived. The German election is scheduled in September and the whole banking and sovereign debt crisis may resurface. With the slight loosening of austerity demand and the slight and gradual improvement of economic condition in the EZ, we hope this is the beginning of a positive reversal, but a lack of sustainable growth and significant unemployment remain the core challenges that the EU is not able to tackle.

A Slowing China

Since the double digit growth in the early to mid-2000s, China’s economy has been slowing. This is significant since China is the second largest economy after the US and is a trading partner to many economies contributing an estimated 13% this year to global economic activities.

The slowdown in China is significant for the world economy, but if it can be managed smoothly (i.e. soft landing), China has an average of 10% GDP over the last three decades and the world, let alone China, has to learn to adjust to a slowing China. Managing the 1.3 billion citizen economy is a tricky task. The new president and central government are well aware that, if the slowdown comes too quickly or slows too much, political instability may ensue. In June, China exports shrank by 3.1% compared to a year earlier. This was unexpected since, on a year-to-year basis, exports grew at a 1% rate in May. A tight labor market (wage increases by 71% since 2008) and an appreciating Yuan (gained 25.9% in trade-weighted terms since 2008) contributed to the slowing of exports. Moreover, with its major trading partners still recovering from the financial crisis, the demand for Chinese exports also slowed (sales to EZ dropped 8.3% in June and dropped 5.3% to US). At the same time, the slowing of China is causing China to import less from its trading partners (imports dropped 0.3% in May after a 16.8% expansion in April).

After the very public signaling by Chairman Bernanke on June 19th that the US intends to start wrapping up its large scale asset purchasing program by the end the 2013, the message was heard loudly around the world. This means easy money days are soon coming to an end and interest rates will start to rise or normalize. This created an immediate outflow of capital from China and otheremerging markets. This caused a liquidity squeeze in China. The following day, the interbank lending rate shot up from an average of less than 4% to a record 12.45%. The People’s Bank of China (PBOC) refused to intervene which further agitated the market with Shanghai Composite falling precipitously. The Central Bank maintained this position to squeeze out the shadow banking system6 and to regain control. In recent years, the uneven distribution or availability of bank loan has fuels speculative real estate projects, questionable provincial government sponsored deals and general misaligned lending. The delayed action to intervene shows the seriousness of the central government to engineer an economic soft landing and to operate in a post-super growth environment. This is a signal of the new government’s commitment for structural reform from investment to consumption while slowing credit expansion. This is a bit of a high wire act, and there is no certainty that central government actions and policies will not create unintended consequences that have global growth implications.

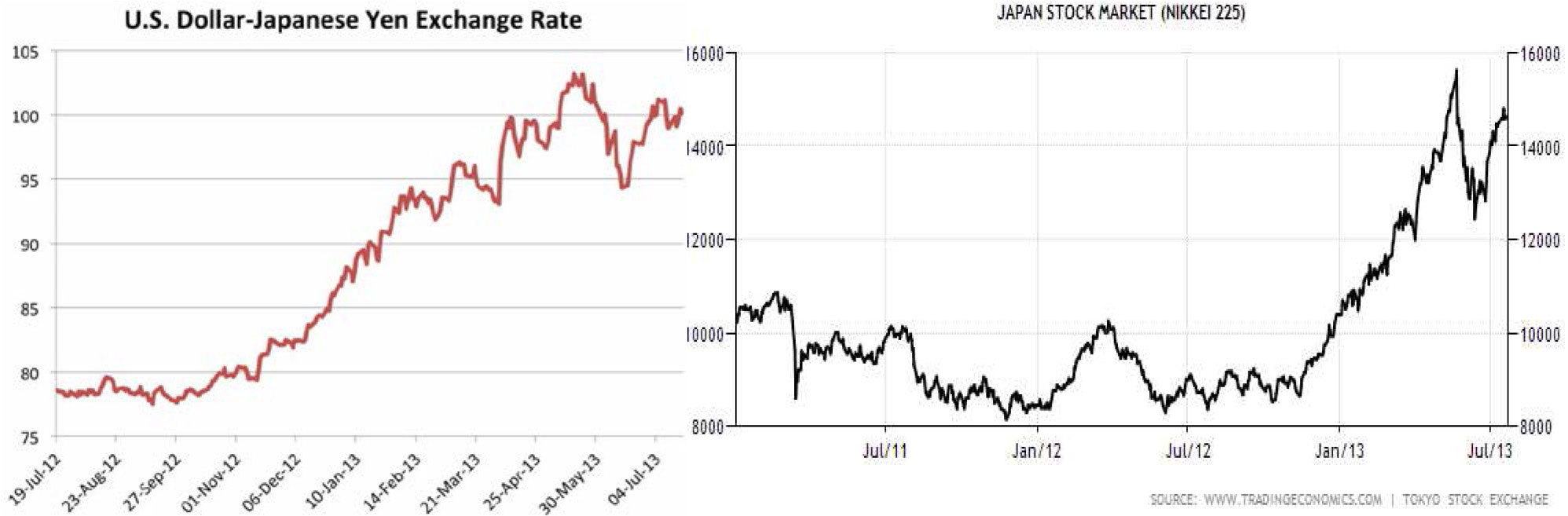

The Japanese Laboratory

After 2 decades of deflation, the new Japanese Prime Minister Shinzo Abe at the beginning of this year introduced a three-prone economic policy in an attempt to reignite the economy – Abenomics.

