On December 16, 2015, the FOMC raised rates for the first time since the key rate moved to 5.25% on June 29, 2006. The 25bp rise was to signal to the market the start of a new phase in monetary policy by the FOMC. At the beginning of this year, the FOMC was signaling a likely four 25bp increases this year. Now, after the sharp drop in stock prices in January and February, the unexpected Brexit in June and equally unexpected Trump victory, the consensus is that the FOMC will hike rates by another 25bp during the upcoming final 2016 Committee meeting.

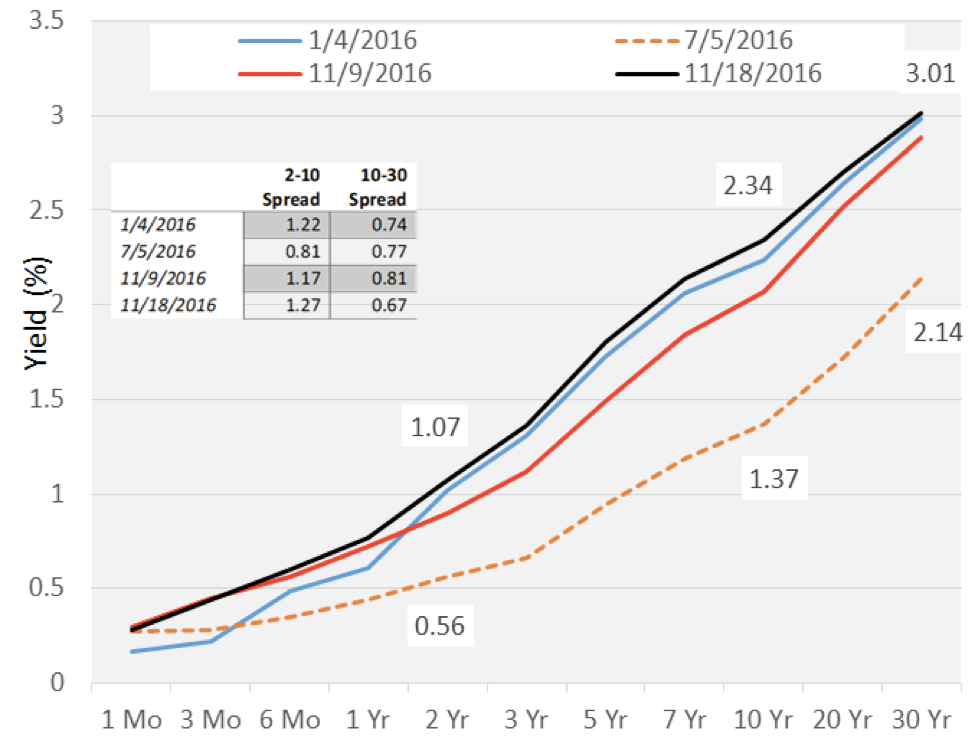

The following chart shows the treasury yield curve currently (black) and at various points this year. The yield curve is basically back to where we were at the start of this year (blue).

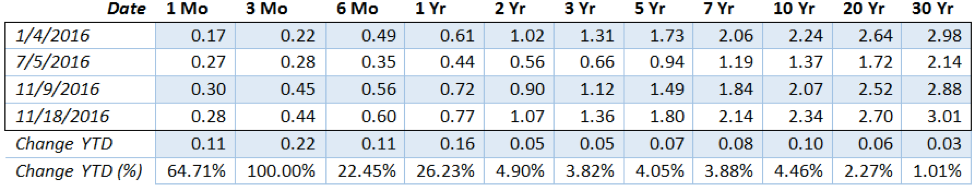

The following table shows the yields along the treasury curve and the change in absolute and percentage terms since the beginning of the year through November 18th.

