Introduction

Target Date Funds (“TDF” or “TDFs”) are fast becoming the dominant investment choice for account-based defined contribution plans in the United States. The purpose of this paper is to review the quantitative analytical tools and factors that should be considered as parts of a prudent process for plan sponsors and their advisors in selecting and monitoring TDFs. Analysis of qualitative factors is outside the purview of this paper, and discussion shall be limited to TDFs in a mutual fund structure, which is the most prevalent, and with easily accessible return data to the public. Traditional performance measurement tools are inadequate in analyzing TDFs. In fact, the construct in which a plan fiduciary evaluates the application, selection, and benchmarking of TDFs should be different than for a style- or asset class-specific investment option, such as a domestic large-cap equity mutual fund. An asset class-specific investment option in a 401(k)-plan investment lineup serves as one building block that participants may select among others to construct a diversified portfolio based on the participant’s personal risk and expected return parameters. A TDF, on the other hand, is an asset allocation portfolio that morphs over forty plus years from high to low portfolio allocation in risky assets. This trajectory that the TDF allocation follows is also known as the “glide path”. To rely solely on traditional benchmarking metrics in analyzing portfolios along a glide path is to view with an inadequate frame and to apply incomplete analytical methodology. Also, there is a lack of homogeneity in TDFs[i], and thus there is no “easy button” for prudent selection or monitoring. Examining a TDF family can be thought of as time traveling across an investor’s working lifetime in five year increments. A distant TDF vintage (e.g. 2050Target) is the same as an earlier TDF vintage (e.g. 2030 Target) and it takes 20 years to evolve into the earlier dated portfolio. One can think of the many portfolios in a TDF family as allowing us to observe all at once the permutations of the same portfolio over a span of 40 years.

Quantitatively there are three levels of investigation. First, analytic tools should be used to better understand and analyze a TDF family’s asset allocation policy and glide path. Second, use Modern Portfolio Theory (MPT) statistics to assess if the underlying funds (TDFs are typically fund-of-funds) have contributed or detracted value on an absolute- or risk-adjusted basis. Third, review and compare fee structures since fees can be a significant detractor of value over time. Qualitative analysis, although not reviewed in this paper, regarding the thoughtfulness and philosophy in glide path construction, investment process, and the variety and timing of introduction of various asset classes to the glide path is important and material to the performance of TDFs. The combination of quantitative and qualitative analysis should be made part of a plan fiduciary’s decision matrix to identify the best fit TDFs for the plan participants.

Popularity of Target Date Funds in Retirement Plans

TDFs popularity stems from two important realities. The first is the relief from fiduciary liability for using qualified default investment alternatives (“QDIAs”) that meet the requirements of the final Department of Labor regulation (ERISA § 2550.404c–5). Under §2550.404c–5(e)(4)(i)[ii], the regulation specifically names and defines TDFs as one of three defined QDIA options. The second is that most participants have demonstrated great reluctance or inability in making asset allocation and investment decisions. After almost thirty years, the tools of investment disclosure and education have substantially failed to transform millions of participants from savers to successful investors. At the end of each investment education and communication session, many participants remain uncertain or unwilling to make portfolio construction and specific investment decisions, while others simply allocate equally among all investment options in a misguided attempt to practice the golden rule of not “putting all the eggs in one basket”. Even those who use online tools to assess personal risk and select a model portfolio can fail to rebalance, react poorly to market volatility, take inappropriate actions, and/or fail to adjust their portfolio allocations as they age. Plan sponsors and regulators confront the realities that the majority of participants are either explicit or implicit “do-it-for-me” investors, thus defaulting their contributions into an age-determined TDF becomes an appropriate and necessary alternative. According to the Investment Company Institute’s publication, “The U.S. Retirement Market, Third Quarter 2011”, TDF assets rose from $83 billion at the end of 2006 to $247 billion at the end of the third quarter 2011[iii]. This represents an almost 300% increase over less than a 5-year period. According to the same report, the total plan assets including 403(b) plans, 457 plans, and private employer-sponsored DC plans including 401(k) plans at the end of the third quarter 2011 was $4,326 billion. This means TDFs represented 5.71% of the plan assets when they were only 2.03% at the end of 2006.

Fiduciary Duty

The Prudent Man Rule as defined under part 4 of title I of ERISA section 404 states that:

“a fiduciary shall discharge his duties with respect to a plan solely in the interest of the participants and beneficiaries and–

(A) for the exclusive purpose of:

(i) providing benefits to participants and their beneficiaries; and

(ii) defraying reasonable expenses of administering the plan;

(B) with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims;

(C) by diversifying the investments of the plan so as to minimize the risk of large losses, unless under the circumstances it is clearly prudent not to do so; and

(D) in accordance with the documents and instruments governing the plan”.

ERISA § 2550.404c–5(b), regarding the fiduciary relief available to QDIA, states under subsection (2) that “[n]othing in this section shall relieve a fiduciary from his or her duties under part 4 of title I of ERISA to prudently select and monitor any qualified default investment alternative under the plan or from any liability that results from a failure to satisfy these duties, including liability for any resulting losses.”

Even though ERISA § 2550.404c–5(e)(4)(i) further says that “the asset allocation decisions for such products [TDFs] and portfolios are not required to take into account risk tolerances, investments or other preferences of an individual participant”, the “sole interest” standard under the fiduciary duty of loyalty and good faith, and the duty of due care to act ” with the care, skill, prudence, and diligence” must apply when analyzing, selecting, and monitoring TDFs as investment options for a retirement plan.

