Philip Chao was featured in this article on CNBC.

Company News

Philip Chao featured in CNBC article “2022 Was the Worst-Ever Year for Bonds.”

Bonds are supposed to be an asset class that counteracts the volatility of stocks, especially on the downside. Well, that did not happen in 2022 which led to the pronouncement of the death of the quintessential 60/40 portfolio. This is pre-mature. The significant...

Philip Chao Featured in CNBC Article “Robin Hood to pay a 1% ‘Match’ on Customer Contributions to Retail IRAs”

Free Toasters to Free 1% Match Four decades ago, savings and loans and banks lured customers to deposit their money by giving toasters away. Today, we are hearing a free 1% "match" for encouraging people to save for retirement in setting up new IRA accounts. I suggest...

Philip Chao featured in CNBC article “Retirement savers seek safe havens within their 401(k) plans. They may regret it later.”

Key Points Eighteen of 21 trading days in October saw 401(k) investors favor fixed income (like stable value, money market and bond funds) versus stock funds, according to Allight Solutions. Investors appear to have been spooked by stock volatility. Selling out of...

Philip Chao featured in CNBC article “Billions of Dollars Get Left Behind: The 401(k) industry now has a ‘lost and found’ for your old retirement accounts.”

Key Points Fidelity Investments, Vanguard Group and Alight Solutions - three of the largest administrators of 401(k) plans - are teaming up to reconnect workers with savings left behind at old employers. Current rules allow employers to move accounts of less than...

About Experiential Wealth

Experiential Wealth revolves around the experiences our clients wish to accomplish, and we have two main tasks to deliver these experiences to them.

Your Next Quarterly 401(k) Statement May Be Alarming. Here’s Why

Philip Chao was interviewed by CNBC. Here is the complete article.

Why Employers May Not Be So Quick to Jump on the 401(k) Bitcoin Bandwagon

Click here for the full article.

How Rising Interest Rates Affect Annuities

Click here for the full article.

Philip Chao in P&I Article “Empower bulks up by adding Prudential unit”

Here is the complete article.

Philip Chao in CNBC Personal Finance Article “Why buying a market dip can be good and bad”

Here is the complete article.

Philip Chao in Financial Advisor Article “ Bridging The Income Gap For Early Retirees”

Here is the complete article.

How Secure Act 2.0 Delayed RMD Age Would Boost Annuities

Click here for the full article.

Philip Chao Viewpoints Published in Advisorpedia – Higher Inflation: Transitory of Sustained

We are joyfully anticipating and participating in the post-pandemic robust economic recovery and at the same time sensing the beginning of a gradually less supportive environment for stocks and bonds as the market participants test the resolve of the Fed on its...

Philip Chao in Financial Advisor Article “Can Annuities Boost Retiree Returns?”

Click here for the full article.

401k Wire – Jenny Johnson’s SPARK Interview with Philip Chao

The publication 401kWire.com recently released an article regarding Philip Chao's interview with Jenny Johnson, Franklin Templeton President and CEO, at this month's SPARK conference. Here is the article.

Philip Chao interviewed by Pension & Investments – Acquisition moves Empower closer to its ultimate goal

Philip Chao shares his thought about the recordkeeping industry and, more specifically, using Empower’s recent announcement of buying Mass Mutual retirement business. Read the P&I article here.

Philip Chao Viewpoints Published in Iris.xyz – The Fed is Codifying Lower for Much, Much Longer

Moving from “ex ante” to “ex post” In the annual end of summer economic policy symposium sponsored by the Federal Reserve Bank of Kansas City (virtual for 2020), the theme this year was “Navigating the Decade Ahead: Implications for Monetary Policy.” Chair Powell of...

Philip Chao Viewpoints Published in Iris.xyz – the Un(settling)-Normal

The Un(settling)-Normal Here is the complete article.

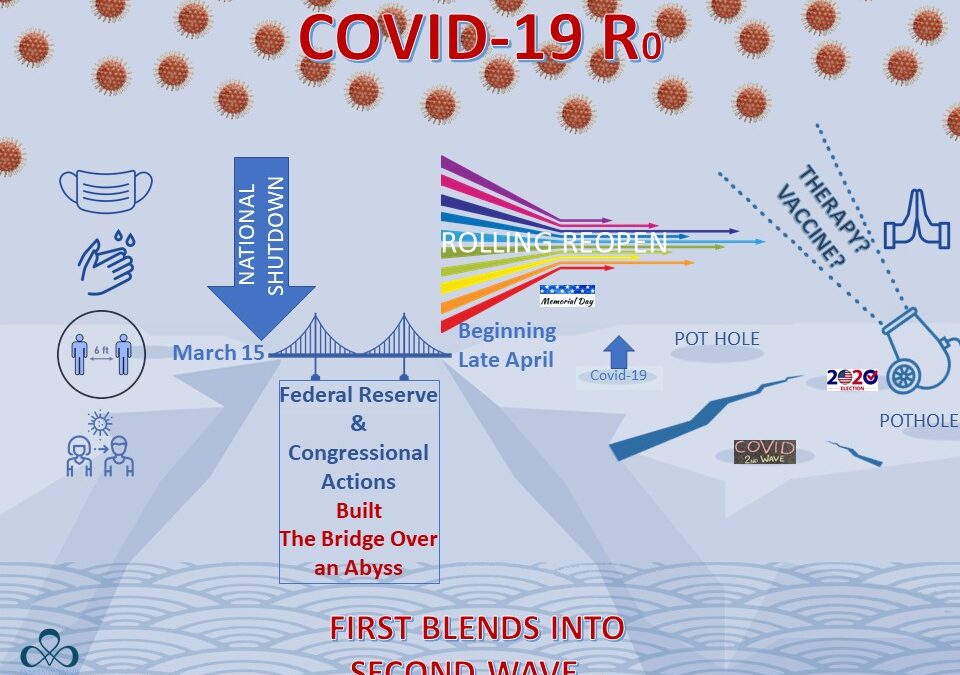

Philip Chao Viewpoints Published in Iris.xyz – The Future of the Financial Markets, After COVID-19

This global pandemic is not a Black Swan event - an unpredictable event that is beyond what is normally expected of a situation and has potentially significant rewards or consequences. COVID-19, like SARS, MERS, Ebola and other viruses before, is quite a predictable...