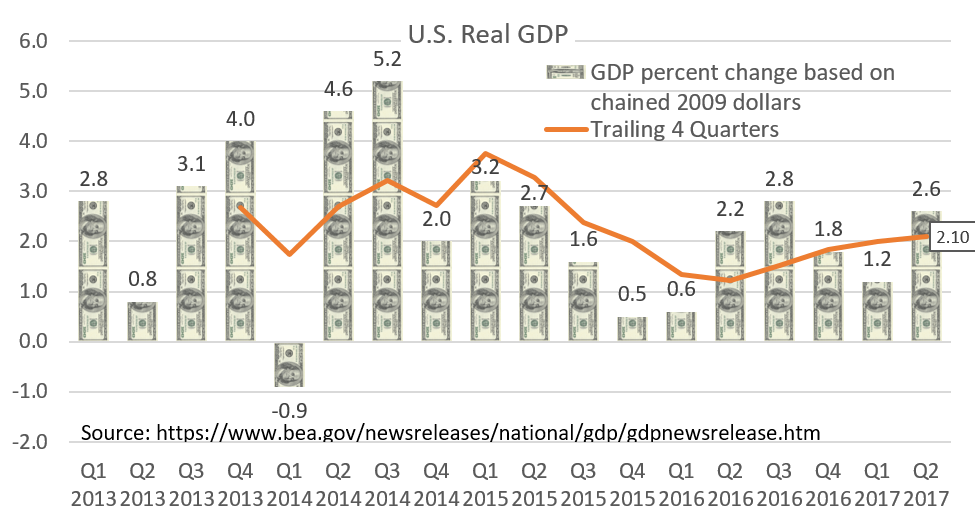

On July 28, 2017, the Bureau of Economic Analysis released the Advance Estimate for the U.S. second quarter GDP[1]. Compared to the first quarter of (revised) 1.2% real GDP rate, the 2.6% is a welcomed bounce. For the first half of 2017, we are growing at an annual rate of 1.9% and on a trailing 4 quarter basis at 2.1%.

The uplifting consumer and business sentiment in anticipation of the Trump Administration’s fiscal policy and structural reforms have been reflected in the financial markets but not much in the real economy. Unless there are serious infrastructure spending, an increase in net government expenditures and tax reform/cuts, the next few quarters’ real GDPs would likely remain in the 2% annualized range.

Let’s take a look deeper into consumer, business and government sectors.

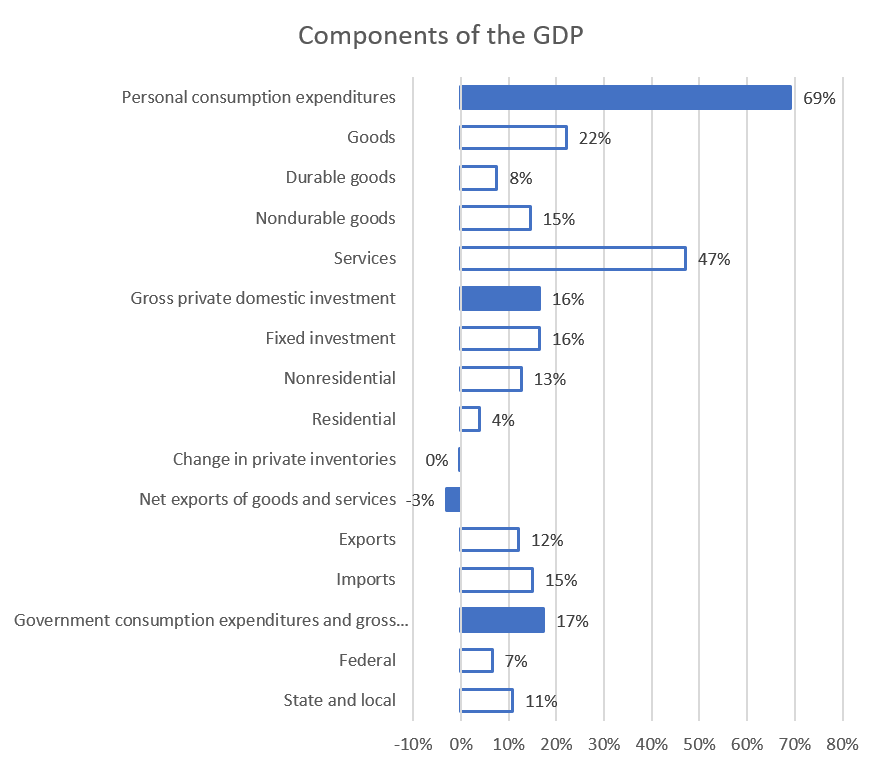

With the U.S. economy moving towards $20 trillion, the consumer remains the largest component at 69%. 47% of the economy lies strictly in consumer services, and government spending and capital expenditure (i.e. commercial investments) are roughly equal at 17% and 16% of the economy respectively.