Thus, an ERISA fiduciary’s obligation when selecting and monitoring TDFs should follow a prudent process in the best interest of the Participants.

The Prudent Process

The common purpose of retirement plans is to optimize the probability of the median participant achieving the desired income replacement ratio at retirement in order to provide an adequate income stream throughout retirement. Although generating the best investment performance is not a part of the fiduciary obligation, establishing a prudent process in selecting investments that pursue the plan’s purpose is expected. The duty of loyalty requires the prudent process to start with a clear understanding of the demographic and behavioral data of the participant group. The duty of due care requires a reasonable and robust investigation of quantitative facts and qualitative information to screen TDFs and all investment options. At the end of the process, fiduciaries will have arrived at an informed and reasoned decision to select the most appropriate TDFs to meet the “exclusive purpose” of the plan and to have done so in the “sole interest” of the participants.

Evaluation Criteria

There are three main drivers that significantly determine the outcome of a TDF: asset allocation policy, manager/fund selection, and fees.

Setting the asset allocation policy is by far the most important determinant of portfolio outcome with regards to both volatility and return. The oft quoted studies of Brinson et al[iv] have shown that investment policy explains over ninety percent of the variation in portfolio total returns. A family of TDFs is a single multi-asset portfolio with a predetermined investment policy that reduces the portfolio weighting in risky assets over time. This multi-decade investment policy may become static on and after the Target Date (“To Allocation”) or may continue to lower risky asset weightings until sometime after the Target Date (“Through Allocation”). A family of TDFs is made up of a series of multi-asset portfolios along a glide path that are distinctive based on their individual target dates. Each distinctive portfolio is referred to as a “vintage” and typically is in five year intervals. Under the mutual fund structure, the base asset allocation for each TDF vintage is disclosed in the fund prospectus (“Target Asset Allocation”). The fund prospectus further discloses the active asset allocation process (“Active Allocation”) of managing asset class weights relative to the base asset weights under the Target Asset Allocation policy. A variance weighting band for each asset class is established so that, by policy, the Asset Allocation Manager’s ability to make tactical or strategic actions is quantified. Through the process of Active Allocation, the Asset Allocation Manager’s decision to deviate from the Target Asset Allocation intends to add value by lowering portfolio volatility and/or enhancing return (“Active Allocation Alpha”).

The mutual fund manager (in the case of active funds) or investment (in the case of passive funds) selection is an important component of the Asset Allocation Manager’s skill set. Under a fund-of-funds structure, the Asset Allocation Manager makes the selection decision among all eligible choices within the mutual fund complex to invest TDF assets in meeting the Active Allocation position. The basic premise is to select each underlying fund that can best fit the specified asset classes and, in the case of an actively managed fund, to derive a positive Alpha value (a manager’s out-performance) by each Underlying Fund Manager. Each underlying mutual fund has its own set of investment guidelines, limitations and risks. The Asset Allocation Manager attempts to select the “right” group of underlying funds to deliver a positive additive result and deliver portfolio outperformance (“Selection Alpha”) when compared with the Target Asset Allocation portfolio.

Controlling plan expenses is one of the ERISA fiduciary’s responsibilities. The simplest answer seems to be selecting the lowest cost provider whenever possible. However, “controlling” plan expenses does not equate to “removing” such expenses. In a same manner of fund selection, investment fees and expenses should be reviewed and considered in the context of a prudent process. The complication in share class selection is the potential plan sponsor requirement of revenue from investments to offset all or some of the plan expenses. The process by which an advisor recommends or plan sponsor selects a specific mutual fund share class for revenue sharing purposes is beyond the scope of this paper. Nonetheless, the share class selected should meet the reasonability test. After all, an excessive fee claim is a claim against a plan fiduciary’s loyalty and due care.

Quantitative Tools

With the popularity of TDFs and the recognition of the investment vehicle moving from the fringe to center stage, new analysis and benchmarking tools have been developed by fund sponsors and index providers as their proprietary way of screening, selecting or evaluating TDFs. The publicly available tools can be grouped as follows: A) benchmarking, B) performance attribution, and C) factor analysis.

- A) Benchmarking Tools

According to Ibbotson Methodology Paper, Selecting a Target Date Benchmark, dated September 30, 2011[v], the following list of primary benchmarks were compiled from reviewing 408 open-end target maturity fund prospectuses as the fund’s selected benchmarks.

Primary Prospectus Benchmark |

% of TDFs Using the Benchmark |

| S&P 500 | 28.2 |

| Russell 3000 | 8.8 |

| Blended Benchmark | 7.8 |

| Dow Jones Target Date Indexes | 7.1 |

| BarCap US Aggregate Bond | 5.9 |

| S&P Target Date Index Series | 4.9 |

| Dow Jones Real Return Portfolio Target Date Indexes | 2.7 |

| Dow Jones US Total Full Cap | 2.7 |

| Russell 1000 | 2.7 |

| Morningstar Lifetime Allocation Indexes | 2.4 |

| MSCI US Broad Market | 1.2 |

| S&P 1500 | 1.2 |

| S&P Global BMI | 1.2 |

| FTSE All World | 0.7 |

| MSCI AC World Ex USA | 0.7 |

| BarCap US Aggregate Intermediate | 0.5 |

| BofAML US Treasuries 1-3 Year | 0.3 |

| Dow Jones Moderately Conservative | 0.3 |

| Russell 1000 Value | 0.3 |

| No Listed Primary Benchmark | 18.4 |

Six out of the nineteen benchmark indexes are blend or multi-asset indexes, and the rest are either domestic or global single asset class indexes with the S&P 500 and Russell 3000 capturing 37% of the benchmark usage. This is astonishing. There is no reason to use a single asset static index as the benchmark for an asset allocation portfolio with changing asset mix as the target date approaches.

