History

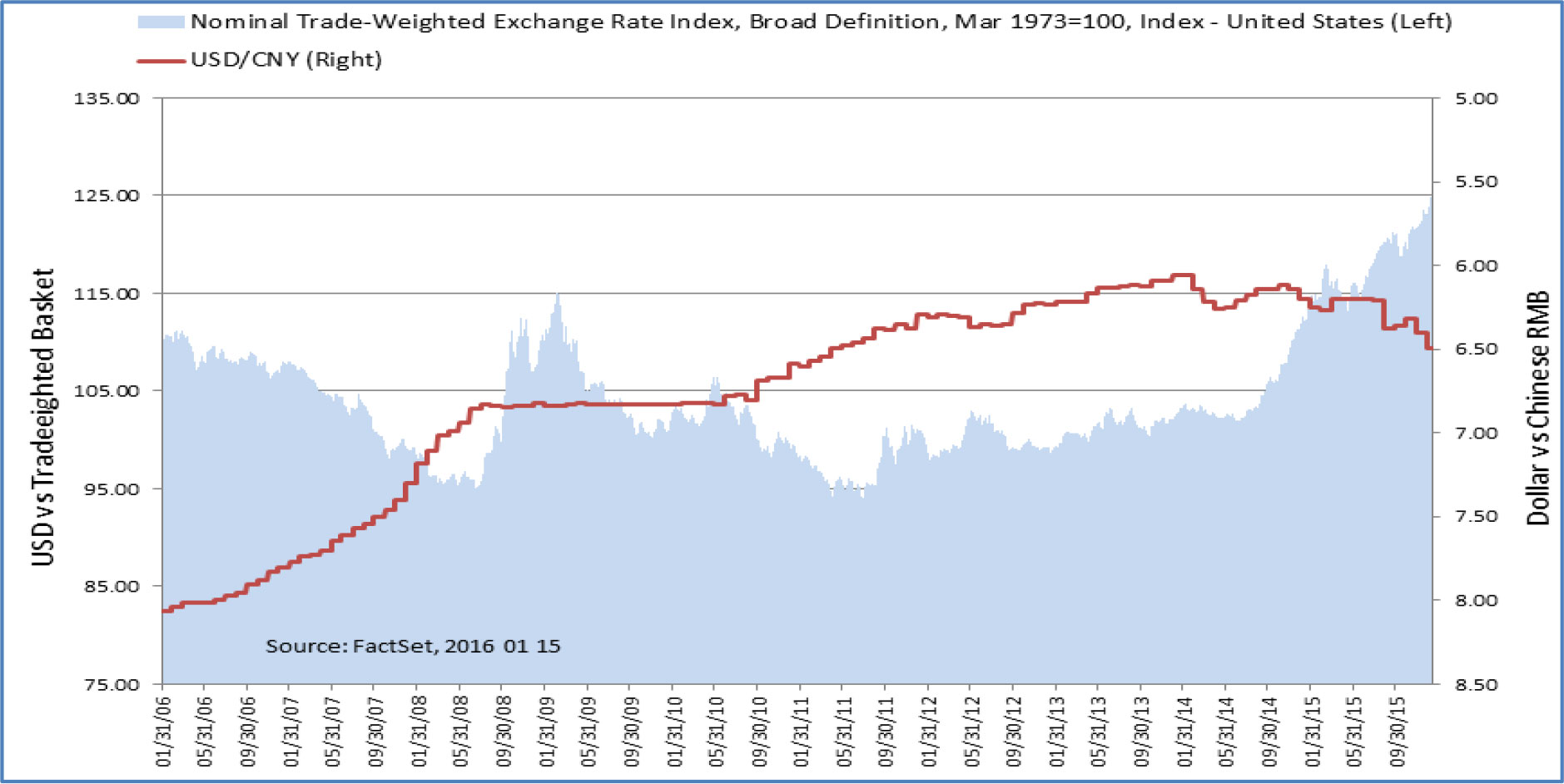

In the 90’s, China’s currency, Renminbi (RMB), was not a free floating currency and “maintained” by China on a fixed exchange rate basis to achieve exchange rate stability. This means it was illegal to exchange currency at any other rate. This fixed exchange rate was 8.11 RMB to $1 USD. In 2005, China moved from a fixed rate to a managed floating rate band approach. At the height of the Financial Crisis in 2009, the central parity price was set to track the USD by the People’s Bank of China (PBoC) daily, and the rate was allowed to float within a narrow band of 0.3%. This was sort of a “peg light” and has witnessed a steady and consistent rise against other currencies as USD gained strength as the U.S. economy recovers faster than most other countries. The band was widened to 0.5% in 2007, 1% in 2012 and 2% in 2014 in an attempt to further liberalize the RMB. The PBoC promised in 2010 to reform “the RMB exchange rate regime and increase the RMB exchange rate flexibility”. Even with this widening, the RMB continued its ascension with the USD and was viewed favorably for its appreciation and stability.