Thus, real wages, consumer sentiments, and consumer spending are important factors that economists focus on when assessing the strength, growth and sustainability of the U.S. economy. Government spending and capital expenditure by companies would also be significant contributors. Thus, realizing President Trump’s promise for income and corporate tax reform (more likely cuts), significant fiscal spending (such as infrastructure and DOD spending) and rolling back regulations would be a significant boost to the U.S. economy.

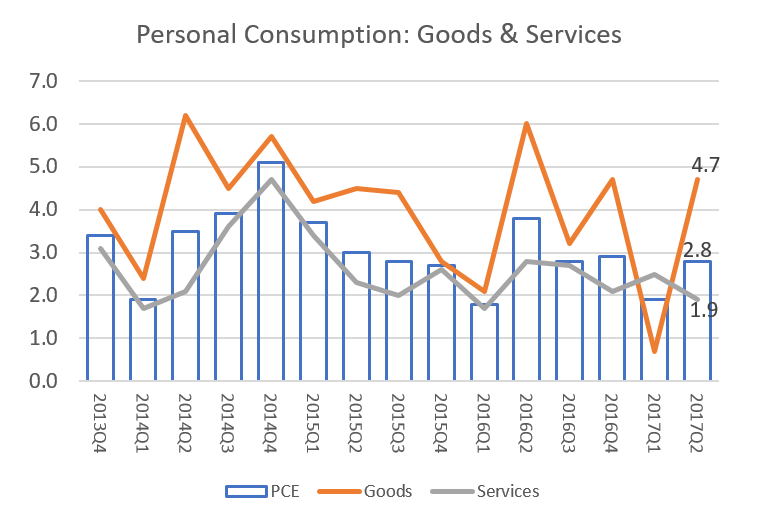

Consuming spending is divided into goods and services. Goods are further divided into durable and non-durable goods. The service component of Personal Consumption has dropped in the second quarter to 1.9% from the first quarter at 2.5%. The average over the trailing 4-quarters (since 2016Q3) is 2.3%. In the case of the goods component of Personal Consumption, it has spiked up in the second quarter to 4.7% from the first quarter at 0.7%. The average over the trailing 4-quarters (since 2016Q3) is 3.3%. Bear in mind, second quarter since 2014 has always spiked.

Durable goods (such as auto, furnishing etc.) recovered significantly from the first quarter of -0.1% to +6.3% while the non-durable goods (food, beverage, clothing, etc.) recovered from the first quarter of 1.1% to 3.8%.

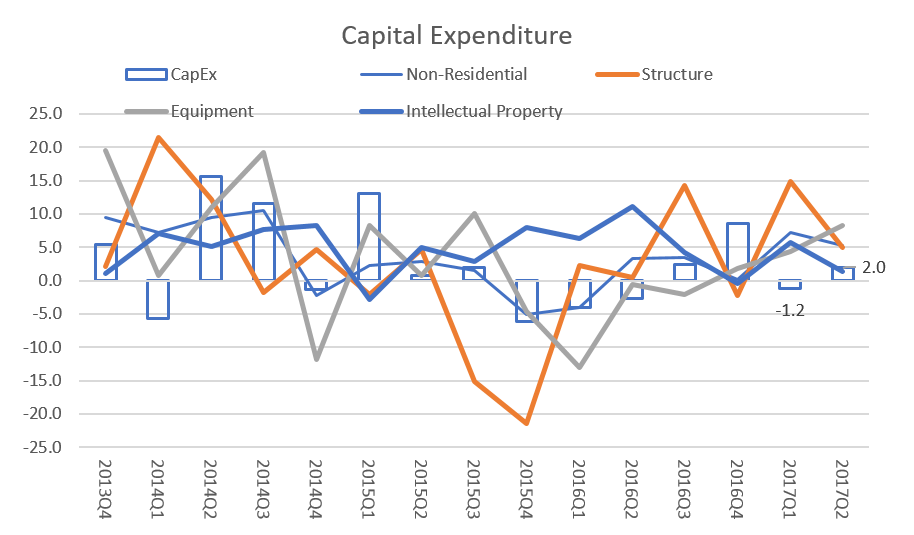

The business sector or capital expenditure spending is up during the second quarter to 2% from the first quarter at -1.2% rate.