This paper will limit its discussions to six benchmarks that are often employed to screen TDF families. These benchmarks are further divided into two types. The first three are proprietary indexes that is constructed by the index provider based on a set of assumptions. The second is an amalgamation or bundling of a group of TDFs into a “representative” index or peer group universe.

1) Proprietary Index

- a) Dow Jones U.S. Target Index℠[vi]

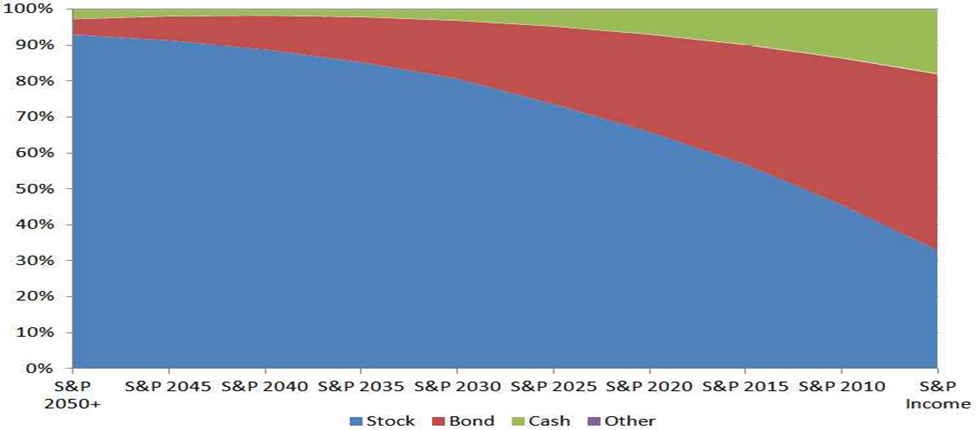

The Dow Jones US Target Date Index℠ was created in December 2009 for the purpose of benchmarking TDF portfolios (Dow Jones has also created a global TDF and a real TDF index). According to Dow Jones’ literature, the Dow Jones Target Date Indexes “are a composite of other indexes. These sub-indexes represent three major asset classes—stocks, bonds and cash. The asset classes are weighted within each Target Date Index to reflect a targeted level of risk. Over time, the weights are adjusted based on predetermined formulas to reduce the level of potential risk as the index’s maturity date approaches.”

The glide path is constructed as follows. “For the first five years, the index’s targeted risk level is set at 90% of the risk of the equity portion of the index. Stocks, bonds and cash—as represented by underlying indexes—are rebalanced monthly within the index to maximize the weighting to the asset class with the highest historical return at the 90% risk level. At 35 years prior the maturity date, the index begins to reflect reductions in potential risk. A new targeted risk level is calculated each month as a function of the current risk of the equity component and the number of months remaining to maturity. The monthly risk reductions continue until the index reflects 20% of the equity risk, on December 1st of the year ten years after maturity. Once an index reaches that date, it always reflects 20% of the equity risk.” The sub-indexes are as follows[viii]:

Dow Jones U.S. Stock CMAC Index |

Barclays Capital Bond Composite |

| Dow Jones U.S. Large-Cap Growth Index | Barclays Capital Government Bond Index |

| Dow Jones U.S. Large-Cap Value Index | Barclays Capital Corporate Bond Index |

| Dow Jones U.S. Mid-Cap Growth Index | Barclays Capital Mortgage Bond Index |

| Dow Jones U.S. Mid-Cap Value Index | Barclays Capital Cash Composite |

| Dow Jones U.S. Small-Cap Growth Index | Barclays Capita; 1-3 Month T-bill Index |

| Dow Jones U.S. Small-Cap Value Index |

According to Dow Jones, its glide path is represented as follows[ix]

1. b) Russell Investments

- Russell Investments views each vintage along a glide path as a single portfolio. After all, a 2040 vintage will become the 2035 vintage in 5 years. At any moment in time, a vintage portfolio along a glide path is a snap shot of a single portfolio traveling through time. As such it is more meaningful if all the vintages are collapsed during any moment in time and view as one giant portfolio for performance analysis purposes. Russell developed a proprietary analytical tool known as the Target Date Metric (TDM)[x]. The TDM combines monthly returns of all the vintages along a glide path for family of TDFs to generate a performance metric over a specified period. TDM considers the complete fund family’s strategy over time and compares the target date fund family performance against a benchmark composed of 40% Russell 3000 Index, 20% Russell Global ex-us Index, and 40% BarCap U.S. Aggregate Index[xi] (alternative benchmark can be made available). This benchmark index is the most popular baseline portfolio allocation among institutional investors with a long investment time horizon. All aspects of the TDF family’s investment process are incorporated as a result.