This graph shows how the RMB (CNY) has tracked the rise of the USD (a weighted index basket) since the Financial Crisis in an effort to keep the Chinese currency steady and predictable until last summer when China decided to “liberalize” or widen RMB’s trading range against the USD in hopes of becoming a world reserve currency by being added to the Special Drawing Right (SDR) basket in 2016. After China became a member of the World Trade Organization (WTO) in December 2001, an inclusion into the SDR would be another important milestone in the integration of the Chinese economy into the global market.

Every five years, the IMF reevaluates the composition and weighting of the Special Drawing Right basket of currencies1. Created by the IMF in 1969 to supplement its member countries’ official reserves, the SDR is an international reserve asset. Its value is currently based on a basket of four major currencies – the U.S. dollar, the euro, the Japanese yen and the British pound. Germany and the U.S. have given their conditional support for adding the RMB to the SDR basket provided that China must continue to liberalize trading in the yuan. On November 30, 2105, IMF announced that SDR basket will be expanded to include the RMB as the fifth currency2, effective October 1, 2016. SDRs can be exchanged for freely usable currencies.” This marks the achievement of integrating into the global monetary system3. China would expands its ability to settle cross-board trades and use the RMB as an acceptable medium of exchange and moving towards a free floating currency with full and unrestrained convertibility.

De-Pegging from the USD – Just Can’t Keep Up Anymore

In late July last year, China announced its intention to widen the currency trading band from 2% to 3% against the dollar4. That means the Renminbi would be allowed to rise or fall 3% from a daily midpoint rate set by the PBoC every morning – the daily fix. This is a further sign where China is continuing its exchange rate flexibility for the RMB but also beginning to move the focus from a bilateral RMB-USD regime to a RMB-currency basket5 approach. In order to be recognized as a reserve currency with its own standing, the RMB needs to delink from the USD with China being recognized as having an important share of global export and its currency “freely usable”.