- The massive Keynesian approach is unprecedented anywhere and it includes a 20.2 trillion yen ($210 billion) stimulus package of which half is devoted to infrastructure spending and a third is earmarked to stimulate private investment, including steps to promote clean energy.

- The Bank of Japan sets its inflation target to 2%.

- The government is aiming to create 600,000 jobs within two years. The hope is to drive down its currency against its trading partners so that Japanese goods and services become much more competitive. This would revive its economy and ignite employment and increase stock prices.

This will complete the Abenomics circle that leads to increased consumer spending. With Abe’s Liberal Democratic Party and its coalition party, the New Komeito party, winning 76 additional seats in the upper house, this assures him control over both parliamentary houses to implement Abenomics policies.

So far so good. The Yen is down and the Neikei is up. Japan’s industrial output in May grew a seasonally adjusted 1.9% from April and the index of industrial shipments was revised upward, to1% while the industrial inventories index was down 0.4%. In the near term, all these signs are positive and it appears Abenomics is having some effect. It is imperative that Abenomics produces the intended effect because the consequence is significant otherwise. The world is skeptically optimistic.

After the experience of the Chinese liquidity squeeze and the clear slowing of the Chinese economy, Bank of Japan is worried that a weak China (Japan’s largest trading partner) coupled with a tightening in the US could derail Japan’s unprecedented efforts to reignite its economy.

Conclusion

The Federal Reserve has painted itself into a corner. The twin policies of near zero interest rate and the large scale asset purchase program have made the market and investors dependent and less concerned with risk in seeking higher (normal) returns. All good things must come to an end, and the Federal Reserve cannot keep quantitative easing going forever. Regardless of how well intentioned their “forward guidance” is, every word is subject to market interpretation and suspicion. Even though logically investors should be pleased with the idea that the US economy is finally able to support itself without the fiscal injections or monetary crutches, the excess liquidity and knowing that the Federal Reserve is there to promote risk taking is very comforting. With the Fed’s dual mandate of price control and full employment, regardless of how exact or transparent their forward guidance is, the Fed has significant leeway to make their tapering or interest rate decisions. Further, there are many tools in their tool box to manage “normalization”. On the other hand, the global market is far bigger than even the Federal Reserve can control. The May and June reactions are good examples of market sensitivity to (perceived) Fed actions. Increase market volatility is more likely going forward as the Fed attempts to navigate and the market participants attempt to anticipate a world of shrinking quantitative easing and ultimately normalization of the Fed Fund rates. This journey will likely be protracted since the US and global economies remain weak which makes the removal of support a slow and long term process. In fact, with the current US economic and labor environment, the Fed is not likely to taper this year, in spite of what has been hinted by Chairman Bernanke. Regardless of when and how the Federal Reserve will act, it is reasonable to suggest that there will be sustained headwinds for the fixed income markets.

The underlying challenge for almost all economies is to reach sustainable growth. Each trading bloc has its own unique challenges, but long-term solutions to economic malaise are not currency devaluation and exporting your way out. Although the significant tail-risk to the global financial market may have been truncated, navigating in this post-financial crisis world remains challenging. As one set of challenges subsides, a new reality presents itself which requires new thinking and new tools to help avoid the potholes and sinkholes. “May you live in interesting times!”

- http://www.federalreserve.gov/newsevents/testimony/bernanke20130522a.htm

- http://money.cnn.com/2013/06/19/investing/bonds-fed-bernanke/index.html

- http://data.cnbc.com/quotes/.DXY/tab/2

- http://www.markiteconomics.com/Survey/PressRelease.mvc/6c45a62f0c5a427c8ecdcf4ffffb6688

- http://www.ft.com/intl/cms/s/0/3e58e6c4-cec4-11e2-8e16-00144feab7de.html#axzz2ZmRgN3pz

http://www.ft.com/intl/cms/s/0/9423e13a-e238-11e2-a7fa-00144feabdc0.html#axzz2ZmRgN3pz - July 5 statement from the China State Council sated that the government would guide banks toward separating their traditional lending businesses from their businesses that sell wealth-management products, which are generally short-term investments offering higher returns than traditional deposits. These products have risen in popularity in recent years as Chinese investors look for yields. Because they aren’t subject to the government ceiling on bank-deposit rates, they allow banks more freedom in determining interest-rate levels.

http://online.wsj.com/article/SB10001424127887324853704578587280709001580.html?mod=rss_mobile_uber_feed