The results of the TDM calculation are a ratio of the TDF family’s composite performance to the benchmark. A reading of 100 would indicate performance that matches the benchmark, while 110 would indicate a 10% excess return over the benchmark. Less than 100 would indicate lower performance than the benchmark for the reporting period. However, this single value measure is insufficient to be the “one-stop-shop” in determining if a glide path is appropriate for a plan sponsor, the risk budget is aligned, and the glide path is a To Allocation or a Through Allocation, just to name a few factors. Moreover, the RTM is constructed based on a set of Russell centric views which may or may not be shared by every plan fiduciary or advisor. The RTM uses a non-linear weighting so that more weights are allocated to the vintages closest to the target date. This tool would be even more helpful if it is available on line to allow the plan fiduciaries and advisors to adjust the assumptions and the benchmark composition to better fit their views.

- c) Morningstar Lifetime Allocation Index – to be discussed in the next section.

2) Peer Group Benchmark

Two of the most prominent peer group benchmarks are from Standard & Poor’s’ (“S&P”) and Morningstar.

- a) S&P Target Date Index – A consensus target date glide path is created using cross-sectional asset allocations of active target date managers that represent the aggregate opinion with respect to asset class exposures. S&P conducts an annual holdings survey of active target date managers for the data. The index asset allocations used for each target date and the associated glide paths across target dates are derived from this data. Each index’s glide path is consequently a function of cross-sectional market observations. S&P believes that it distinguishes itself by conforming to the CFA Institute standards as well as other best practices[xii] and being a consensus index[xiii].

- b) Morningstar provides three types of services. The first is a custom index; second is a peer universe category, and the third is a rating service.

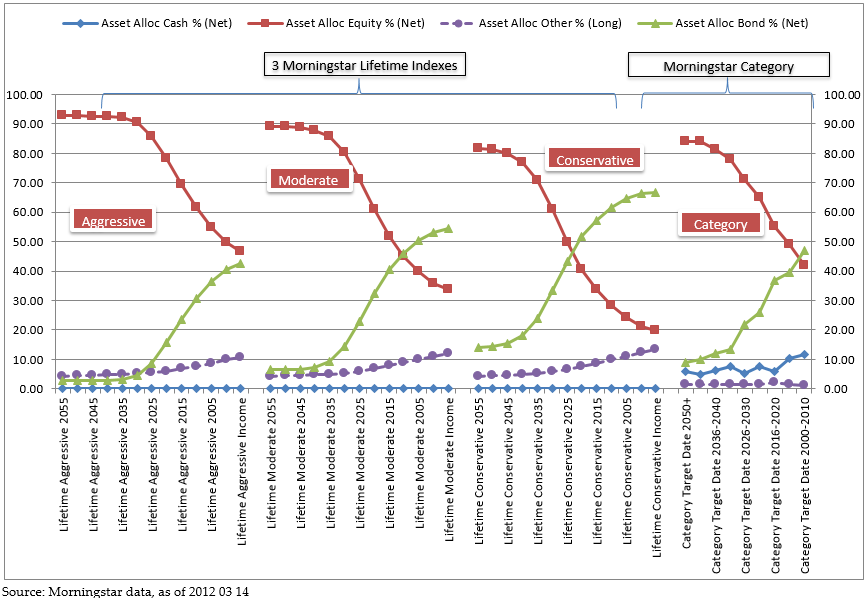

- i) Morningstar Lifetime Allocation Index

Morningstar created three custom “risk tracks” benchmark indexes: aggressive, moderate and conservative. Each glide path uses a Through Allocation with consideration given to “the median U.S. citizen’s total economic situation including an evolving picture of their financial capital, human capital, and retirement income liability” in an attempt to generate “total wealth closest to MPT’s Sharpe maximizing portfolio while considering the nature of the participants’ liabilities.” This approach divides the TDF universe into three risk-based glide paths. The equity allocation differentiation among the three risk tracks increases progressively over time with the landing point from 20% (conservative) to almost 50% (aggressive) allocation to equities. The graph below compares the portfolio allocations among all three risk tracks. This approach faces the same challenges mentioned earlier for any asset allocation based portfolio benchmark index where, regardless how thoughtful and careful each glide path is constructed and invested, there is a danger that each benchmark is viewed as the standard. All vintages that perform better than the benchmark are considered superior, and the remaining vintages are somehow inferior. This may be the wrong conclusion.

- ii) Peer Group Average Category[xiv]

Morningstar Category represents a peer group universe, and Morningstar assigns its Category based on the underlying mutual fund portfolio statistics and compositions over the past three years. Every fund Category assignment is verified semi-annually. Morningstar Categories serve as peer group universe for fund comparison. Morningstar divides target-date funds into the following categories:

| Retirement Income | Target-Date 2000-2010 | Target-Date 2011-2015 |

| Target-Date 2016-2020 | Target-Date 2021-2025 | Target-Date 2026-2030 |

| Target-Date 2031-2035 | Target-Date 2036-2040 | Target-Date 2041-2045 |

| Target-Date 2050+ |

The asset allocation for each Category also appears in the graph below. The Morningstar peer group average category has an equity allocation glide path similar to the Morningstar Lifetime Allocation Conservative Index.

iii) Morningstar Rating Service

According to Morningstar, the firm evaluates target-date funds based on five components—People, Parent, Performance, Portfolio, and Price. People and Parent ratings are determined by both qualitative and quantitative measures of the funds’ management processes. Performance, Portfolio, and Price ratings use quantitative measures to evaluate the quality of both the target-date funds and the underlying holdings in which they invest as well as the cost that investors must pay. Morningstar assigns one of five ratings for each component: Top, Above Average, Average, Below Average, or Bottom. Based on the five component ratings, each target-date fund series earns an overall rating using the same grade scale. The Morningstar Rating Service does not currently rate all TDFs available to the public.