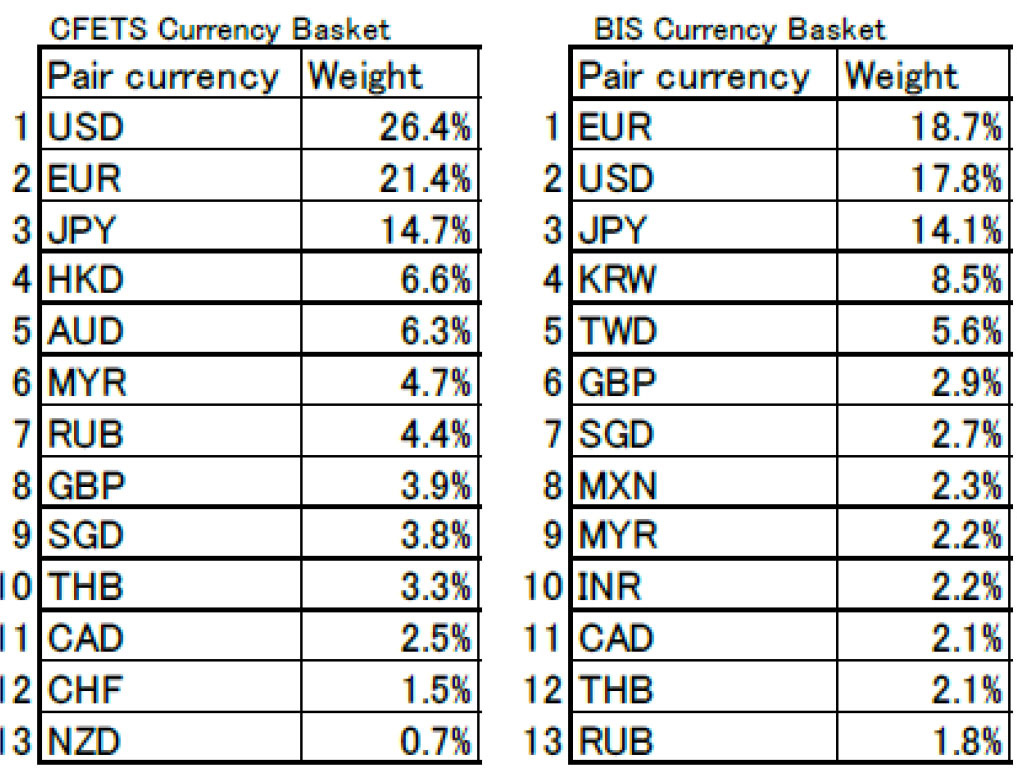

In January 2015, the China Foreign Exchange Trade System (CFTS) released the new CFETS RMB Index as a new and comprehensive way to assess RMB market conditions. When the RMB is referenced to a basket of currencies, it “does not mean pegging to a basket of currencies or adjusting RMB exchange rate mechanically in line with the movements of the exchange rate index of the currencies in the basket. Market supply and demand is another important reference.6” The following table compares the 13 currencies in the CFETS RMB Index against the BIS Currency Basket a currency pairs (Source: Institute for International Affairs, 2-16 01 127):

SDR Basket 20108

| Currency | Initial new Weight (share) |

|---|---|

| Euro | 37.45% |

| Japanese yen | 9.4% |

| Pound Sterling | 11.3% |

| U.S. dollar | 41.9% |

Even though RMC de-pegs from the USD, the largest weight in its new index remains the USD. When compared to the Bank of International Settlement (BIS) basket, the overall weight for the USD, the euro (EUR) and the Japanese Yen (JPY) is 62.5% in the CFETS basket vis-à-vis 50.6% in the BIS basket.