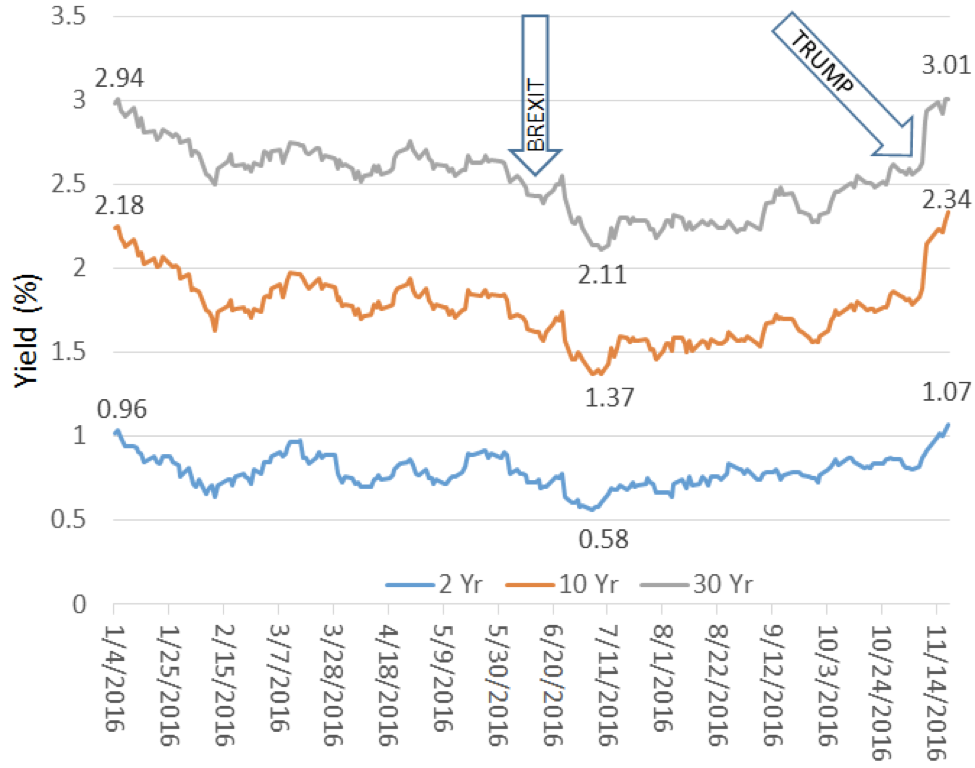

The significant move up in the short-end of the yield curve (1 month through 1 year) is a clear anticipation of (or pricing in) a December 25bp rate increase. The low reached on July 5th was a direct result of central bank immediate response to Brexit globally. Further, Chair Yellen’s October 14th speech at the Boston Fed hinted at letting the economy run hotter as a way to assure the return of inflation and to further improve economic activities. The following chart shows the 2-, 10- and 30-yaer treasury yields since the beginning of this year through November 18th. Rates have slowly returned to pre-Brexit levels but the sharp rise came since Trump’s win on November 8th is astonishing.

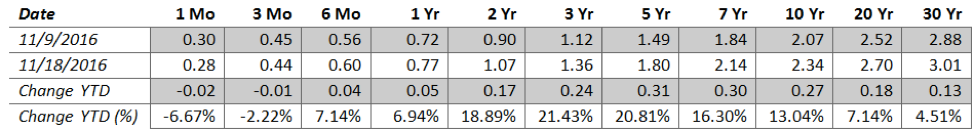

The following table shows the change in yields and the percentage changes between the day after the election and 9 days later.

There has been a significant spike in rates and a steepening of the yield curve with the market anticipating:

- A likelihood of the FOMC letting the economy to get “hotter” before increasing the pace of rate hikes. This is inflationary, and

- A likelihood of Trump led Republic Party to unleash fiscal policies through infrastructure and defense spending, corporate and personal income tax reform, and repeal regulations. These are inflationary forces as well.

Even before Trump’s win, evidence of tightening labor force and wage inflation at the bottom deciles of American workers suggest inflation is bubbling up.

A Trump Administration does not assure trickle-down economics and increase government spending or in the scope or scale anticipated or desired. Furthermore, the speed by which such changes can materialize and implemented is also questionable. Then there is the anti-immigrant, anti-trade policies that can have unintended consequences for corporations and the domestic economy.

The interest rate low reached this summer may be the bottom for this cycle with inflation finally showing signs of returning; however, the current speed of change may be too excessive. Regardless if the Trump Administration will turn the country more inward and leads the charge to de-globalize, the long-term interest rates are market driven and influenced by foreign purchasers. Even if the U.S. turns more nationalistic, the financial markets remain porous and global. This will remain impactful on the U.S. yield curve. The effect of diverging monetary policies will be translated through currencies. As such, the U.S. dollar strength could also become a weight in the pace of rate normalization.

Clearly, markets always go to where the puck is (expected to be) going. After all, market is forward looking and anticipatory. But the market is often wrong by over shooting one direction or another in the periods of euphoria and despair. It is way too early to know where the puck will end up. What we are certain about is elevated uncertainty driven by political risks.

This commentary represents the current views of Chao & Company and they are subject to change. The comments and views should not be deemed as Philip Chao, or any member of this Firm, offering investment advice. The commentary is informational only and is insufficient to be relied upon to make any financial or investment decisions or to make any changes to your financial condition.