These six different measurement yardsticks have their advantages and incompleteness, and deploying one or all these benchmarking approaches in analyzing or monitoring a TDF remains deficient. Dow Jones created a TDF index based on a proprietary glide path using an index-of-indexes approach. This Through Allocation glide path assigns a high equity allocation initially and begins to roll down the allocation 35 year prior to the Target Date. The equity reduction slope is gradual. The Dow Jones glide path and its underlying asset and sub-asset class allocation represent one of an infinite number of glide path (asset allocation) designs and underlying investment selections. When used as a benchmark to compare against a TDF, the comparative dataset (i.e. equity allocation along the glide path, the inclusion of various asset and sub-asset classes, risk, return, etc.) is of little value unless the Dow Jones Target Date Index glide path and its underlying investments deployed align with the selection and review criteria and objectives of the Plan Sponsor. Russell’s RTM suffers a similar challenge. Although the idea of collapsing all the vintages into one portfolio makes good sense, its weightings and other assumptions as well as the basic benchmark may not be acceptable to all plan fiduciaries. None of these benchmark indexes able to take into consideration the rate of the glide path reduces equity exposure over time, the inclusion or differentiation of asset classes unique to a glide path, or other unique glide path construction features.

Once more, the same type of challenges is faced by using the S&P Target Date Index or the Morningstar Peer Group Categories. The consensus view of the world of TDFs or the average glide path performance are of little value unless the view or the average coincide with or otherwise closely resemble the selection and review criteria or objectives of the Plan Sponsor. The information and data derived from the S&P Target Date Index and Morningstar Peer Group Categories may be interesting; however, they are not very helpful when used on a standalone basis. For one vintage, for example the 2040 Target Date Fund from mutual fund company A, to have outperformed the comparable S&P Target Data Index or Morningstar Peer Group Category vintage offers little value. It simply means that, for that reporting period (end point bias), the 2040 Target Date Fund has performed better or appreciated more than the consensus or average. It is not clear under the TDF context the utility of knowing the average. This single data point is more meaningful when the 2040 Target Date Fund is observed along with its portfolio allocation, return attribution, portfolio volatility, and with appropriately regressed Modern Portfolio Theory Statistics against the best fit index or category. Moreover, the 2040 vintage should be viewed in the proper context as one vintage along the glide path so that the performance of one vintage is not considered in isolation.

Finally, as so stated above, the three Morningstar “risk track” Lifetime Allocation Indexes pose the same challenge. The biggest danger is to use any one of these benchmarks as a standard for TDF selection or monitoring. When a glide path is placed among the three risk tracks, it is easy for anyone to “eyeball” the similarities of one or the other risk track index and jump to a conclusion. A glide path that appears to be more “conservative” than the Aggressive risk track index only suggests that the amount of allocation to equities is less than the Aggressive risk track index. This does not speak to the actual portfolio volatility or risk. Further, judging the worthiness or prudence of a glide path should not begin and end by comparing each vintage to the respective vintages along all three glide paths or the other indexes and benchmarks.

One of the biggest danger in relying on a benchmark index or peer group benchmark as the single approach to a TDF selection decision is the psychology of anchoring. Simply stated, the act of anchoring is a cognitive bias that we heavily rely on one recent data point or information (i.e. anchor) when making decisions about the future or take future actions. For example, when a number of TDF glide paths with all the portfolio vintages are plotted against a TDF benchmark, it is natural for a plan fiduciary to eliminate from consideration all TDF families that have performed below the comparable benchmark vintage portfolios. Let’s assume that the benchmark index has a higher equity weighting throughout the glide path and let’s further assume that the trailing 3-year measuring period was a bull market for stocks (i.e. a risk-on environment). One should expect all the vintages along the benchmark glide path to have out-performed comparable vintages with lower equity allocations. This heuristic approach of TDF selection will lead to an unfortunate decision of buying at the height of a market cycle.

The major differences among the benchmarks are summarized below per Morningstar:

Index |

Glide Path Methodology |

Asset Classes |

# of Asset Classes |

Intra-Stock / Intra-Bond Methodology |

| S&P Target Date Series | Modified peer group average based on survey of fund families with AUM of $100 million or more. If an asset class is included in 25% of target maturity funds it is included in the average. Summed survey results lead to the equity glide path. Final curve fitting procedure smoothes the results. | Equity: U.S. Large Cap, U.S. Mid Cap, U.S. Small Cap, International Equities, Emerging Markets, U.S. REITs Fixed Income: Core Fixed Income, Short Term Treasuries, TIPS | 9 | Modified peer group average based on survey of fund families with AUM of $100 million or more. If asset class is included in 25% of target maturity funds it is included in the average. Summed survey results lead to the equity glide path. Final curve fitting procedure smoothes the results. |

| Dow Jones US Target | Semi-variance-based glide path. Starting 40 years prior to the target date, the funds target 90% of the semi-variance of equity. This decreases to 20% of the semi-variance of equity 10 years after the retirement date. | Equity: U.S. Large Cap Growth, U.S. Large Cap Value, U.S. Mid Cap Growth, U.S. Mid Cap Value, U.S. Small Cap Growth, U.S. Small Cap Value Fixed Income: U.S. Government Bonds, U.S. Corporate Bonds, U.S. Mortgage Bonds, 1-3-month T-bill | 10 | None specified in methodology document. |