Onshore and Offshore Challenge – A Two Headed Dragon

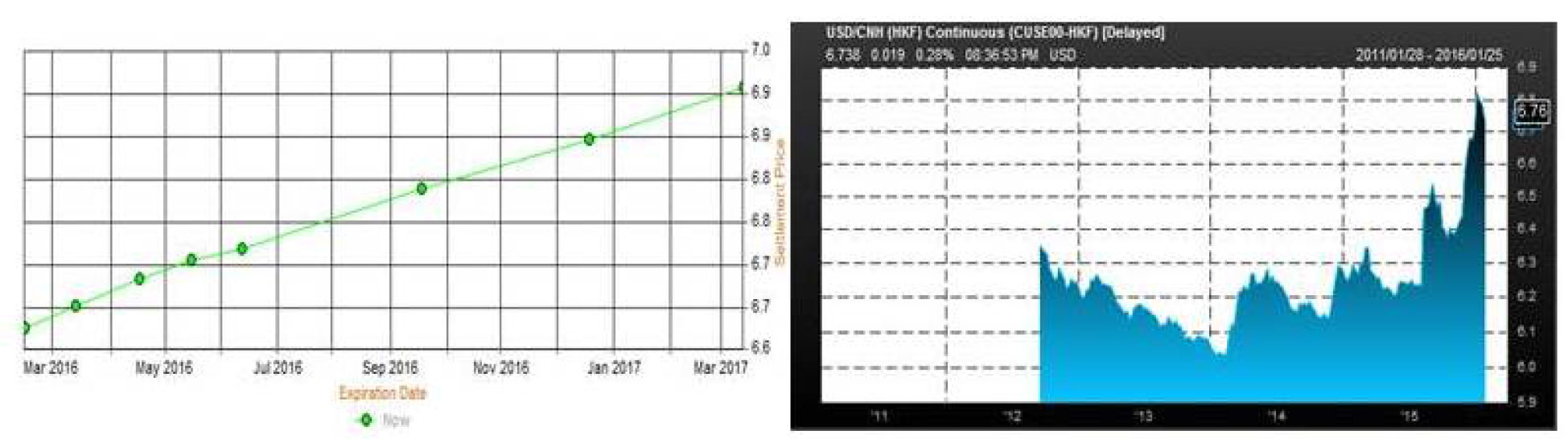

As a summary highlight, in 2004, Hong Kong residents were allowed to purchase and hold RMB and make the first cross-border trading of the currency. In 2007, dim sum bonds issued by Chinese banks were introduced (bonds denominated in RMB) and subsequently foreign corporations (e.g. McDonalds) and banks (e.g. HSBC) became issuers. And in 2014, Dim Sum bonds were listed on the Luxembourg exchange. In 2008, geographically limited cross-broader RMB settlements were initiated. In 2009, China entered into currency swap agreements with 14 central banks for offshore RMB holdings. And in 2010, China and Russia agreed to trade using their own respective currencies in lieu of the USD. By 2014, 25 bilateral swap agreements were in place with other central banks. But the majority of the offshore deposits remain Hong Kong and the total represents an insignificant amount of onshore deposits in China. In 2015, China opened the inter-bank bond market for central banks, sovereign wealth funds and international financial institutions. The growth of the offshore RMB market – also referred to as the CNH market – came as a rush to own Chinese currency for its onshore stability and appreciation (since it has been pegged to the rising USD), but that has reversed. With the CNY de-pegging from the dollar, offshore CNH is being sold as investors and holders are expecting the CNY to devalue as it is managed and guided to a new basket of currencies. The following chart (from FactSet) on the left, dated 1-25-2016, shows where the market believes the CNH will settle going forward. It is a straight line up from here at 6.76 CHK to 1 USD to over 6.9 CHK. This represents another 6% devaluation.

The right chart above shows the history of the CNH and USD currency pair. The CNH market now serves as a forward looking indicator or market for what the holders and investors expect the CNY to be valued. This is delivering the outcome China wants to avoid – a lack of stability in the RMB.

This is a battle between the market and the PBoC. With over USD$3 Trillion, China has been spending approximately $100 billion a month to narrow the exchange gap between the market driven CNH rate and the managed rate of the CNY. PBoC has four approaches in achieving this outcome9. 1) Baby Steps – to continue the careful management of the gap and deploy the necessary foreign reserve to bring CNH inline; 2) Big Steps – use a one off large scale band widening (e.g. 7%) in hope to significantly reducing the market’s further desire to indirectly bet against the CNY through selling CNH, 3) Free Style – let the currency be entirely market driven or 4) Have a Party – bring other central bankers together to form a coordinated alliance to stabilize the RMB. Baby Steps is the base case approach and likely to remain as the approach in the foreseeable future along with policy guidance from the PBOC to amplify the desired effect. China understands the need to be a responsible global player and will try to balance short and long term objectives. With the sizable war chest, a repeat of George Soros’ style of breaking the British pound in 1999 by any group is not easily accomplished under a controlled Chinese currency environment. Moreover, China is most likely to be initiating new rounds of fiscal stimulus and government spending to generate economic growth and maintaining employment at the desired level. If successful, this would reduce the pressure of capital flight and drive CNH lower. Of course, if the USD continues to strengthen, this would add more challenges to China’s effort.

Currency War – Treading Water

With Japan’s recent induction into the negative rate club and the Bank of England becoming more dovish in its statements, the world remains in a low growth, disinflation challenged state. The “we will do whatever it takes” attitude of central bankers means more quantitative easing and more low to negative interest rates in the name of price stability. Implicitly or explicitly, this is currency devaluation in order to export deflation and gain export competitiveness. China’s long term goal to reform its financial system and to transform its economy arebeing carried out at the same time. The necessary currency realignment from pegging the USD to pegging a new trade weighted basket is unfortunately being viewed as China’s desire to promoting economic growth through low cost export competitiveness (the old model). Sadly, regardless of the true intentions, Chinese trading partners will respond in kind to remain competitive and relevant in a global economy.Ultimately, this is a zero sum game.

This document is for informational purposes only. Other factors and data not presented herein may be equally relevant and no investment decisions or actions should be taken based on any information and view provided. All graphs and charts are as of 2/9/2016. Data providers are solely responsible for data accuracy.

- http://www.imf.org/external/np/pp/eng/2015/071615.pdf

- http://www.imf.org/external/np/exr/faq/sdrfaq.htm

- http://www.brookings.edu/research/reports/2012/02/renminbi-monetary-system-prasad

- http://www.cnbc.com/2015/07/27/china-to-widen-yuan-trading-band.html

- http://www.chinamoney.com.cn/fe/Info/15851090

- http://hwww.chinamoney.com.cn/fe/Info/15875909

- http://www.iima.or.jp/Docs/column/2016/0112_e.pdf

- http://www.imf.org/external/np/tre/sdr/sdrbasket.htm

- http://www.bloomberg.com/news/videos/2016-01-15/crescenzi-markets-don-t-know-what-china-will-do-next