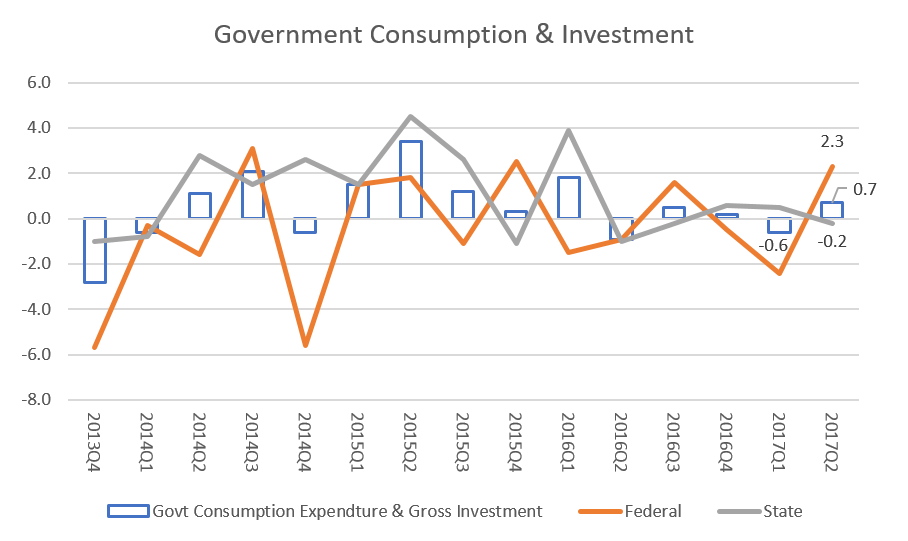

In the case of the government, 0.7% for the second quarter is a pick-up from the first at -0.6%. This is solely due to an increase in federal spending.

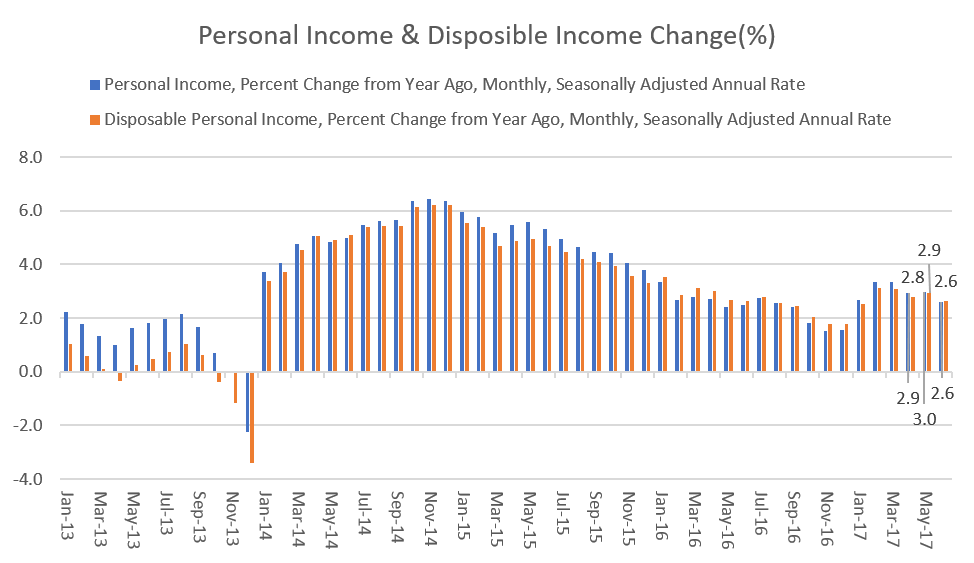

Both Personal Income[2] and Disposable Income[3] in June declined with Personal Income dropping from 2.9% to 2.6% from a year ago and disposable income dropping from 3% to 2.6%. However, on a trailing 12-month basis (since July 2016), the average rate for Personal and Disposable Income has been around 2.5%.

The second quarter shows the economy is humming along in the post-financial crisis 2% range. As the labor economy continues to recover, consumers continue to be the pillar of support for the economy. It is ironic that Candidate Trump made repeated disparaging remarks about how a Clinton administration would be more of the same as the disastrous Obama economy. Now under the Trump Administration, we can’t tell the difference as we await the fiscal and structural policy blastoff.

[1] https://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm

[2] Personal income is the income that persons receive in return for their provision of labor, land, and capital used in current production and the net current transfer payments that they receive from business and from government.

[3] Disposable personal income is personal income less personal current taxes. It is the income available to persons for spending or saving.