| Morningstar Lifetime Allocation (w/risk tracks) | Modern Portfolio Theory (MPT)-based glide path evolves with the median U.S. citizen’s total economic situation (including an evolving picture of their financial capital, human capital, and retirement income liability). The glide paths attempt to maximize a participant’s total financial health by investing their financial capital in such a way that it brings their total wealth closest to MPT’s Sharpe maximizing portfolio (adjusted for risk preferences) while considering the nature of the participants’ liabilities. | Equity: U.S. Large Cap Growth, U.S. Large Cap Value, U.S. Large Cap Core, U.S. Mid Cap Growth, U.S. Mid Cap Value, U.S. Mid Cap Core, U.S. Small Cap Growth, U.S. Small Cap Value, U.S. Small Cap Core, Non-US Developed, Emerging Markets Fixed Income: Long-Term Core Bonds, Intermediate-Term Bonds, Short-Term Bonds, Global Government Bonds, Emerging Market Bonds, TIPS, Cash Other: Commodities | 19 | Gradual movement from asset-only asset class allocations to liability-relative optimization-based asset allocations. In addition, there is a gradual movement from mean-variance asset allocation to mean-conditional value-at-risk optimizations. |

Source: Internal Morningstar Investment Management analysis based on information collected in March 2011.

This table demonstrates the differences among the three benchmarks as well as gives a side-by-side comparison of glide path construction methodology (i.e. qualitatively). A plan sponsor may not fully agree with any one of these glide path methodologies or find the assumptions to be incongruent with the plan participants.

B) Performance Attribution Tool

Thus far, the focus has been reviewing the publicly available tools to assist in understanding the Glide Path or Target Asset Allocation over time. Now the discussion turns to Active Allocation.

A TDF prospectus provides the Target Asset Allocation for each TDF vintage. The Target Asset Allocation provides the portfolio allocation under “normal market conditions”. Typically, the fund-of-funds Asset Allocation Manager intends to add value by making tactical allocation changes to the portfolio within the disclosed limits and by selecting the Underlying Fund Managers deemed to provide the best performance.

On a portfolio level, the Asset Allocation Manager may over- or under-weight an asset or sub-asset class to enhance the overall portfolio performance on a risk-adjusted or absolute basis. This active portfolio adjustment is available in addition to periodic portfolio rebalancing to align the portfolio with the forward-looking view of the Asset Allocation Manager. On a fund selection level, the Asset Allocation Manager is typically given broad discretion to select funds from the mutual fund complex. In some cases, outside funds (such as exchange traded funds) can be used to meet the Asset Allocation Manager’s discretionary mandate. Thus, the portfolio performance is also subject to the performance of the Underlying Fund Manager. For a portfolio to meet or exceed the performance of the Target Asset Allocation, the tactical asset allocation, rebalancing strategy and the Underlying Fund Manager decisions must have a net positive effect.

A performance attribution tool is helpful in examining the sources of the return and if the Asset Allocation Manager has delivered positive Active Allocation Alpha and if the selection of the Underlying Fund Managers has delivered positive Selection Alpha. The attribution software programs our firm uses is the StyleAnalysis from Zephyr Associates. By using the Target Asset Allocation as the baseline benchmark for each vintage, the tool can perform comparative style and return regression analysis to find out if and how the portfolio allocation deviated as well as generate a clear understanding of MPT statistics such as trailing beta, standard deviation, up- and downside capture, R2, Sharpe Ratio and many other relative risk measurements. This approach dives deeply into the portfolio and its performance characteristic to either confirm a TDF selection decision or meet the duty to perform ongoing monitoring of the selected portfolios along a glide path. Regardless of how one vintage may have performed when compared to an arbitrary benchmark index, it is only through the performance attribution process that a fiduciary can recognize the performance drivers and the range of performance probabilities.

- C) Factor Analysis Tools

Two mutual fund companies have developed online tools that identify specific portfolio factors.

1) JP Morgan

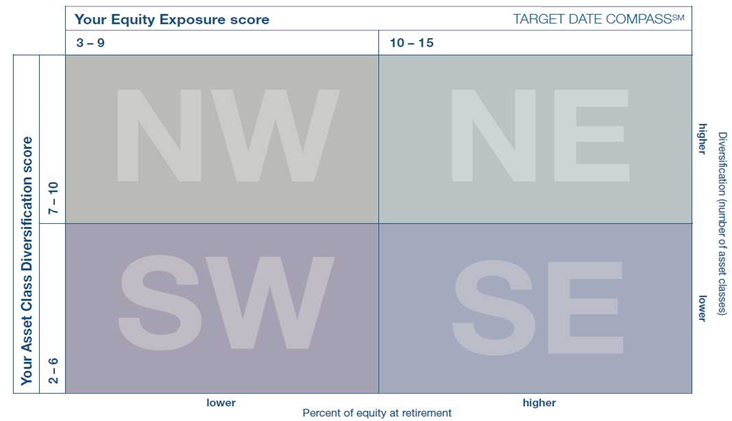

JP Morgan developed the Target Date Navigator and the Target Date Compass[xv]. The Navigator is a questionnaire that assists plan fiduciaries in their process of selecting the “right” glide path based on the plans’ objectives, participant behaviors, and risk tolerance. The outcome from the Navigator exercise helps plan fiduciaries to determine the type of TDF they should further investigate using the Compass. The Compass can be obtained through JP Morgan DCIO representatives upon request from investment advisors and brokers.

The Compass is divided into four quadrants. The X axis shows the amount of equity allocation at retirement (Target Date), and the Y axis shows the number of asset and sub-asset classes available to the Asset Allocation Manager in portfolio construction. This two-factor model of plotting equity exposure (i.e. amount of equity risk remaining at retirement) and number of asset classes (i.e. more asset classes the more diversified) is offering a superficial or prima facie view of portfolio risk. The inferred assumption is that the NW quadrant carries the least portfolio risk whereas the SE quadrant is expected to have the highest portfolio risk.

This Navigator-Compass combination offers a beginning dialog into portfolio risk through diversification and the Target Date landing discussion through equity weighting at retirement, but the Compass is insufficient as a tool to make a final glide path or TDF selection decision. The first problem is that asset diversification does not equal risk diversification. Populating a portfolio with many asset and sub-asset classes that are not lowly or non-correlated does not realize the benefit of portfolio diversification. It is by now common knowledge that a portfolio made up of 40% BarCap US Aggregate Index and 60% S&P 500 Index may appear diversified, but over 95% of the portfolio’s risk is derived from the 60% allocation to stocks. There is very little diversification benefit from a risk perspective. The second problem is that the percentage of equity at retirement does not inform us if each glide path has a To Allocation or Through Allocation. Further, this endpoint data does not offer any information regarding the curvature of the glide path, which is significant. For example, a glide path may have a high equity or risk asset allocation until the final 5 or 10 years to the Target Date and begin to significantly lower its exposure during the last vintage. Fiduciaries should be concerned with the risk asset roll down process and not simply the final risk allocation on and beyond the Target Date.

2) Pacifica Investment Management Company (PIMCO)

PIMCO has developed an online tool (available through DCIO representatives for investment advisors and consultants) to assess the risk factor of the portfolios along a TDF glide path. The idea behind this tool is to assist plan fiduciaries and advisors to be better informed about the portfolio risk of each glide path vintage being considered. In fact, asset allocation using disparate asset and sub-asset classes to construct a portfolio does not necessarily mean risk diversification. The amount of risk taken within any vintage is significant and should be carefully understood and analyzed as a part of a prudent TDF selection and monitoring process. In fact, “diversifying the investments of the plan so as to minimize the risk of large losses” is part of the fiduciary standard promulgated under ERISA. The risk of large losses (tail risk, for example) increasingly becomes significant as the portfolio rolls down the glide path towards the target date. Average participants are not likely to be able to sustain a large loss to their portfolio 5 or 10 years away from their target date since the time required to recover from these shock events would be no longer available and the loss becomes permanent.

Known as the Real Path tool, it decomposes each index into risk factors and employs a block bootstrap methodology. The process begins by computing historical returns that underlie each asset class proxy beginning in January 1997 and then draws a set of 12 monthly returns within the dataset to arrive at an annual return figure. This process is repeated 156,000 times (Monte Carlo simulation) to derive a return series with 15,000 possible annualized returns. The standard deviation of these annual returns is then used to model the volatility of each factor. The same return series for each factor is employed to compute covariance between factors (i.e. correlation among two asset or sub-asset classes). Finally, the volatility of each asset class proxy is calculated as the sum of variances and covariance of factors that underlie that class proxy.

Although the Real Path tool is an important and welcomed addition and represents a critically important discovery step for fiduciaries and advisors, it does not intend to be all encompassing in evaluating or selecting a TDF. The Real Path Tool is a single factor (risk assessment only) simulation tool, and it does not take into account the exact investments within the funds of each fund-of-funds structure. As such, the outcome does not intend to be exact but an approximate. It is a helpful tool that raises consciousness about risk and about the possible lack of risk diversification in a seemingly well diversified portfolio. It enhances the overall evaluation process.

- D) Fees

Controlling plan expenses is an important fiduciary duty. Over time, high fees will significantly lower portfolio returns. However, plan fees cannot be addressed in isolation from the plan sponsor and the plan’s objectives. Otherwise, the default answer to fees is that the lowest fee option is always the best answer. Fees should be viewed in the context of value and for what the plan sponsor expects the plan to be responsible. Notwithstanding the foregoing however, it is one’s fiduciary duty to understand the various fee structures and arrangements and to select the lowest fee class in meeting a plan’s stated objective. Morningstar online is the most accessible for mutual fund share class fees and expenses ratios. Depending on the plan size and the expected amount to be invested in a TDF, investment sponsoring organizations have alternative structures to mutual funds that may further lower fees and expenses. There is no one-size-fits-all fee structure, and careful consideration and review is necessary before making a final decision. Typically, a fee that is less than the Morningstar Category average is a starting point for mutual fund selection.

Conclusion

The prominence of Target Date Funds in participant-directed account-based defined contribution plans will continue to grow with increasing amount of plan assets selected or defaulted into these asset allocation funds. With the rapid disappearance of defined benefit plans where plan sponsors retain the investment and contractual risks, the funding and investment decision, thus risk of underfunding and performance, squarely rests with each plan participant under a 401(k)-plan defined contribution regime. Over thirty years of participant behavior has confirmed what has always been suspected. Participants are savers and not investors, and investment education, communication and voluminous disclosures have substantially failed to move the needle. Until and unless truly personalized investment advice can be provided on a scalable and cost-efficient basis, TDFs are a natural and appropriate investment option where investment decision is made for each participant by investment professionals.

Plan fiduciaries have the duty to prudently select and monitor every investment option under the plan and do so in the sole interest of the participants. In the past, single asset (such as domestic all cap equity, developed economy all cap equity ex U.S., etc.) or style/sector specific (U.S. small cap value equity, Investment Grade U.S. fixed income, etc.) investments could be scrutinized and measured against a fixed benchmark index or against a group of like-kind peers. In the case of an ever-evolving asset allocation portfolio, such as a TDF, the framework of benchmarking and the associated tools must be refined and reconfigured.

As stated earlier, there is no “easy button” to push in selecting TDFs. The objective should not be trying to identify the best performing family of TDFs in the future. Since the future is unknowable, there is no perfect ex ante asset allocation portfolio and we can only know if each vintage has performed well ex pose. Throughout investment history, we learned that driving forward by simply looking backward will get us in trouble. Mining historical performance data on an absolute or relative basis against a benchmark index or peer group must be put into proper perspective. It is even that much more meaningless to view each vintage in isolation. The success of a family of TDFs is based on the proprietary thoughts toward glide path construction, the types and variety of asset and sub-asset classes available and if they are meaningfully included, the Asset Allocation Manager’s ability to deliver positive Active Allocation Alpha and Selection Alpha, the ability for the Underlying Fund Managers to positively contribute, and the careful consideration and actions towards risk and risk management throughout the investment management process. All the benchmarks and tools in the world cannot provide any certainty about the future. They merely confirm the past, albeit critically important. Qualitative analysis should lead the investigative process. Understanding the components to a glide path construction, the process of managing the glide path, the check and balance in the investment structure, the tactical allocation decision metrics, the weighting of top down and bottom up analytical regime, internal structure of spoken or unspoken expectations to use certain underlying funds, and the cultural and investment emphasis on risk awareness and containment are just the beginning of a necessary in depth quantitative due diligence process. The quantitative tools and benchmarks are for the plan fiduciaries and advisors to verify and confirm if the quantitative elements were indeed present ex pose.

The prudent process begins with an understanding of the makeup of the participants (age, turnover, tenure, etc.) and to adhere to a clearly stated investment policy statement that defines the TDF selection and monitoring process. This paper limits its discussion to the quantitative tools that are made available directly or through an advisor or broker. By no means have we included every TDF benchmark and tool available and new benchmarks and tools are constantly being developed. The purpose of this paper is to alert plan fiduciaries and advisors that: 1) they need to view the TDF selection process through the lens of duty of loyalty and due care; 2) a prudent process for selecting and monitoring TDFs is different and much more complex and nuanced than for any single asset investment option; 3) no one tool that we addressed in this paper is sufficient to be the sole method in a prudent process for selection and monitoring a family of TDFs 4) asset allocation does not necessarily imply risk allocation, ERISA dictates that plan fiduciaries should invest in such a way to minimize large losses, and 5) once armed with the understanding to the underlying assumptions, fiduciaries are better equipped to select the proprietary benchmarks, peer group benchmarks, performance attribution tool, and factor analysis tools in establishing the qualitative process of discovery, emphasis, and confirmation. The considered and comprehensiveness of the process developed by each plan sponsor in this regard demonstrates their duty of due care is being met.

[i] Securities and Exchange Commission, 17 CFR Parts 230 and 270, INVESTMENT COMPANY

ADVERTISING: TARGET DATE RETIREMENT FUND NAMES AND MARKETING

http://www.sec.gov/rules/proposed/2010/33-9126.pdf

[ii] An investment fund product or model portfolio that applies generally accepted investment theories, is diversified so as to minimize the risk of large losses and that is designed to provide varying degrees of long-term appreciation and capital preservation through a mix of equity and fixed income exposures based on the participant’s age, target retirement date (such as normal retirement age under the plan) or life expectancy. Such products and portfolios change their asset allocations and associated risk levels over time with the objective of becoming more conservative (i.e. decreasing risk of losses) with increasing age.

[iii] ICI website, http://ici.org/research/stats

[iv] Brinson, Hood, Beebower (1986) and Brinson, Singer, and Beebower (1991)

[v]Ibbotson/Morningstar Methodology Paper, Selecting a Target Date, Thomas Idzorek, et al, 09-30-2011. Benchmarkhttp://corporate.morningstar.com/ib/documents/MethodologyDocuments/IBBAssociates/SelectTargetDateBenchmark.pdf

[vi] Down Jones Target Date Indexes are comprised of three index series: Dow Jones U.S. Target Index℠, The Dow Jones Real Return Target Date Indexes℠ and Dow Jones Real Return Target Date Indexes℠.

[vii] Dow Jones US Target Date Index℠ Methodology

[viii] Dow Jones Target Date Index Brochure

[ix]Dow Jones Index

http://www.djindexes.com/targetdate/?go=chart

[x] Russell Target Date Metric FAQs

[xi] Correction: This benchmark is updated on 05-01-2012 from the March 12, 2012 original paper.

[xii] 2011 Level 3 CFA Program Curriculum Volume 6, Section 5.2 and “Best Practices in Benchmarking Target Date,” available at http://www.spindices.com/targetdate,.

[xiii] S&P Indices – Target Date Benchmarking: The Value of a Consensus Glide Path, October 2011

SP-Indices-Value-of-a-Consensus-Glide-Path.pdf

[xiv] Morningstar Category http://www.morningstar.com/InvGlossary/morningstar_category.aspx?t1=1330805331

[xv] JP Morgan target date tools https://www.jpmorganfunds.com/cm/Satellite?pagename=jpmfVanityWrapper&UserFriendlyURL=retirementhome